Grayscale Research said bitcoin could set new all-time highs in 2026, pushing back against fears that the cryptocurrency is entering a deep, multi-year downturn.

- In a report published Monday, Grayscale argued that bitcoin is unlikely to follow the so-called four-year cycle — the widely held belief that BTC's price tends to peak and then undergo a severe correction once every four years, in line with its halving schedule.

- "Although the outlook is uncertain, we believe the four-year cycle thesis will prove to be incorrect, and that bitcoin's price will potentially make new highs next year," Grayscale analysts said.

- Bitcoin has been experiencing a turbulent stretch since early October, falling 32% from its peak through most of November. The price briefly touched $84,000 on Monday before recovering to $86,909 as of 2:20 a.m. ET Tuesday, The Block's price page shows.

- Grayscale noted that while long-term investors have historically been rewarded for holding through volatility, they must often "stomach sometimes challenging drawdowns" along the way. Pullbacks of 25% or more, the firm added, are common during bull markets and don't necessarily signal the start of a prolonged downtrend.

Breaking the four-year cycle

- Grayscale outlined several reasons why bitcoin is set to break away from its typical four-year rhythm.

- Grayscale pointed out that unlike prior bull markets, this cycle has not seen the kind of parabolic rally that typically precedes a major reversal.

- Unlike prior cycles, the current market structure sees institutional money concentrated in exchange-traded products and digital asset treasuries instead of retail activity on spot exchanges, the report said.

- The macro environment remains relatively supportive as well, Grayscale added, with potential rate cuts and bipartisan momentum on U.S. crypto legislation offering further tailwinds.

- Tom Lee, CEO of Ethereum treasury firm BitMine, echoed Grayscale's view, noting what he sees as a growing disconnect between market fundamentals and prices.

- "Crypto prices have fallen relentlessly even as fundamentals, measured by wallets, onchain, fees or tokenization, have moved forward." Lee wrote on Monday in a post on X. "So risk/reward is attractive for BTC and ETH."

Lee also told CNBC on the same day that he remains bullish on bitcoin and expects the world's largest cryptocurrency to set a fresh all-time high by January next year.

#Grayscale #Bitcoin #Jucom #cryptocurrency #blockchain $BTC/USDT $JU/USDT $ETH/USDT

Lee | Ju.Com

2025-12-02 10:16

❤️ Grayscale predicts new bitcoin highs in 2026, dismisses 4-year cycle view!

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

The New York Stock Exchange (NYSE) has approved the Grayscale DOGE and XRP ETFs and will begin trading on Monday.

- NYSE Arca, a subsidiary of the exchange, received the certification from the US Securities and Exchange Commission (SEC) for “its approval for listing and registration.” The broader cryptocurrency market is expected to remain in the green, with Bitcoin seeing a recovery.

- On Monday’s opening bell, Grayscale’s DOGE and XRP ETFs will go live, allowing institutional clients to take entry positions. This is a pivoting point for both cryptocurrencies, as an uptick in the charts is on the cards.

Traders who took an entry position when XRP fell to the $1.9 range on Friday could benefit.

Grayscale ETFs: XRP and DOGE Turn Green on Monday

- On the heels of the opening bell, the launch of Grayscale’s XRP and DOGE ETFs has made both cryptocurrencies turn green.

- While Dogecoin soared more than 2% on Monday, XRP is up nearly 1.5%. The leading cryptocurrencies could rise further as the market approaches the opening bell.

- The altcoin went from a low of $1.90 to a high of $2.08 in a day, delivering nearly 10% profits.

- Investments from Grayscale’s institutional funds could cause the XRP and DOGE ETFs’ prices to soar. In addition, interest from retail traders could also rise, as investors want to make the most out of the much-awaited launch.

- Riding the bandwagon on the day of the launch can usually generate profits due to the hype and buzz it creates.

- Apart from Grayscale’s XRP ETF, Canary Capital, Bitwise, 21Shares, and CoinShares have also launched institutional trading. This is the time when XRP could turn bullish, rewarding investors who held on during the downturn.

The SEC has turned crypto-friendly after Trump took office in January, promising to make the US the Bitcoin and blockchain capital of the world. #Grayscale #NYSE #Jucom #cryptocurrency #blockchain $DOGE/USDT $JU/USDT $XRP/USDT

Lee | Ju.Com

2025-11-24 15:40

🔥 The NYSE Approves Grayscale XRP & DOGE ETFs, Trading To Begin on Monday

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

- Grayscale Investments has filed to go public, marking one of the most notable Wall Street moves by a cryptocurrency-related asset management firm this year.

- The company has filed a confidential draft IPO with the US Securities and Exchange Commission, according to a notice dated November 13, 2023.

Grayscale's IPO Shows a Common Trend Among Crypto Companies in 2025

- The filing marks Grayscale's planned transition from private ownership to a public listing.

- The company manages tens of billions of dollars in Cryptoasset through multiple trusts and ETFs, including its flagship Bitcoin product. The offering will depend on market conditions and regulatory approval, the company said.

- The move comes after months of speculation when Grayscale first filed its draft S-1 security in July 2023. The company had not disclosed a timetable at that time, but today's confirmation suggests the plan has been accelerated. Market analysts had predicted the earliest possible listing date would be late 2025 or early 2026.

- Estimates from industry analysts range, with an expected value between $30 billion and $33 billion.

- The IPO reflects a more favorable regulatory environment for Cryptoasset managers in the United States. The conversion of Grayscale’s Bitcoin Trust into an ETF has boosted investment Capital and cemented its presence in the public markets. The company now appears to be capitalizing on this to grow further.

- However, there are still major hurdles. The influence of parent company Digital Currency Group could weigh on investor sentiment as the filings progress.

- Today's news adds to a wave of listings in the crypto space , including Gemini, Circle , and Bullish.

However, Grayscale's size makes this filing the most notable, with investors now awaiting official details of the S-1 and regulatory response in the coming months.

#Grayscale #IPO #CryptoIPO #Jucom #cryptocurrency #$

Lee | Ju.Com

2025-11-14 04:10

🚨 Grayscale Files for IPO, Marking a Major Shift for Crypto Asset Managers!

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

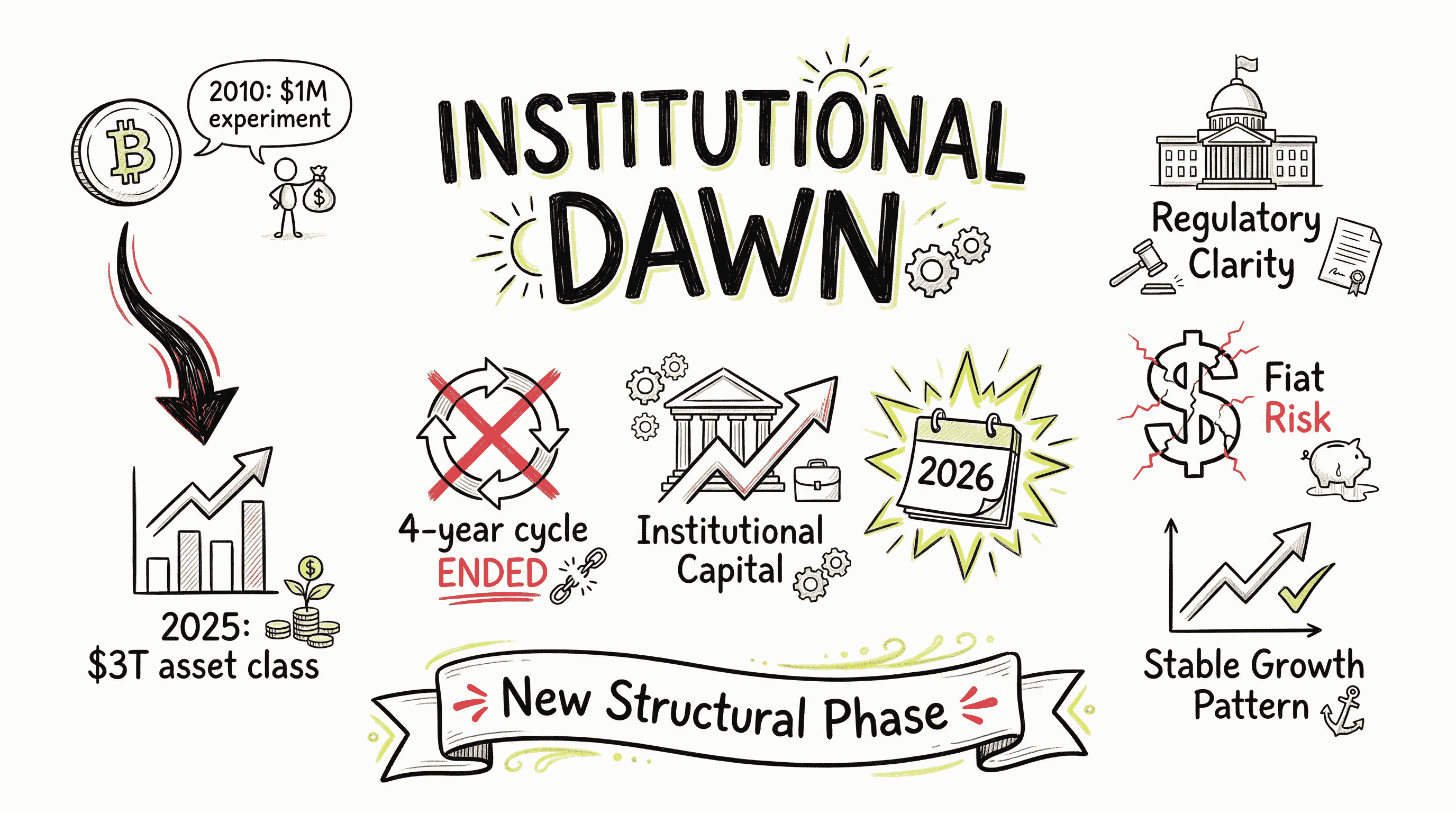

Cryptocurrencies have evolved from a USD 1 million technological experiment 15 years ago into a mid-sized alternative asset class with a total market capitalization of approximately USD 3 trillion. In its latest 2026 outlook, the Grayscale research team makes a bold assertion: the so-called "four-year cycle" theory is coming to an end. The steady inflow of institutional capital is rewriting the market script, and 2026 is expected to mark the crypto market's entry into a new structural phase.

Two Core Pillars Supporting the Transition

The first pillar comes from fiat currency depreciation risk. As of November 2025, U.S. public debt exceeded USD 38.4 trillion, accounting for 125% of GDP—well above the 100% threshold recommended by the IMF for advanced economies. The IMF forecasts that by 2030, U.S. government debt will reach 143.4% of GDP, with annual budget deficits hovering above 7%. The 20 millionth Bitcoin will be mined in March 2026. This digital monetary system with a fixed supply of 21 million coins, transparent and predictable, demonstrates unprecedented appeal as fiat currencies face structural pressures. Bitcoin and Ethereum are increasingly viewed by institutional investors as scarce digital commodities that hedge against fiat currency risk.

The second pillar is the dramatic improvement in the regulatory environment. On July 18, 2025, the GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins Act) was formally signed into law, marking the first comprehensive federal framework for cryptocurrencies in the United States and providing a clear regulatory pathway for stablecoins. The Act requires stablecoin issuers to hold 100% reserves, including U.S. dollar cash, insured deposits, U.S. Treasuries with remaining maturities of no more than 93 days, and other liquid federal government financial instruments. In December 2025, the FDIC proposed implementing rules, and additional regulations from federal banking authorities are expected in 2026, firmly solidifying the legal status of blockchain finance within capital markets.

Institutional Bull Market Characteristics Emerging

Since the launch of Bitcoin ETPs in the U.S. in January 2024, global crypto ETPs have recorded cumulative net inflows of USD 87 billion. Grayscale estimates that less than 0.5% of U.S. professionally managed wealth is currently allocated to crypto assets. 21Shares predicts that global crypto ETP assets under management will reach USD 400 billion by the end of 2026—nearly 4.6 times the current level. Bank of America announced in December 2025 that starting January 5, 2026, its advisors will be allowed to recommend multiple crypto exchange-traded products to clients with no minimum asset requirements. Chris Hyzy, Chief Investment Officer at Merrill and Bank of America Private Bank, stated that for investors who can tolerate higher volatility, allocating 1% to 4% of assets to digital assets may be appropriate.

The maximum year-over-year increase in this bull cycle has been around 240%, far lower than the parabolic surges of 1,000%+ seen in previous cycles. This relatively moderate appreciation reflects the steadier, more rational buying behavior of institutional investors, and the likelihood of deep and prolonged cyclical downturns is diminishing. Economic growth combined with the Fed's accommodative monetary policy provides a favorable environment for risk assets, including cryptocurrencies.

Five Key Investment Themes for 2026

First, demand for monetary alternatives driven by U.S. dollar depreciation risk. Bitcoin and Ethereum, as digital monetary systems with transparent, predictable, and ultimately scarce supply, are attracting increasing capital seeking stores of value. The 20 millionth Bitcoin is expected to be mined in March 2026, and this programmatic certainty stands in stark contrast to the uncertainty surrounding fiat money.

Second, explosive growth of stablecoins. In 2025, outstanding stablecoin supply reached USD 300 billion, with average monthly transaction volumes of USD 1.1 trillion. The passage of the GENIUS Act has cleared the path for compliant development. In 2026, stablecoins are expected to be integrated into real-world use cases such as cross-border payments, derivatives collateral, and corporate balance sheets, with circulating supply projected to exceed USD 1 trillion. This will generate significant value for blockchains recording these transactions such as ETH, Tron, BNB, and Solana, and will also drive growth for supporting infrastructure and DeFi applications like Chainlink.

Third, asset tokenization is approaching an inflection point. Currently, tokenized assets total approximately USD 23 billion, representing just 0.01% of global equity and bond markets. However, Grayscale estimates that with more mature blockchain technology and clearer regulation, tokenized assets could reach USD 500 billion in total value locked by 2026, with 1,000x growth by 2030 not out of the question. This expansion will create substantial value for blockchains handling tokenized asset transactions and a wide range of supporting applications.

Fourth, accelerated development of decentralized finance. DeFi lending platforms such as Aave and Morpho saw significant growth in 2025, while decentralized perpetual futures exchange Hyperliquid has reached daily trading volumes of around USD 8 billion, with annualized revenue exceeding USD 1.3 billion. Its open interest and daily volumes now rival those of some of the largest centralized derivatives exchanges. Improved technology and favorable regulation are pushing DeFi from the margins toward the mainstream.

Fifth, institutional investors are increasingly focused on fundamentals. Transaction fees—among the hardest metrics to manipulate and the most comparable—are becoming a core dimension for evaluating the value of blockchains and applications. Assets with high and growing fee revenues are more likely to gain institutional favor. On Solana, DeFi protocols have attracted substantial liquidity providers and traders through low latency and high throughput advantages, with total DeFi TVL rebounding above USD 8 billion by December 2025.

Survival Rules in an Era of Differentiation

Cryptocurrencies are entering a new era defined by differentiation rather than broad-based rallies. The GENIUS Act clearly distinguishes regulated payment stablecoins from other stablecoins, granting the former specific rights and responsibilities. The same logic applies across the broader crypto asset class: tokens with clear use cases, sustainable revenue sources, and access to regulated venues and institutional capital will thrive in the institutional era. Institutional adoption raises the bar for mainstream success. Projects that can cross this line will attract massive institutional inflows, while those that cannot will gradually be marginalized.

Standing at the threshold of 2026, cryptocurrencies have completed a long journey from experimental technology to speculative instruments and finally to an institutional asset class. The competition ahead is no longer about who can generate the most extreme price surges, but about who can strike the right balance between regulatory compliance, user value, and sustainable revenue. Projects that adapt to this new paradigm will become the forces that truly define the future of financial infrastructure. This is an era rich with opportunity but far more demanding, and only genuinely valuable innovation will survive the dawn of the institutional age.

Read the complete in-depth analysis: 👇 https://blog.ju.com/grayscale-2026-digital-asset-analysis/?utm_source=blog

#Grayscale #Crypto #Bitcoin #Ethereum #DeFi

JU Blog

2025-12-31 09:35

Grayscale 2026 Outlook: The Dawn of the Institutional Era

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.