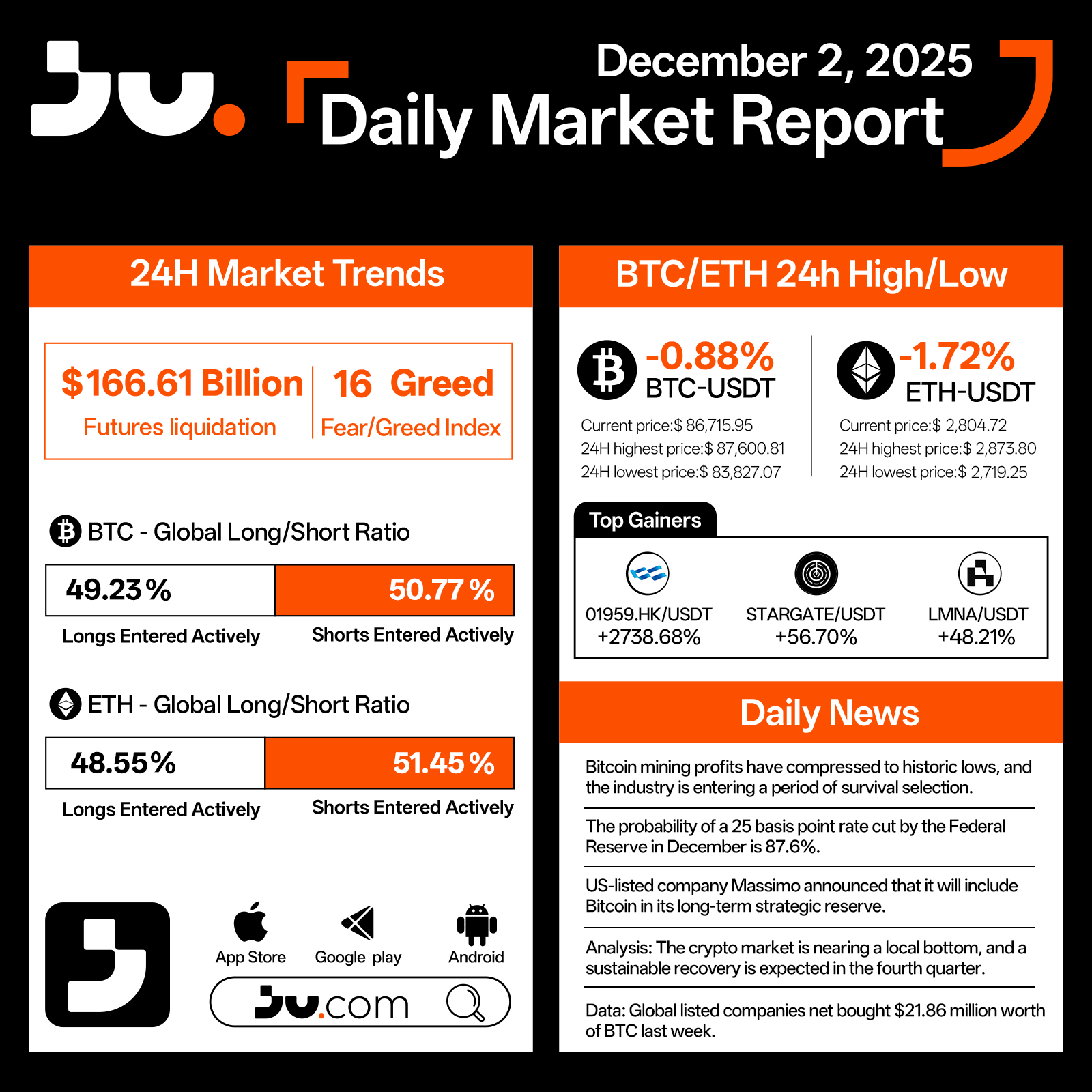

BTC and ETH Continue to Retreat as Market Enters a Stress Phase – Dec 2, 2025

Crypto markets extended their decline on December 2, with major assets facing renewed downward pressure. Total futures liquidations climbed to $166.61 billion, while the Fear & Greed Index slipped to 16, signaling a return to fear-driven sentiment. Bitcoin (BTC) fell 0.88% to $86,715.95, trading within a range of $87,600.81 at the high and $83,827.07 at the low. Ethereum (ETH) dropped 1.72% to $2,804.72, with intraday movement between $2,873.80 and $2,719.25.

Derivatives positioning remained slightly bearish, with BTC showing 49.23% longs versus 50.77% shorts, and ETH posting 48.55% longs against 51.45% shorts. Despite the broader market weakness, several tokens staged notable rallies, led by 01959.HK/USDT with an extraordinary +2738.68% surge, followed by STARGATE/USDT at +56.70% and LMNA/USDT at +48.21%, highlighting pockets of aggressive speculation.

Industry developments added context to the current market conditions. Bitcoin mining profitability has compressed to historic lows, pushing the mining sector into a phase of survival-driven consolidation. The probability of a 25 bps rate cut by the Federal Reserve in December rose to 87.6%, reinforcing expectations of a shift toward looser monetary conditions. US-listed company Massimo announced that Bitcoin will be incorporated into its long-term strategic reserves, signaling continued institutional confidence. Analysts noted that the crypto market may be approaching a cyclical bottom, with the fourth quarter offering potential for a more sustainable recovery. Data also showed that global listed companies collectively purchased approximately $218.6 million worth of BTC last week, reflecting ongoing accumulation from institutional investors.

Although BTC and ETH remain under pressure, institutional flows and improving policy expectations are helping to form a stabilizing backdrop. With macro and liquidity factors intensifying through December, the market may be gearing up for decisive movement following the current consolidation phase.

#cryptocurrency #blockchain #finance #Bitcoin

JU Blog

2025-12-02 03:06

BTC and ETH Continue to Retreat as Market Enters a Stress Phase – Dec 2, 2025

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

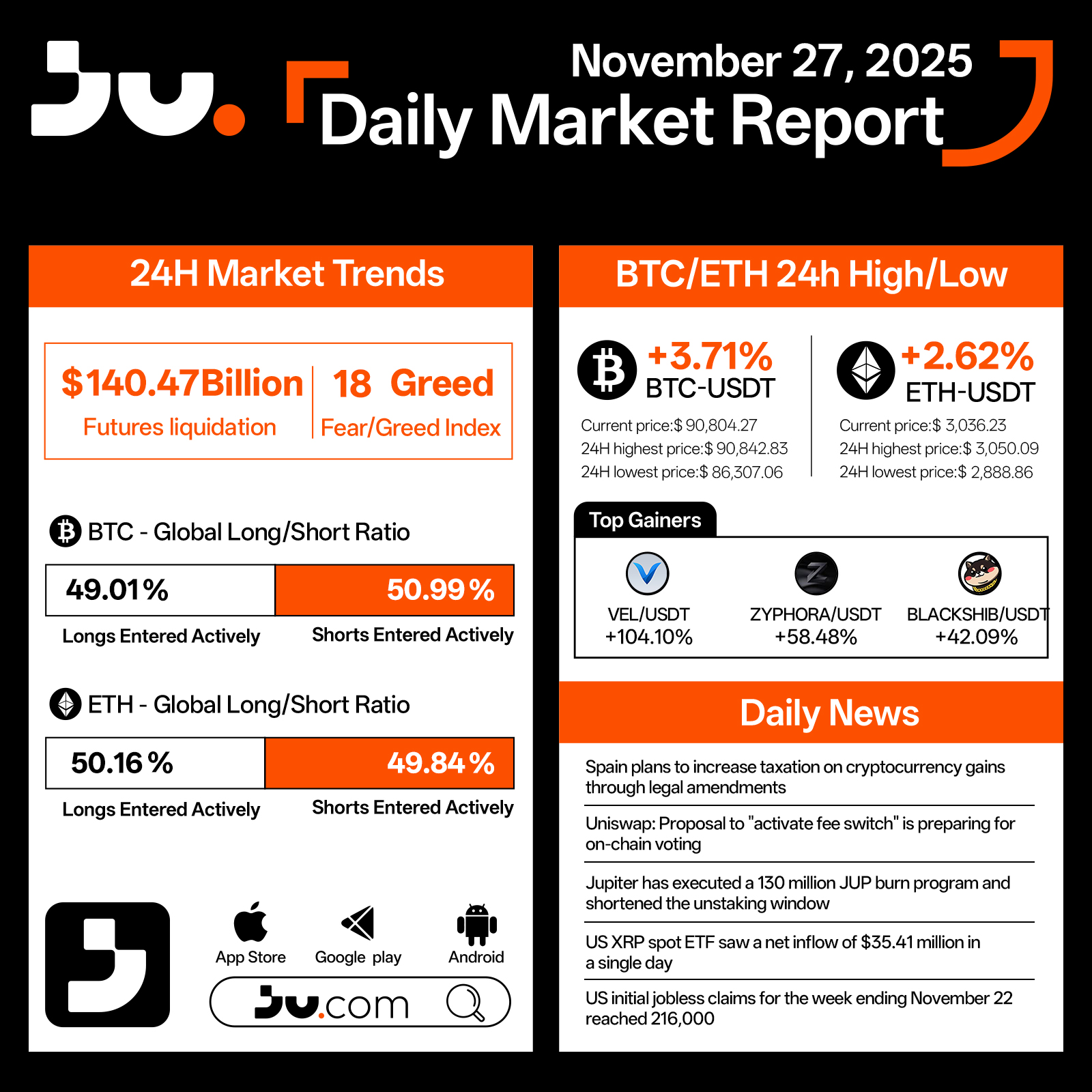

Daily Market Report - Nov 27, 2025

Crypto markets strengthened on November 27, showing a notable rebound in momentum. Total futures liquidations reached $140.47 billion, while the Fear & Greed Index climbed to 18, suggesting that although sentiment remains cautious, panic is gradually easing. Bitcoin (BTC) rose 3.71% to $90,804.27, trading between a high of $90,842.83 and a low of $86,307.06 over the past 24 hours. Ethereum (ETH) gained 2.62%, last trading at $3,036.23, with intraday movements ranging from $3,050.09 to $2,888.86.

Long–short ratios remain balanced but cautious. BTC saw 49.01% longs versus 50.99% shorts, while ETH skewed slightly bullish at 50.16% longs and 49.84% shorts, reflecting a market that is stabilizing but still hesitant to take strong directional positions. Among top-performing tokens, VEL/USDT surged 104.10%, ZYPHORA/USDT advanced 58.48%, and BLACKSHIB/USDT gained 42.09%, highlighting strong speculative activity in select high-volatility assets.

Regulatory and macro developments contributed to today’s narrative. Spain announced plans to increase taxes on cryptocurrency gains through upcoming legal amendments, underscoring the tightening regulatory climate across Europe. Uniswap’s proposal to activate its “fee switch” is moving toward on-chain voting, potentially reshaping the protocol’s long-term revenue design.

Jupiter executed a 130 million JUP burn program and shortened its unlocking schedule, reinforcing its commitment to token value management. Meanwhile, the US XRP spot ETF recorded an impressive $354.41 million net inflow in a single day, reflecting ongoing institutional appetite for digital assets. U.S. initial jobless claims for the week ending November 22 reached 216,000, indicating a gradually cooling labor market.

With BTC and ETH both staging strong rebounds, market sentiment shows signs of recovery, though investors remain highly sensitive to regulatory shifts and macroeconomic indicators. As the month draws to a close, liquidity conditions and policy developments will play an increasingly important role in shaping short-term market direction.

#cryptocurrency #blockchain #finance #Bitcoin

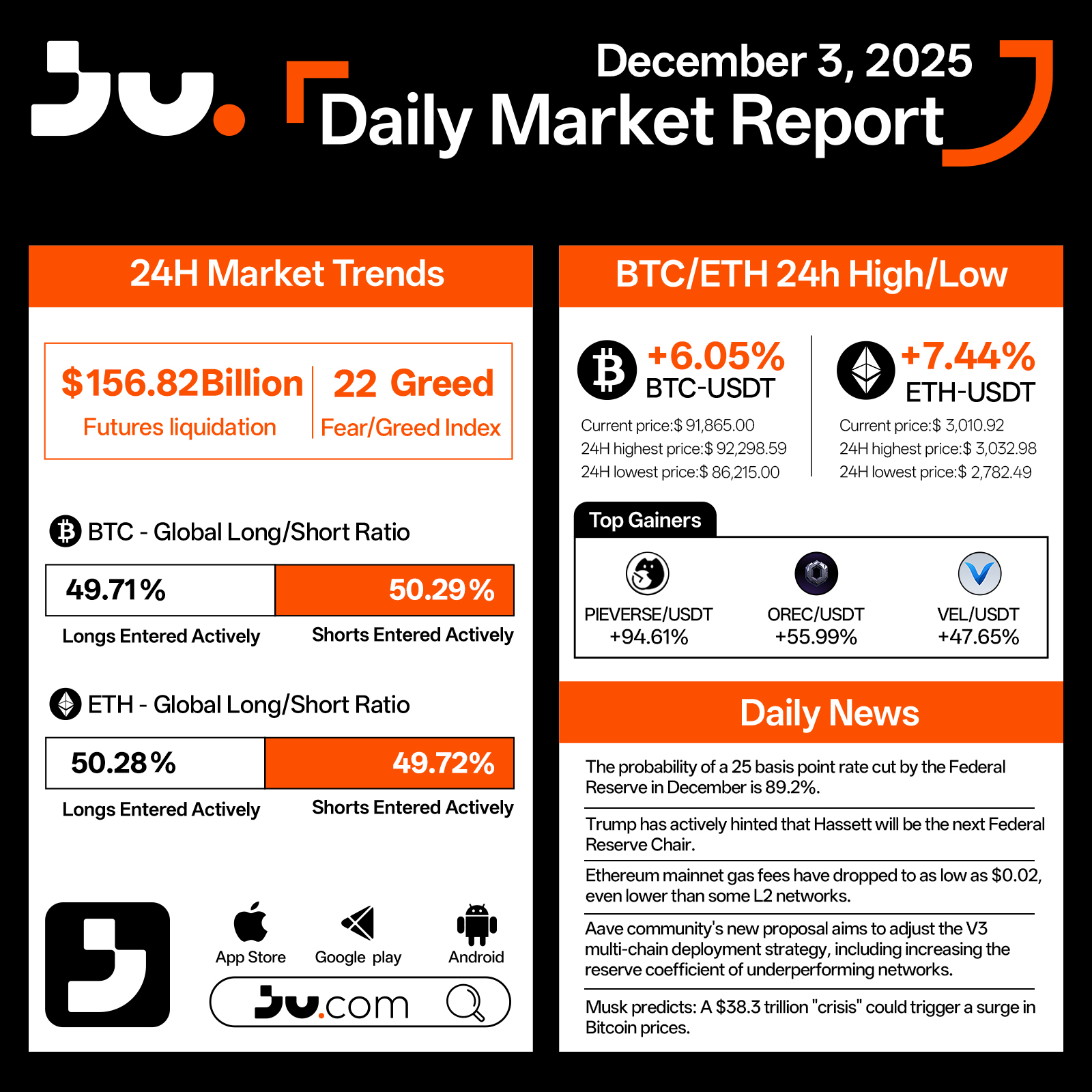

Crypto markets rallied strongly on December 3, marking one of the most notable reversals of the month. Over the past 24 hours, total liquidations reached $156.82 billion, yet the Fear & Greed Index climbed to 22, reflecting a meaningful recovery in sentiment after several sessions of pressure. Bitcoin (BTC) rose 6.05% to $91,865, with a trading range between a high of $92,298.59 and a low of $86,215. Ethereum (ETH) outperformed with a 7.44% daily gain, closing at $3,010.92, while swinging between $3,032.98 at the high and $2,782.49 at the low.

Derivatives positioning signaled a gradual shift from caution toward optimism. BTC long positions accounted for 49.71% compared with 50.29% shorts, while ETH saw 50.28% longs against 49.72% shorts, showing a balanced but improving risk appetite. Several tokens posted exceptional gains, including PIEVERSE/USDT with 94.61%, OREC/USDT with 55.99%, and VEL/USDT with 47.65%, highlighting pockets of strong speculative momentum.

Macro and protocol-level developments also shaped market sentiment. The probability of a 25 bps rate cut at the December Federal Reserve meeting rose to 89.2%, fueling expectations of easing liquidity. Trump signaled that Hassett may be the next Federal Reserve Chair, increasing attention on future monetary policy direction. On-chain activity improved as Ethereum mainnet gas fees fell to $0.02, even lower than some L2 networks, making interactions significantly cheaper. The Aave community proposed adjustments to its V3 multi-chain deployment strategy, including changes to reserve coefficients for underperforming networks. Elon Musk added further intrigue by suggesting that a $38.3 trillion “crisis” could ultimately drive Bitcoin prices sharply higher.

With BTC and ETH staging powerful rebounds and macro conditions showing signs of easing, market sentiment is strengthening rapidly. As year-end approaches, traders are increasingly optimistic that the recovery may continue into December’s final stretch.

#cryptocurrency #blockchain #technical analysis #finance #Bitcoin

Mining in Cryptocurrencies: A Complete Guide to How Digital Coins Are Created and Secured

Understanding Cryptocurrency Mining

Cryptocurrency mining is the backbone of many digital currencies, especially Bitcoin (BTC). It is a process that involves validating transactions and creating new units of the cryptocurrency. Unlike traditional money, which is issued by central banks, cryptocurrencies rely on decentralized networks where miners play a vital role in maintaining system integrity. When miners verify transactions, they add them to the blockchain—a secure, transparent ledger accessible to all participants.

This process ensures that every transaction is legitimate and prevents double-spending without needing a central authority. Miners compete to solve complex mathematical problems using powerful computers; the first one to find a solution earns rewards in the form of newly created coins and transaction fees. This incentive structure encourages continuous participation and helps keep the network secure.

How Cryptocurrency Mining Works

Mining involves solving cryptographic puzzles through computational work known as Proof of Work (PoW). In Bitcoin’s case, miners gather unconfirmed transactions into blocks and then race against each other to find a specific hash value that meets certain criteria set by the network's difficulty level. The first miner who succeeds broadcasts their solution across the network for verification.

The difficulty adjustment mechanism ensures that blocks are added approximately every ten minutes regardless of how many miners participate or how much computing power they deploy. As more miners join or hardware becomes more efficient, this difficulty increases; if miners leave or hardware becomes less effective, it decreases accordingly.

Mining Hardware Evolution

Initially, individual hobbyists used standard personal computers with CPUs for mining purposes. However, as competition increased and mining puzzles became more complex, specialized hardware emerged—most notably Application-Specific Integrated Circuits (ASICs) designed solely for mining cryptocurrencies like Bitcoin. These devices offer significantly higher processing power while consuming less energy compared to GPUs (Graphics Processing Units), which were once popular among early adopters.

Today’s mining landscape favors these high-performance ASICs due to their efficiency but also raises concerns about centralization since large-scale operations often dominate due to substantial capital investment required for such equipment.

Environmental Impact of Mining Activities

One major challenge associated with cryptocurrency mining is its substantial energy consumption. Because solving cryptographic puzzles requires intense computational work over extended periods—often running 24/7—mining farms consume vast amounts of electricity worldwide. This has led environmental concerns regarding carbon footprints linked directly to fossil fuel-based energy sources used by some large-scale operations.

Efforts are underway within the industry toward greener solutions such as utilizing renewable energy sources like solar or hydroelectric power or developing more energy-efficient hardware designs aimed at reducing overall environmental impact.

Mining Pools: Collaborating for Better Rewards

Given the competitive nature of PoW algorithms—and increasing difficulty levels—individual miners often join forces through "mining pools." These pools combine computing resources from multiple participants so they can collectively solve puzzles faster than solo efforts would allow. When a pool successfully mines a block, rewards are distributed proportionally based on each member’s contributed processing power.

Joining pools reduces variance in earnings for small-scale miners who might otherwise rarely succeed alone but also means sharing potential profits among members rather than earning full rewards independently.

Block Rewards and Transaction Fees

Miners earn two primary types of compensation:

Block Reward: Initially set at 50 BTC per block when Bitcoin launched in 2009; this reward halves approximately every four years—a process called "halving"—to control supply inflation until maximum coin issuance (~21 million BTC) is reached.

Transaction Fees: Paid voluntarily by users submitting transactions; these fees incentivize timely inclusion into new blocks especially when block rewards diminish over time as part of protocol design.

These combined incentives motivate ongoing participation despite rising computational challenges and decreasing block subsidies over time.

Recent Trends Shaping Cryptocurrency Mining

The industry has seen significant shifts recently driven by technological innovation and regulatory developments:

Energy Efficiency Initiatives: Miners increasingly seek renewable energy sources or adopt newer hardware technologies designed for lower power consumption.

Regulatory Environment: Governments worldwide are scrutinizing crypto-mining activities due to environmental concerns or financial regulations; some regions have imposed restrictions or taxes on operations.

Alternative Consensus Mechanisms: Technologies like Proof of Stake (PoS) offer promising alternatives that require less computational effort while maintaining security standards—a move seen as environmentally friendly compared to PoW systems.

Decentralization Challenges: Large-scale centralized farms have raised questions about decentralization's erosion within networks traditionally built around distributed consensus mechanisms.

Potential Risks & Future Outlook

While cryptocurrency mining underpins blockchain security effectively today, it faces several risks:

- Environmental scrutiny could lead regulators worldwide imposing stricter rules—or outright bans—that limit operational capacity.

- Market volatility impacts profitability; fluctuating coin prices can make ongoing investments unsustainable without sufficient transaction fee income.

- Technological disruptions may shift dominance toward alternative consensus models like PoS—which could render existing PoW infrastructure obsolete if adopted widely.

- Security vulnerabilities arise if malicious actors gain majority control ("51% attack"), threatening network integrity despite decentralization efforts.

Final Thoughts on Cryptocurrency Mining Dynamics

Mining remains an essential element ensuring trustworthiness within blockchain ecosystems such as Bitcoin's network by validating transactions securely without centralized oversight. However—as with any rapidly evolving technology—it must adapt continually amid environmental pressures, regulatory landscapes changes—and technological innovations aiming at sustainability and efficiency improvements will likely shape its future trajectory significantly.

Keywords: cryptocurrency mining explained | how does crypto mining work | bitcoin mining hardware | proof-of-work vs proof-of-stake | environmental impact crypto mining | future trends in crypto-mining

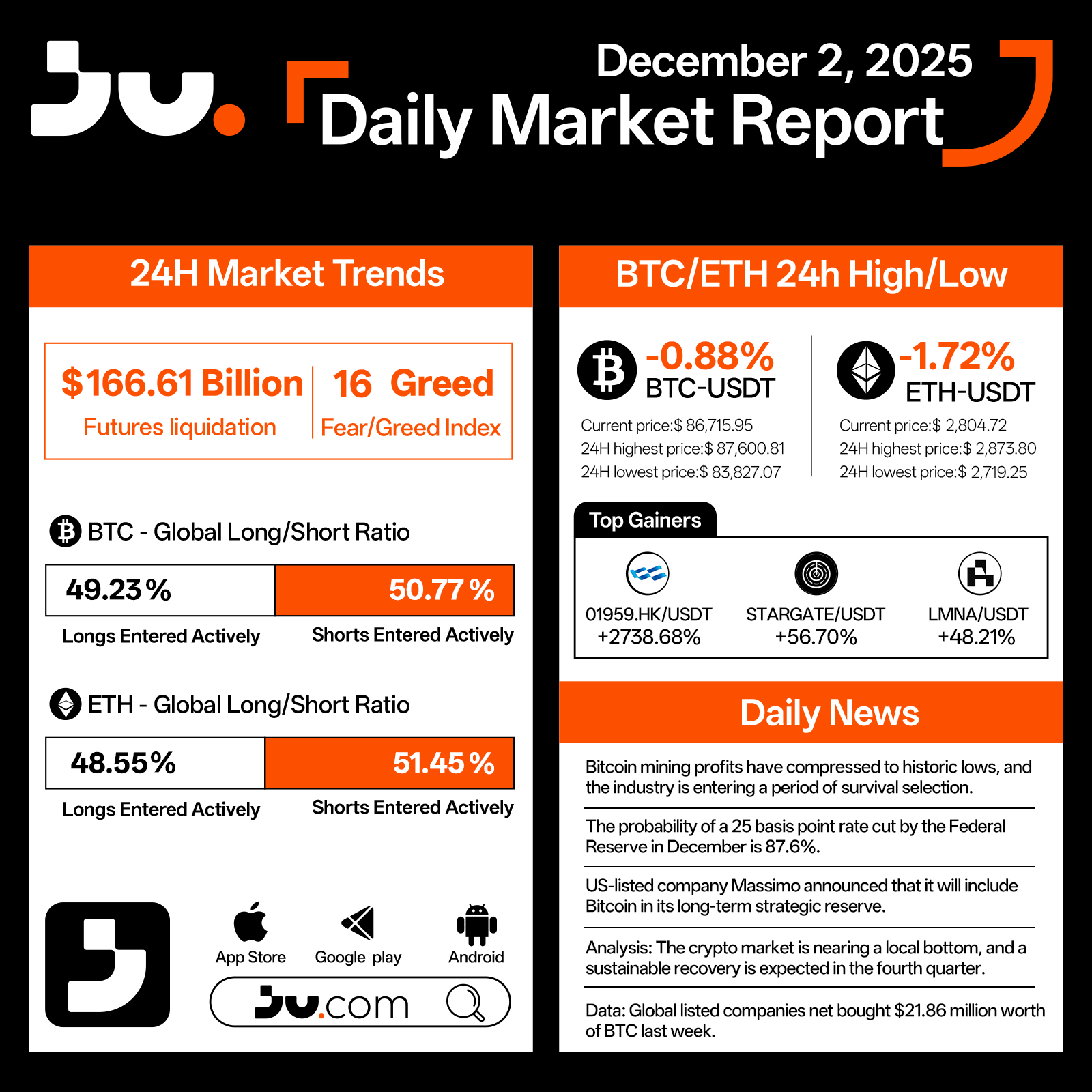

Crypto markets extended their decline on December 2, with major assets facing renewed downward pressure. Total futures liquidations climbed to $166.61 billion, while the Fear & Greed Index slipped to 16, signaling a return to fear-driven sentiment. Bitcoin (BTC) fell 0.88% to $86,715.95, trading within a range of $87,600.81 at the high and $83,827.07 at the low. Ethereum (ETH) dropped 1.72% to $2,804.72, with intraday movement between $2,873.80 and $2,719.25.

Derivatives positioning remained slightly bearish, with BTC showing 49.23% longs versus 50.77% shorts, and ETH posting 48.55% longs against 51.45% shorts. Despite the broader market weakness, several tokens staged notable rallies, led by 01959.HK/USDT with an extraordinary +2738.68% surge, followed by STARGATE/USDT at +56.70% and LMNA/USDT at +48.21%, highlighting pockets of aggressive speculation.

Industry developments added context to the current market conditions. Bitcoin mining profitability has compressed to historic lows, pushing the mining sector into a phase of survival-driven consolidation. The probability of a 25 bps rate cut by the Federal Reserve in December rose to 87.6%, reinforcing expectations of a shift toward looser monetary conditions. US-listed company Massimo announced that Bitcoin will be incorporated into its long-term strategic reserves, signaling continued institutional confidence. Analysts noted that the crypto market may be approaching a cyclical bottom, with the fourth quarter offering potential for a more sustainable recovery. Data also showed that global listed companies collectively purchased approximately $218.6 million worth of BTC last week, reflecting ongoing accumulation from institutional investors.

Although BTC and ETH remain under pressure, institutional flows and improving policy expectations are helping to form a stabilizing backdrop. With macro and liquidity factors intensifying through December, the market may be gearing up for decisive movement following the current consolidation phase.

#cryptocurrency #blockchain #finance #Bitcoin

🔸BTC: $116,337

🔸ETH: $4,297

🔹Fear/Greed: 49 (Neutral)

🔹BTC.D: 58.83%

🚀 Bitcoin is pushing toward $117K, riding momentum from a strong September (+5.2%) and Q3 (+6.3%). The next big resistance sits near $117.5K — a breakout there could open the path to new ATHs.

💡 Still, liquidity dynamics remain tricky. Heavy long positions are stacked just below price, and some analysts warn that BTC could dip to “flush” leverage before continuing higher.

🥇 Meanwhile, gold hit another all-time high at $3,895/oz, reviving the BTC–gold correlation. Historically, Bitcoin has lagged gold by weeks before catching up, and some traders now see conditions aligning for a rotation from gold into BTC.

In short: Bitcoin looks strong, but with liquidity traps lurking below, the next few sessions will show whether bulls can flip $117.5K into support — or if another shakeout comes first.

#JuExchange #Bitcoin #cryptocurrency #blockchain #finance

- The United States and China have taken a major step toward easing trade tensions, agreeing to temporarily suspend some tariffs that have rocked global markets this year.

- However, despite the diplomatic breakthrough, Bitcoin prices have yet to reflect the optimism expected from the deal.

US-China reach historic agreement

- The White House announced on November 1 that President Donald Trump and Chinese President Xi Jinping had reached a trade and economic agreement. The agreement was finalized during meetings held in South Korea.

- Under the deal, China will suspend new export controls on rare earths and issue general licenses for shipments. Beijing also pledged to limit fentanyl exports to the United States and suspend all retaliatory tariffs imposed on March 4.

In return, Washington will reduce 10% tariffs on Chinese goods and extend existing tariff exemptions until November 2026.

“[This is] a major victory that protects America's economic strength and national security, while putting American workers, farmers, and families first,” the White House said .

- The Kobeissi Letter, a macroeconomic research firm, said this was the most significant thaw in US-China trade relations in years , with the potential to ease global supply chain tensions.

Bitcoin Ignores Diplomatic Optimism

- However, financial markets were not very excited about this news.

- Bitcoin, which often responds to geopolitical and macro signals, is up less than 1% in the past 24 hours. At the time of writing, it is trading at $110,785.

- Indeed, this subdued reaction contrasts sharply with the volatility seen in October , when Trump’s announcement of new retaliatory tariffs sparked a $20 billion wave of liquidations across the cryptocurrency market.

- Meanwhile, industry analysts say the lackluster price reaction this time around reflects deeper structural changes in Bitcoin ownership, rather than the market being less sensitive to macro factors.

- James Check, an on-chain analyst on Bitcoin, noticed that long-time holder are selling coins at a faster rate than in previous cycles.

- He said Bitcoin selling pressure remains strong, with the Medium age of coins sold now around 100 days, up sharply from the previous period's Medium of 30 days.

According to him, this shift shows a transition period: long-term holder are selling their positions to new market entrants, patient and with large Capital potential.

“We are seeing a shift in power from the OGs who rode the first waves of risk, to the TradFi buyers who prefer calmer waters,” Check explains .

Despite the short-term price weakness, experts say Bitcoin’s long-term fundamentals remain solid. They see the current rotation as a natural progression in the asset’s maturation process — where seasoned traders leave the game and traditional finance begins to Vai over.

#Bitcoin #Jucom #cryptocurrency #blockchain #finance