Holiday-Thinned Liquidity Brings Mild Rebound — Dec 25, 2025

On December 25, crypto markets traded under reduced holiday liquidity, with overall activity cooling while price action showed signs of stabilization. Total liquidations over the past 24 hours fell to $72.24 billion, a notable contraction from prior sessions, while the Fear & Greed Index edged up to 28, suggesting sentiment has begun to steady in a lower-volatility environment.

Bitcoin rose 0.79% to $87,925.58, holding within a narrow intraday range between $88,035.35 and $86,440.52, as prices remained anchored in the middle of the recent consolidation zone. Ethereum also posted modest gains, climbing 0.52% to $2,953.91 after finding support near $2,889.57. While intraday swings remained uneven, overall price behavior reflected a gradual repair rather than renewed downside momentum. Positioning data supported this view, with BTC long positions increasing to 50.23% and ETH longs reaching 50.54%, indicating a slight bullish bias toward major assets despite subdued trading volumes.

Beneath the surface, speculative appetite persisted in select segments. HALV/USDT surged an extraordinary 667.55% within 24 hours, while ROBO/USDT and ZBT/USDT advanced 93.69% and 36.42%, respectively. These moves underscore that even during holiday conditions, capital continues to rotate aggressively into high-beta, small-cap tokens when majors remain range-bound.

Macro and policy developments added further context to market sentiment. The onshore yuan strengthened past the 7.01 level against the U.S. dollar, marking a new high for 2024 and reinforcing expectations of improving liquidity conditions in Asia. The U.S. concluded its previous administration’s probe into China’s chip trade, confirming no additional tariffs would be imposed over the next 18 months, easing near-term geopolitical and trade-related uncertainty. At the same time, the European Union officially implemented the DAC8 directive, intensifying crypto taxation and signaling higher long-term compliance costs for market participants. On the security front, Polymarket disclosed a third-party authentication vulnerability affecting a limited number of user accounts, highlighting ongoing infrastructure risks as on-chain platforms scale.

Overall, the crypto market appears to be entering a brief consolidation and repair phase amid holiday-thinned liquidity and a relatively stable macro backdrop. While major assets remain range-bound, continued participation in high-volatility tokens suggests risk appetite has not fully retreated, leaving the market poised for its next directional catalyst.

#cryptocurrency #blockchain #technical analysis #finance #

JU Blog

2025-12-25 10:44

Holiday-Thinned Liquidity Brings Mild Rebound — Dec 25, 2025

Penafian:Berisi konten pihak ketiga. Bukan nasihat keuangan.

Lihat Syarat dan Ketentuan.

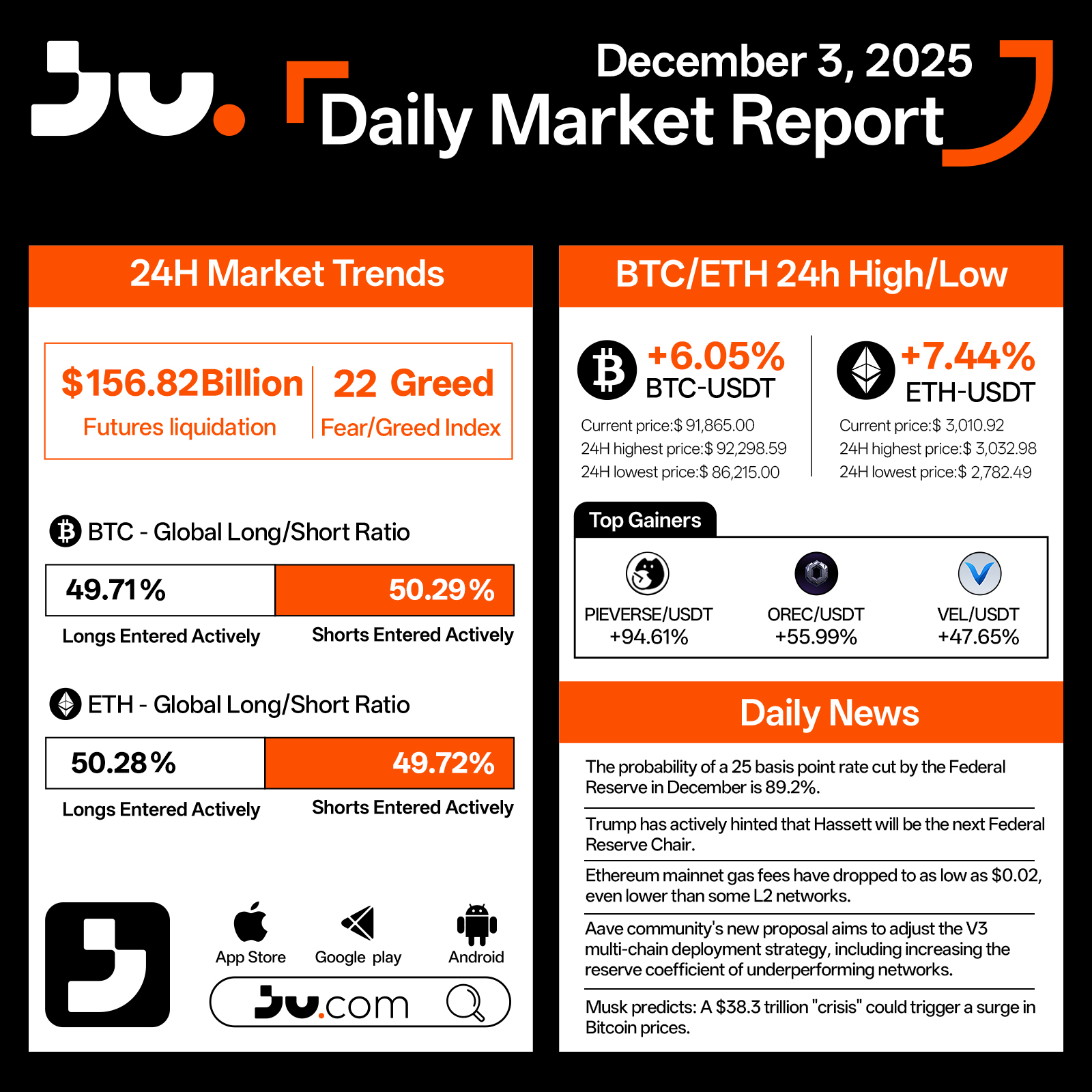

Crypto markets rallied strongly on December 3, marking one of the most notable reversals of the month. Over the past 24 hours, total liquidations reached $156.82 billion, yet the Fear & Greed Index climbed to 22, reflecting a meaningful recovery in sentiment after several sessions of pressure. Bitcoin (BTC) rose 6.05% to $91,865, with a trading range between a high of $92,298.59 and a low of $86,215. Ethereum (ETH) outperformed with a 7.44% daily gain, closing at $3,010.92, while swinging between $3,032.98 at the high and $2,782.49 at the low.

Derivatives positioning signaled a gradual shift from caution toward optimism. BTC long positions accounted for 49.71% compared with 50.29% shorts, while ETH saw 50.28% longs against 49.72% shorts, showing a balanced but improving risk appetite. Several tokens posted exceptional gains, including PIEVERSE/USDT with 94.61%, OREC/USDT with 55.99%, and VEL/USDT with 47.65%, highlighting pockets of strong speculative momentum.

Macro and protocol-level developments also shaped market sentiment. The probability of a 25 bps rate cut at the December Federal Reserve meeting rose to 89.2%, fueling expectations of easing liquidity. Trump signaled that Hassett may be the next Federal Reserve Chair, increasing attention on future monetary policy direction. On-chain activity improved as Ethereum mainnet gas fees fell to $0.02, even lower than some L2 networks, making interactions significantly cheaper. The Aave community proposed adjustments to its V3 multi-chain deployment strategy, including changes to reserve coefficients for underperforming networks. Elon Musk added further intrigue by suggesting that a $38.3 trillion “crisis” could ultimately drive Bitcoin prices sharply higher.

With BTC and ETH staging powerful rebounds and macro conditions showing signs of easing, market sentiment is strengthening rapidly. As year-end approaches, traders are increasingly optimistic that the recovery may continue into December’s final stretch.

#cryptocurrency #blockchain #technical analysis #finance #Bitcoin

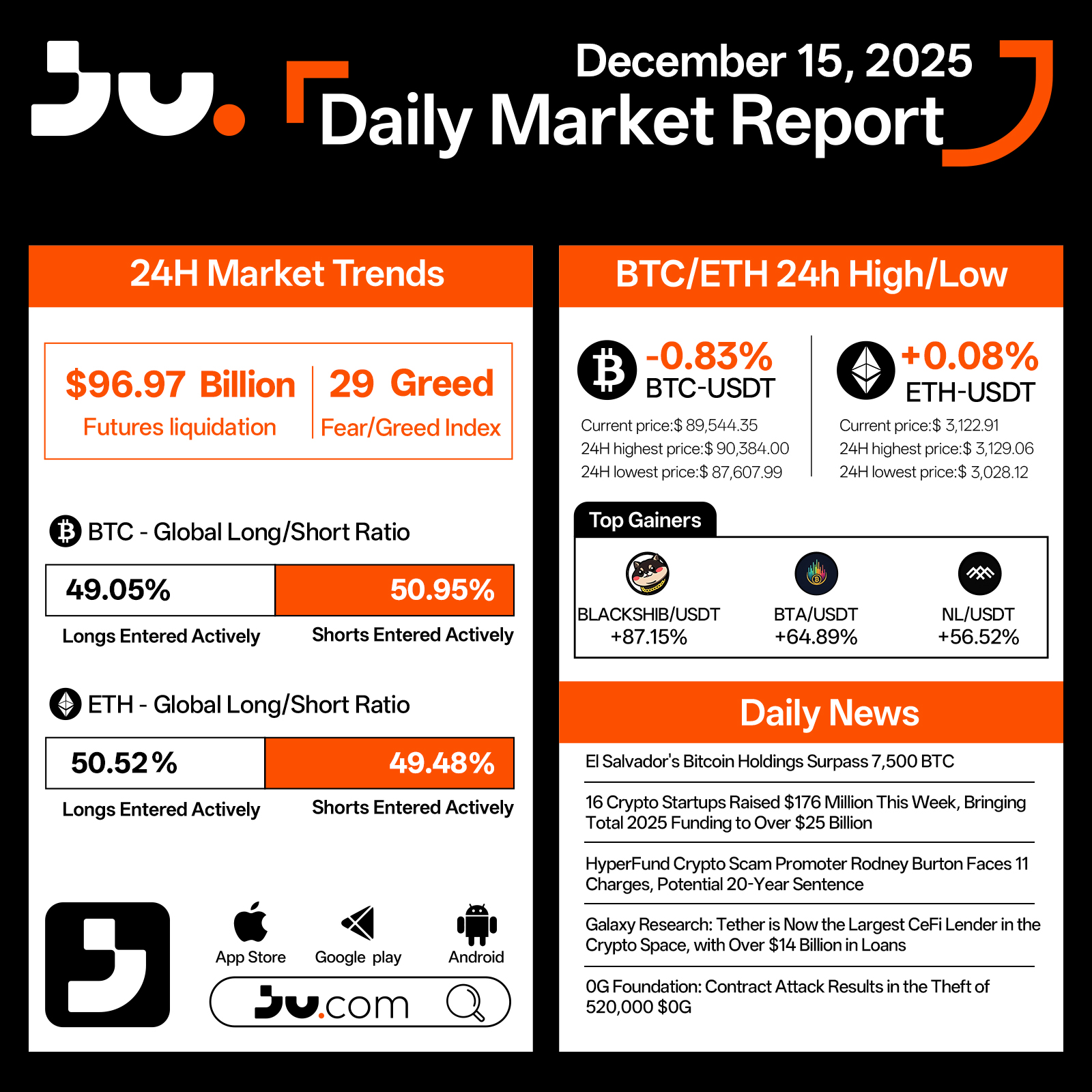

Crypto markets traded sideways on December 15 with a mild defensive tone. Twenty-four hour liquidations totaled $96.97 billion, and the Fear & Greed Index printed 29. Bitcoin(BTC) fell 0.83% to $89,544.35, moving within a $90,384.00–$87,607.99 range, while Ethereum(ETH) edged 0.08% higher to $3,122.91 after fluctuating between $3,129.06 and $3,028.12. Positioning remained balanced but slightly bearish for BTC at 49.05% longs vs. 50.95% shorts, whereas ETH leaned modestly bullish at 50.52% longs vs. 49.48% shorts. High-beta names outperformed, with BLACKSHIB/USDT +87.15%, BTA/USDT +64.89%, and NL/USDT +56.52%, pointing to a rebound in short-term speculation.

News flow was neutral to supportive. El Salvador’s sovereign Bitcoin stash surpassed 7,500 BTC, extending its accumulation trend. Sixteen crypto startups raised $176 million this week, pushing total 2025 funding above $25 billion, a sign of resilient primary-market activity. In enforcement, alleged “HyperFund” promoter Rodney Burton faces 11 charges with potential sentencing of up to 20 years. Galaxy Research reported that Tether is now the largest CeFi lender in crypto with more than $14 billion in outstanding loans. Meanwhile, OG Foundation suffered a contract exploit resulting in the theft of roughly 520,000 $OG. With no major macro shocks and steady institutional signals, sentiment remains cautiously constructive; the next directional cue hinges on BTC reclaiming and holding above the $90K handle and ETH pressing through the $3,150–$3,200 band.

#cryptocurrency #blockchain #technical analysis #Cryptocurrency #finance

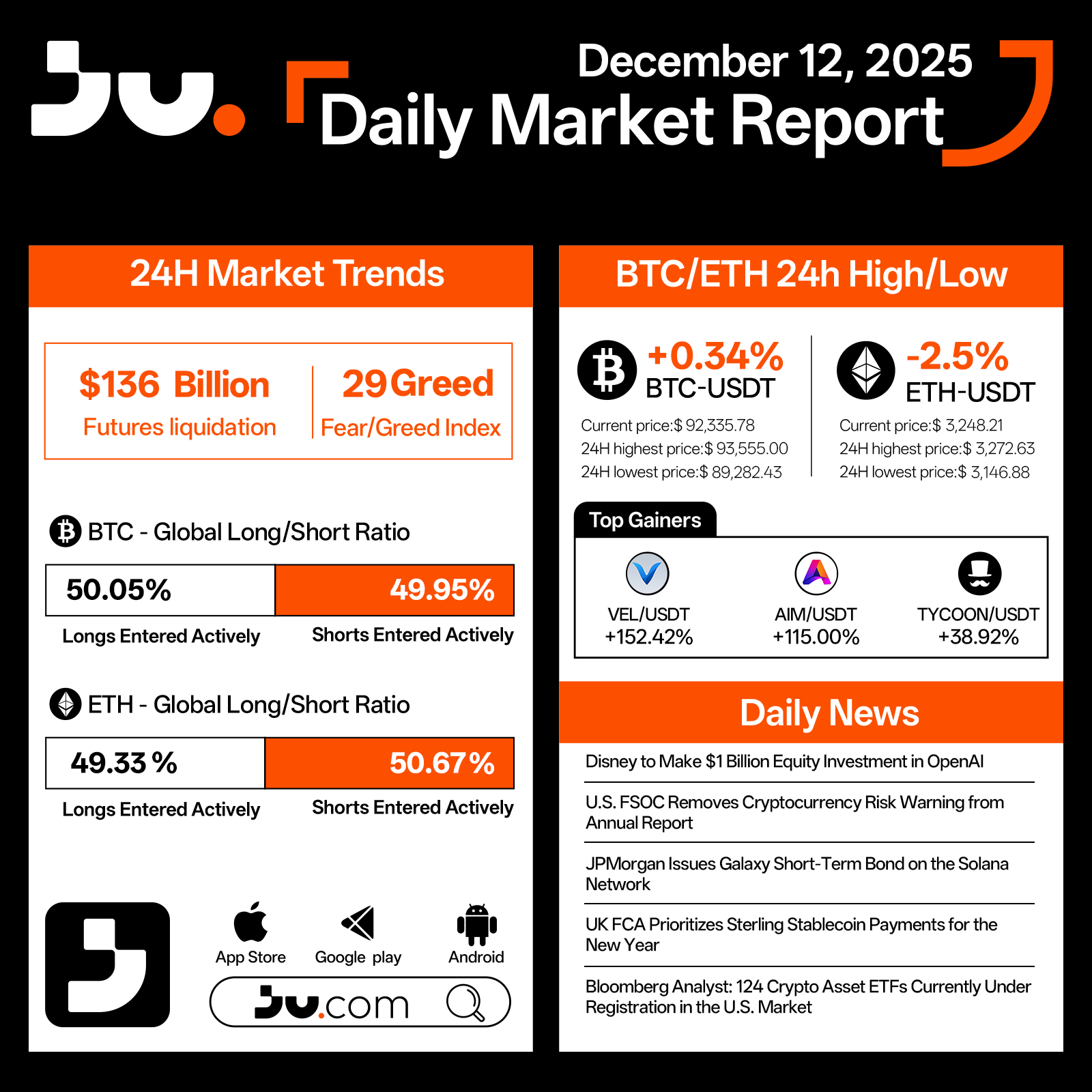

Crypto markets were broadly stable on December 12, with risk appetite hovering in mildly positive territory. Total 24-hour liquidations came in at $136 billion and the Fear & Greed Index printed 29. Bitcoin(BTC) edged up 0.34% to $92,335.78, trading between $93,555.00 and $89,282.43. Ethereum(ETH) eased 2.50% to $3,248.21, within a daily range of $3,272.63–$3,146.88. Positioning was balanced to slightly bullish on BTC with 50.05% longs vs. 49.95% shorts, while ETH leaned modestly bearish at 49.33% longs vs. 50.67% shorts. Speculative pockets outperformed, led by VEL/USDT (+152.42%), AIM/USDT (+115.00%), and TYCOON/USDT (+38.92%).

News flow skewed supportive for structural adoption. Disney announced a $1 billion equity investment in OpenAI, underscoring deeper convergence between AI and media. The U.S. FSOC removed its cryptocurrency risk warning from the annual report, signaling a more neutral policy stance. JPMorgan issued a Galaxy short-term bond on the Solana network, marking another bridge between TradFi and public chains. The UK FCA prioritized sterling stablecoin payments for the new year, pointing to faster regulated use cases. A Bloomberg analyst noted 124 crypto-asset ETFs are currently in U.S. registration, a pipeline that could expand product access and channel fresh inflows. With BTC holding gains and policy momentum improving, late-year performance will hinge on whether these catalysts translate into sustained net demand over the coming week.

#cryptocurrency #blockchain #technical analysis #finance

BTC: $111,459

Support: $109,700 Resistance: $112,600

Next Move: Rangebound; breakout above $112.6k may target $115k, breakdown below $109.7k may drop to $107k.

ETH: $3,822

Support: $3,660 Resistance: $3,860

Next Move: Bullish bias; holding above $3.66k may push to $3.9k–$4k, losing support may fall to $3.55k.

#cryptocurrency #technical analysis #blockchain #finance #trading strategies #

On December 25, crypto markets traded under reduced holiday liquidity, with overall activity cooling while price action showed signs of stabilization. Total liquidations over the past 24 hours fell to $72.24 billion, a notable contraction from prior sessions, while the Fear & Greed Index edged up to 28, suggesting sentiment has begun to steady in a lower-volatility environment.

Bitcoin rose 0.79% to $87,925.58, holding within a narrow intraday range between $88,035.35 and $86,440.52, as prices remained anchored in the middle of the recent consolidation zone. Ethereum also posted modest gains, climbing 0.52% to $2,953.91 after finding support near $2,889.57. While intraday swings remained uneven, overall price behavior reflected a gradual repair rather than renewed downside momentum. Positioning data supported this view, with BTC long positions increasing to 50.23% and ETH longs reaching 50.54%, indicating a slight bullish bias toward major assets despite subdued trading volumes.

Beneath the surface, speculative appetite persisted in select segments. HALV/USDT surged an extraordinary 667.55% within 24 hours, while ROBO/USDT and ZBT/USDT advanced 93.69% and 36.42%, respectively. These moves underscore that even during holiday conditions, capital continues to rotate aggressively into high-beta, small-cap tokens when majors remain range-bound.

Macro and policy developments added further context to market sentiment. The onshore yuan strengthened past the 7.01 level against the U.S. dollar, marking a new high for 2024 and reinforcing expectations of improving liquidity conditions in Asia. The U.S. concluded its previous administration’s probe into China’s chip trade, confirming no additional tariffs would be imposed over the next 18 months, easing near-term geopolitical and trade-related uncertainty. At the same time, the European Union officially implemented the DAC8 directive, intensifying crypto taxation and signaling higher long-term compliance costs for market participants. On the security front, Polymarket disclosed a third-party authentication vulnerability affecting a limited number of user accounts, highlighting ongoing infrastructure risks as on-chain platforms scale.

Overall, the crypto market appears to be entering a brief consolidation and repair phase amid holiday-thinned liquidity and a relatively stable macro backdrop. While major assets remain range-bound, continued participation in high-volatility tokens suggests risk appetite has not fully retreated, leaving the market poised for its next directional catalyst.

#cryptocurrency #blockchain #technical analysis #finance #