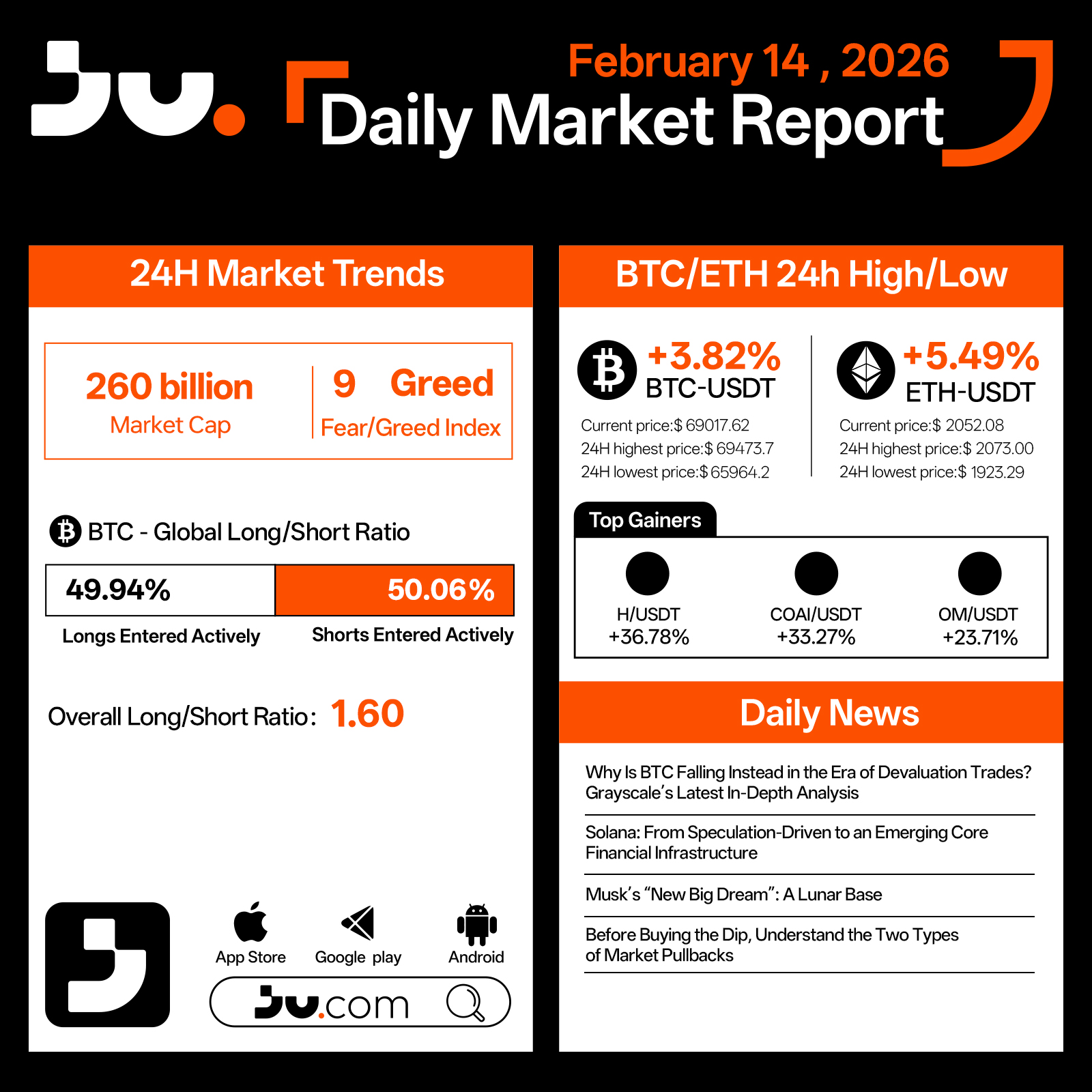

On February 14, the crypto market staged a notable rebound following consecutive sessions of decline, with total market capitalization rising to $260 billion. Although the Fear & Greed Index remains at 9, firmly within extreme fear territory, price action suggests that immediate selling pressure has eased, allowing for short-term recovery momentum.

Bitcoin gained 3.82% to $69,017.62, trading between $65,964.2 and $69,473.7 during the session. Long positions account for 49.94%, while shorts stand at 50.06%, with the aggregate long–short ratio declining to 1.60, reflecting a contraction in leveraged exposure. The rebound appears driven by short covering and tactical dip buying rather than a confirmed structural reversal.

Ethereum outperformed, rising 5.49% to $2,052.08, after dipping to $1,923.29 intraday. As a higher-beta asset, ETH demonstrated stronger recovery elasticity, highlighting renewed risk appetite at lower price levels, though broader market structure remains in a rebuilding phase.

Among leading gainers, H, COAI, and OM posted significant advances, largely attributable to oversold bounces and speculative positioning rather than a broad-based improvement in fundamentals.

Narrative focus centered on Grayscale’s analysis of why Bitcoin has not fully aligned with the “devaluation trade” thesis, emphasizing that macro liquidity dynamics continue to influence crypto pricing. Discussions around Solana’s transition from speculation-driven momentum to a potential core financial infrastructure further underscore evolving sector narratives. Analysts also cautioned investors to distinguish between different types of market pullbacks before engaging in dip-buying strategies.

Overall, February 14 reflects a technical rebound rather than a confirmed trend reversal. While short-term sentiment has improved marginally, extreme fear readings indicate that confidence remains fragile. In the absence of clearer liquidity or policy catalysts, volatility and consolidation are likely to persist in the near term.

#cryptocurrency #blockchain #JU #Jucom

JU Blog

2026-02-14 06:12

Technical Rebound Emerges Amid Persistent Extreme Fear - Daily Market Report | February 14, 2026

Penafian:Berisi konten pihak ketiga. Bukan nasihat keuangan.

Lihat Syarat dan Ketentuan.

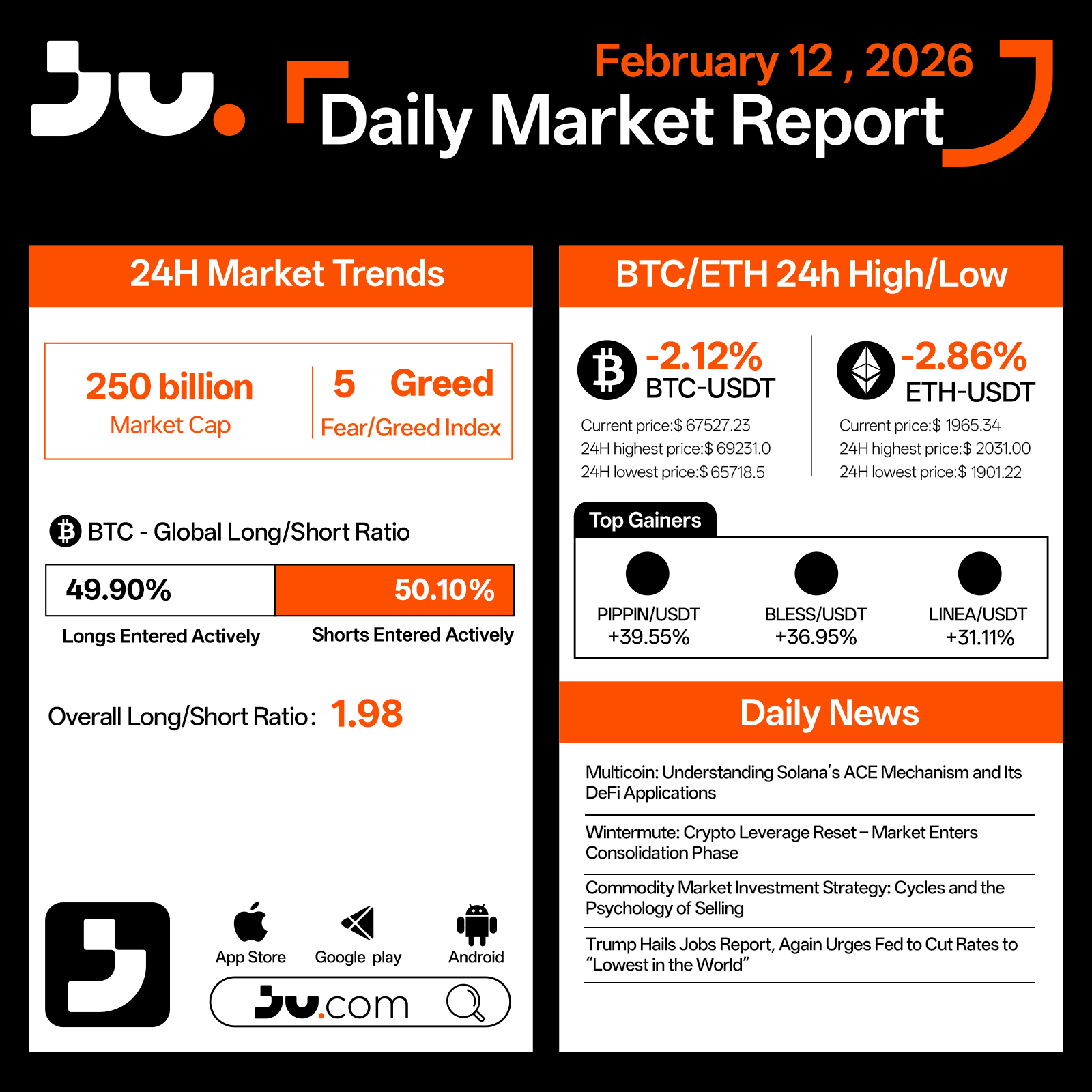

On February 12, the crypto market extended its decline, with total market capitalization falling to $250 billion. The Fear & Greed Index plunged to 5, marking one of the lowest readings of the current cycle and signaling extreme market anxiety. Liquidity remains tight, and post-leverage liquidation dynamics continue to shape price action.

Bitcoin dropped 2.12% to $67,527.23, trading between $65,718.5 and $69,231.0 during the session. Long positions account for 49.90%, while shorts stand at 50.10%, with an aggregate long–short ratio of 1.98, indicating near-balanced positioning despite continued downward pressure. The breakdown below key psychological levels has reinforced cautious sentiment, and volatility remains elevated.

Ethereum declined 2.86% to $1,965.34, with an intraday low of $1,901.22. As a higher-beta asset, ETH continues to exhibit greater downside sensitivity compared to BTC, reflecting ongoing risk reduction across the broader market.

Among top performers, PIPPIN, BLESS, and LINEA recorded strong gains, largely driven by tactical flows and sector rotation rather than a broad-based recovery in sentiment.

From a narrative perspective, Multicoin’s analysis of Solana’s ACE mechanism and its DeFi applications highlights continued innovation within high-performance blockchain ecosystems. Wintermute suggests that following a broad leverage reset, the market may enter a consolidation phase. Discussions surrounding commodity cycles and selling psychology further underscore prevailing macro uncertainty. Meanwhile, renewed political pressure for aggressive rate cuts adds another layer of complexity to risk asset pricing.

Overall, February 12 reflects a market in extreme fear territory. While such readings can historically coincide with late-stage capitulation, the absence of a clear liquidity or policy pivot suggests that consolidation at lower levels may persist before a more sustainable recovery emerges.

#cryptocurrency #blockchain #technical analysis #JU #Jucom

JU Blog

2026-02-12 04:28

Extreme Fear Deepens as Market Tests Lower Boundaries - Daily Market Report | February 12, 2026

Penafian:Berisi konten pihak ketiga. Bukan nasihat keuangan.

Lihat Syarat dan Ketentuan.

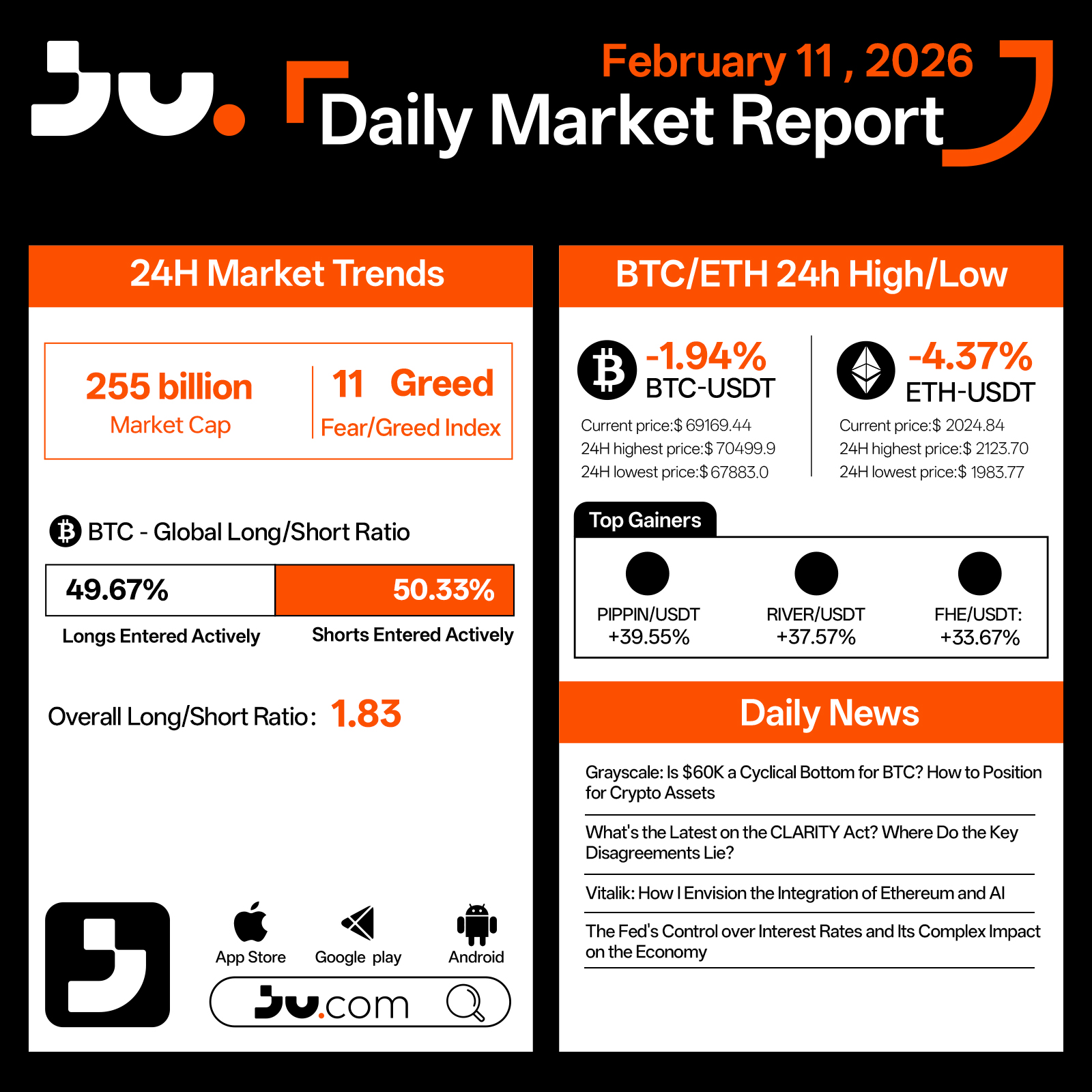

On February 11, the crypto market extended its pullback, with total market capitalization declining to $255 billion. The Fear & Greed Index ticked slightly higher to 11, yet remains firmly within extreme fear territory. Sentiment continues to be fragile, and risk appetite remains constrained.

Bitcoin fell 1.94% to $69,169.44, trading between $67,883.0 and $70,499.9 during the session. Long positions account for 49.67%, while shorts stand at 50.33%, with the aggregate long–short ratio rising to 1.83. This suggests selective positioning for a bounce at lower levels, though the broader structure still leans defensive. With BTC slipping below the $70,000 threshold, debate around whether $60,000 could represent a cyclical bottom has intensified.

Ethereum experienced sharper pressure, dropping 4.37% to $2,024.84, after briefly touching $1,983.77 intraday. Compared with Bitcoin, ETH displayed greater downside sensitivity, reflecting the market’s tendency to reduce exposure to higher-beta assets during risk contraction phases.

Among outperformers, PIPPIN, RIVER, and FHE posted notable gains, largely driven by short-term tactical positioning rather than a broad improvement in sentiment.

Narrative focus shifted toward structural and macro themes. Grayscale raised the question of whether $60,000 may serve as a cyclical base for Bitcoin, prompting renewed discussions on strategic positioning. Progress and disagreements surrounding the CLARITY Act remain a key regulatory variable in the United States. Meanwhile, Vitalik Buterin’s vision for Ethereum’s integration with AI highlights longer-term innovation pathways beyond current volatility. The Federal Reserve’s influence over interest rates continues to shape broader economic expectations, leaving markets attentive to future liquidity signals.

Overall, February 11 reflects a phase of continued fear with moderating selling intensity. While a decisive reversal has yet to emerge, downside momentum appears to be narrowing. In the absence of clearer macro or regulatory catalysts, markets are likely to remain range-bound near recent lows as participants search for a more durable base.

#cryptocurrency #blockchain #technical analysis #JU #Jucom

JU Blog

2026-02-11 04:22

Testing the Lower Range as Fear Persists - Daily Market Report | February 11, 2026

Penafian:Berisi konten pihak ketiga. Bukan nasihat keuangan.

Lihat Syarat dan Ketentuan.

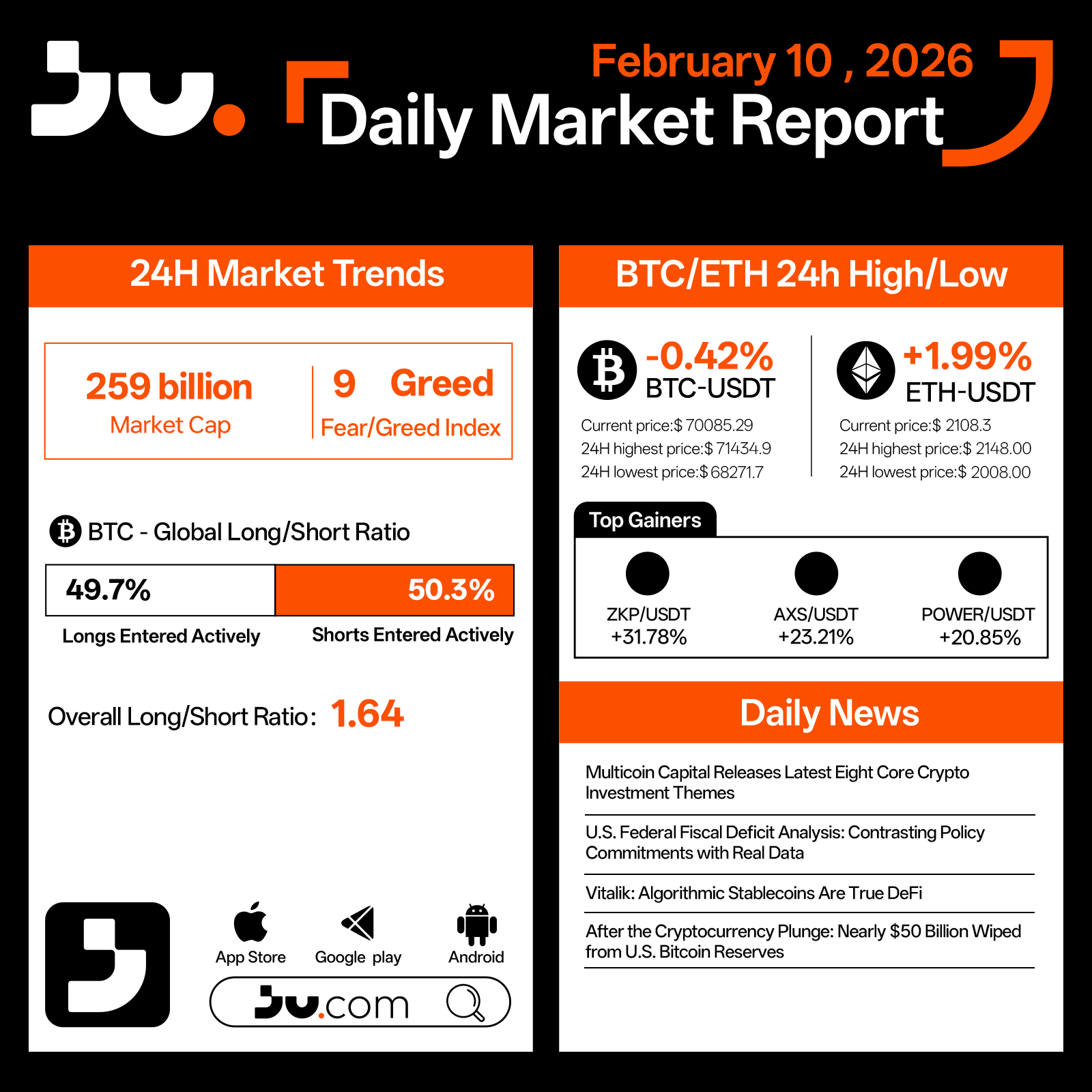

On February 10, the crypto market continued to trade within extreme fear territory, with total market capitalization holding at $259 billion and the Fear & Greed Index slipping further to 9. While sentiment remains deeply risk-averse, the pace of downside acceleration has clearly slowed compared with last week’s sell-off.

Bitcoin edged down 0.42% to $70,085.29, fluctuating between $68,271.7 and $71,434.9 throughout the session. Positioning data shows longs at 49.7% versus shorts at 50.3%, with the aggregate long–short ratio falling to 1.64. This reflects continued deleveraging and shrinking speculative exposure, suggesting the market is transitioning from a high-volatility liquidation phase to a low-leverage consolidation period.

Ethereum showed relative resilience, gaining 1.99% to $2,108.30 after briefly dipping to $2,008 before rebounding. This divergence indicates selective dip-buying in core assets even as overall risk appetite remains constrained.

Among smaller-cap tokens, ZKP, AXS, and POWER led gains, driven largely by short-term positioning and tactical rebounds rather than a broad-based improvement in sentiment. Market dynamics remain characterized by selective recovery rather than a full risk-on rotation.

Narrative focus continues to shift away from price action toward structural and long-term considerations. Variant’s reflections on insider trading in prediction markets highlight governance and transparency challenges in decentralized platforms. a16z reiterated its long-term philosophy for crypto, emphasizing that cyclical drawdowns do not negate the structural trajectory of the industry. At the same time, Goldman Sachs’ evolving crypto strategy and renewed discussion around the strategic role of gold underscore how digital assets and traditional safe havens are increasingly evaluated within the same macro allocation framework.

Overall, February 10 reflects a phase of late-stage fear and tentative stabilization. While selling pressure has eased, confidence remains fragile. Without clearer signals from liquidity conditions, macro policy, or regulation, the market is likely to remain range-bound near the lows as it searches for a durable base.

#JU #Jucom #cryptocurrency #blockchain #technical analysis

JU Blog

2026-02-10 06:02

Divergent Stabilization Under Extreme Fear - Daily Market Report | February 10, 2026

Penafian:Berisi konten pihak ketiga. Bukan nasihat keuangan.

Lihat Syarat dan Ketentuan.

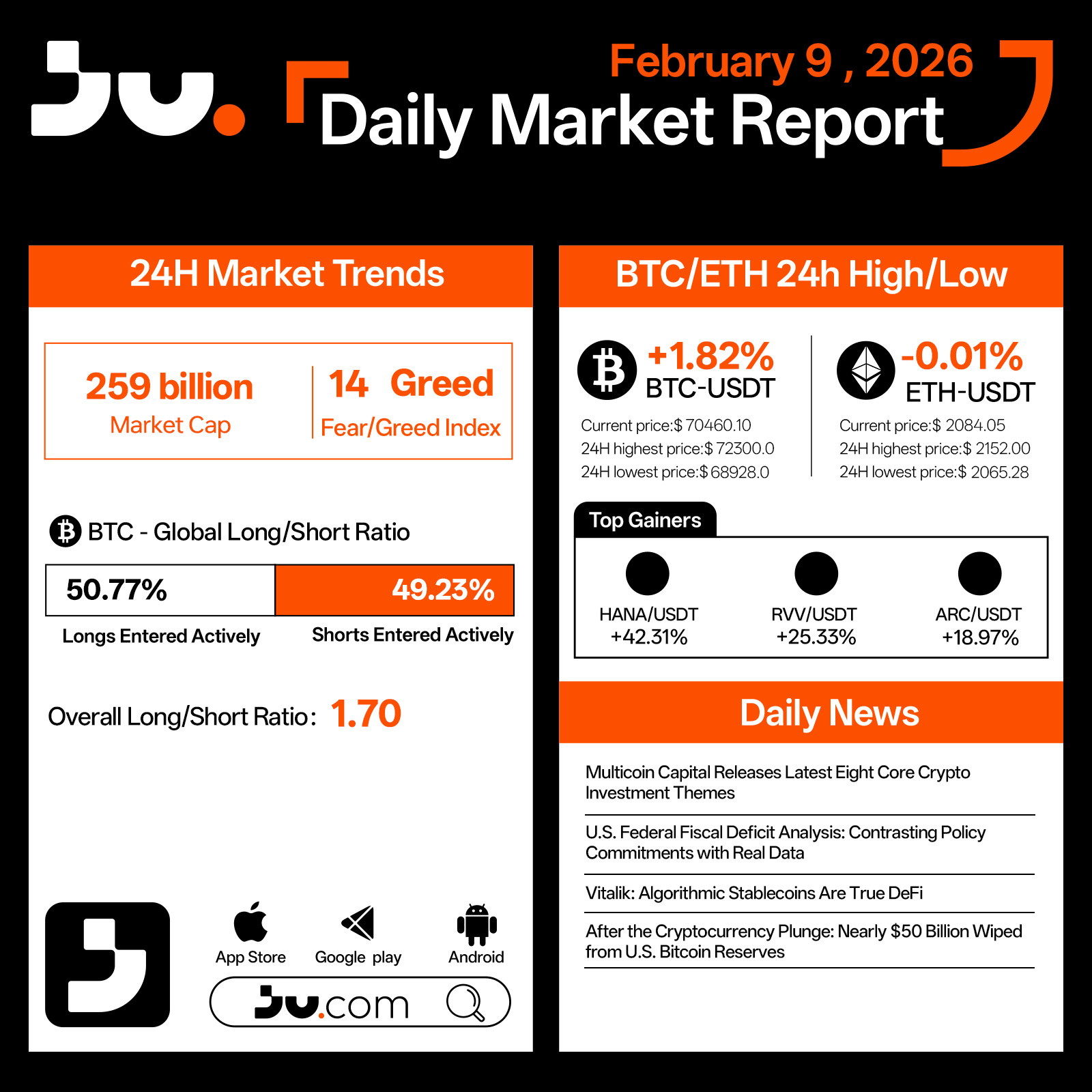

On February 9, the crypto market staged a modest rebound following the recent wave of extreme panic. Total market capitalization recovered to $259 billion, while the Fear & Greed Index remained depressed at 14, indicating that sentiment is still cautious even as selling pressure begins to ease.

Bitcoin rose 1.82% to $70,460.10, trading within a $68,928–$72,300 range. After last week’s aggressive deleveraging, downside momentum has clearly slowed. Positioning data shows BTC long exposure edging up to 50.77%, but with the aggregate long–short ratio at just 1.70, the move appears driven primarily by short covering and tentative dip-buying rather than conviction-based inflows. Ethereum lagged the rebound, finishing nearly flat at $2,084.05, underscoring continued weakness in higher-beta assets while risk appetite remains fragile.

Among smaller-cap tokens, names such as PIPPIN, RVV, and ARCU posted outsized gains, reflecting opportunistic trading in a liquidity recovery phase rather than a broad-based improvement in market sentiment.

From a narrative perspective, attention is shifting from post-crash blame to structural reflection. Multicoin Capital’s release of eight core crypto investment themes offers a refreshed framework for long-term positioning, while renewed scrutiny of the U.S. federal fiscal deficit highlights the growing gap between policy commitments and fiscal reality. Vitalik’s assertion that algorithmic stablecoins represent “true DeFi” has also resurfaced, prompting deeper discussion about the fundamental direction of decentralized finance.

Notably, following the recent sell-off, nearly $5 billion was wiped from U.S. Bitcoin reserves, reinforcing the idea that crypto assets are now intertwined with macro balance sheets rather than isolated from them.

Overall, February 9 appears to mark a technical rebound after extreme fear, not a confirmed trend reversal. While prices have stabilized, true recovery will depend on further deleveraging, improving liquidity conditions, and clearer macro signals. Until then, the market is likely to remain range-bound and fragile as it searches for a new equilibrium.

#cryptocurrency #blockchain #technical analysis #JU #Jucom

JU Blog

2026-02-09 03:52

A Technical Rebound Amid Persistent Fear - Daily Market Report | February 9, 2026

Penafian:Berisi konten pihak ketiga. Bukan nasihat keuangan.

Lihat Syarat dan Ketentuan.

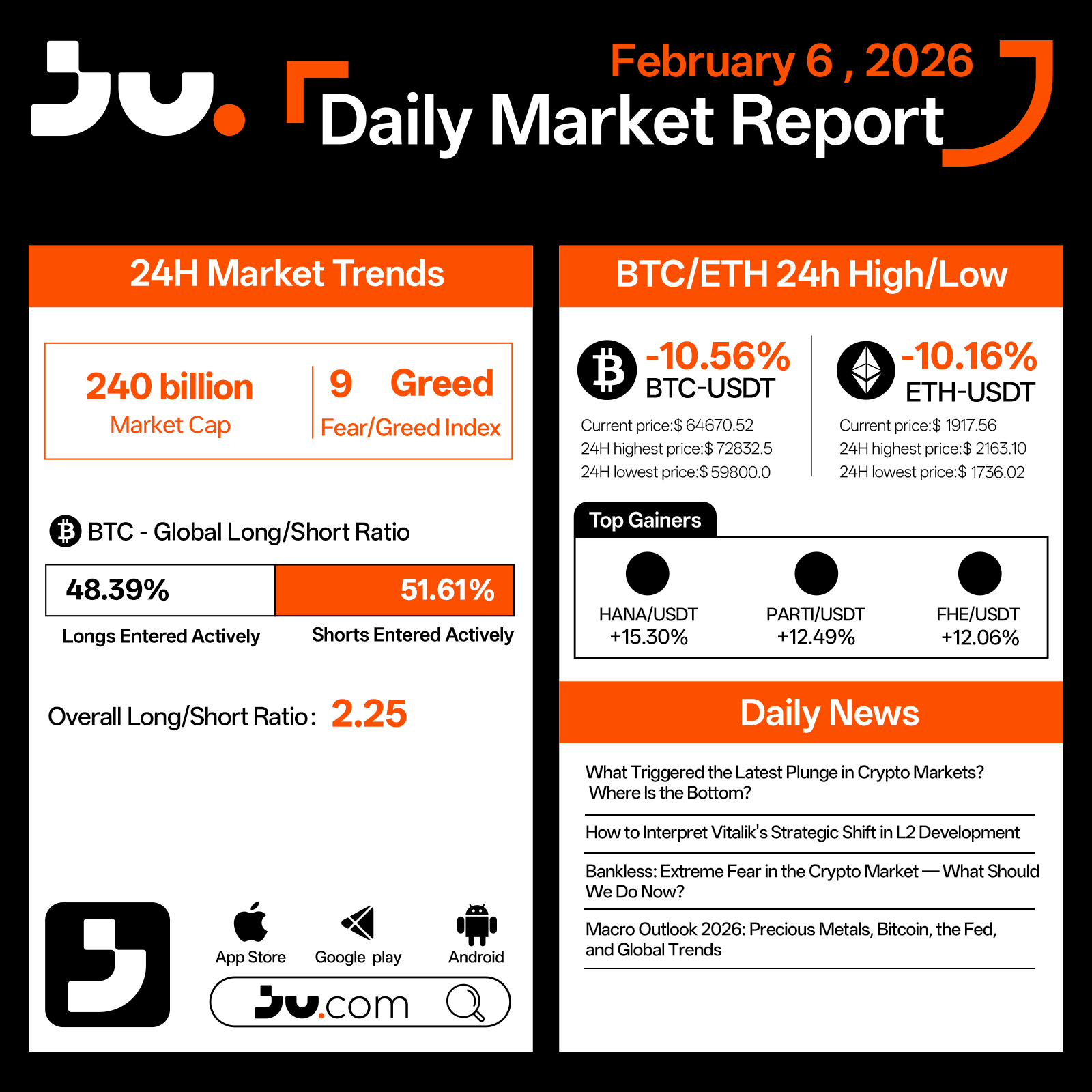

On February 6, the crypto market experienced its sharpest acceleration lower in the current downturn. Total market capitalization fell to $240 billion, while the Fear & Greed Index plunged to 9, firmly entering extreme fear territory. Sentiment and liquidity collapsed simultaneously, pushing the market into a forced, non-linear liquidation phase.

Bitcoin dropped 10.56% to $64,670.52, with an exceptionally wide intraday range from $72,832.50 down to $59,800.00, a clear sign that liquidations and forced selling dominated price action. Ethereum followed closely, falling 10.16% to $1,917.56, after briefly touching $1,736.02. High leverage and Ethereum’s higher beta amplified downside volatility. Positioning remains defensive, with BTC longs at just 48.39% and the aggregate long–short ratio easing to 2.25, suggesting some leverage has been flushed out, though risk aversion persists.

Against this systemic sell-off, a handful of small-cap tokens such as HANA, PARTI, and FHE posted double-digit gains. These moves appeared opportunistic and liquidity-driven, rather than signaling any meaningful recovery in market risk appetite.

Narratively, attention has shifted toward identifying the true trigger of the plunge. While panic selling is the visible catalyst, the underlying drivers remain tightening liquidity, sustained ETF outflows, and mounting macro uncertainty. Discussions around Vitalik’s strategic adjustments to Layer 2 development are increasingly framed as long-term structural shifts, not near-term bullish catalysts.

Notably, voices like Bankless are steering the conversation away from “buying the bottom” toward survival and risk management, emphasizing capital preservation over directional conviction during periods of extreme fear. At the macro level, the ongoing repricing between precious metals, Bitcoin, and Federal Reserve policy expectations continues to pressure risk assets.

In summary, February 6 marks a phase defined by extreme fear and forced deleveraging. Whether the market is approaching a local bottom will depend less on isolated news and more on whether fear is fully exhausted and liquidity conditions stabilize. Until then, violent volatility is likely to remain the market’s dominant feature.

#JU #Jucom #cryptocurrency #blockchain

JU Blog

2026-02-06 09:38

Liquidity Breakdown Amid Extreme Fear - Daily Market Report | February 6, 2026

Penafian:Berisi konten pihak ketiga. Bukan nasihat keuangan.

Lihat Syarat dan Ketentuan.

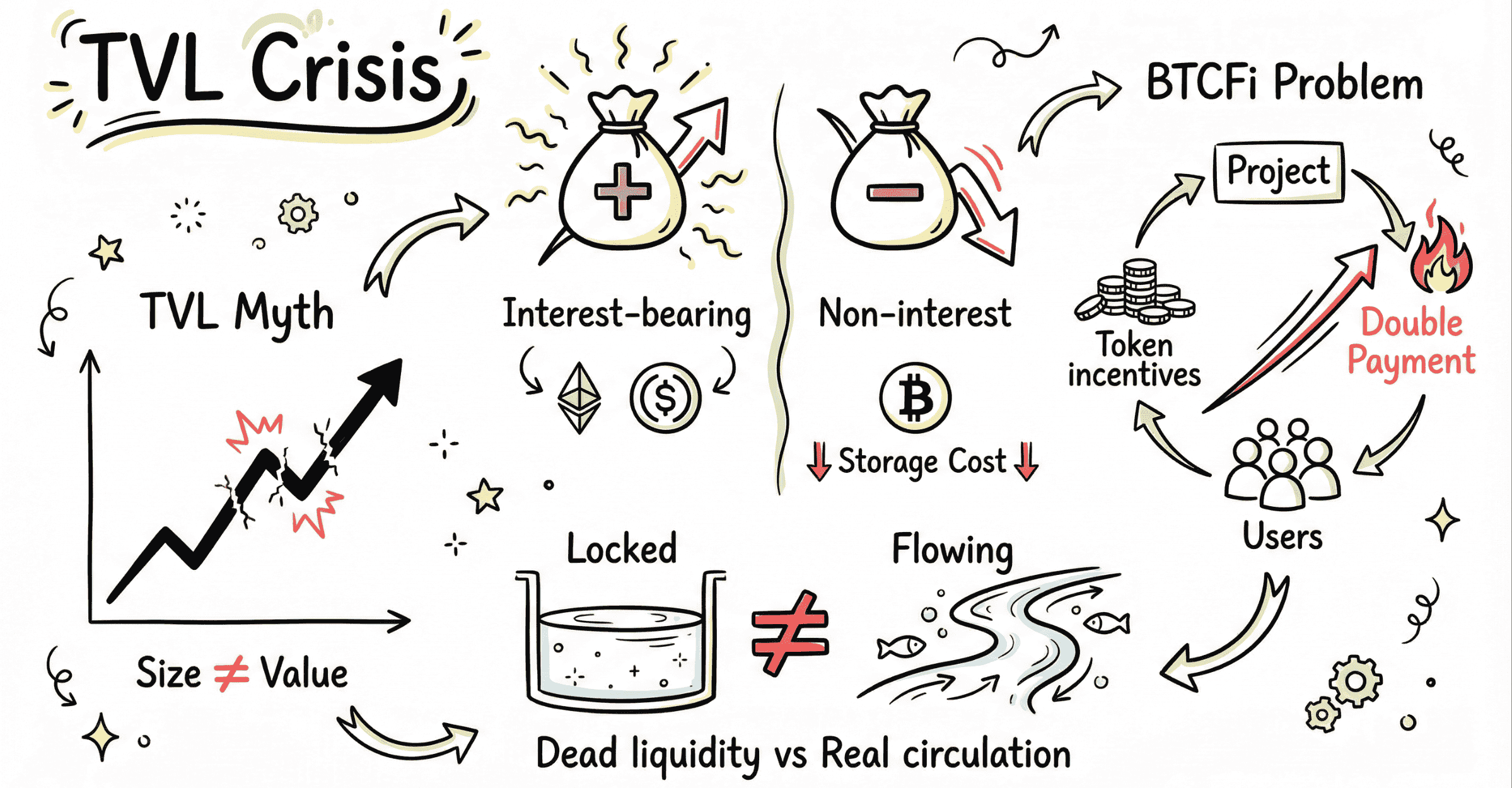

The crypto market's obsession with Total Value Locked (TVL) has transformed from a healthy ecosystem metric into a destructive force driving internal competition. Ju.com's latest research reveals how this "vanity metric" is crushing innovation and pushing projects into unsustainable debt cycles.

💰 The Core Problem:

TVL has evolved from a simple activity indicator into a heavy financial burden for project teams. "Dead assets" locked without internal circulation fail to generate real value, while borrowing costs to meet exchange listing requirements are creating a vicious cycle of data manipulation and opaque fee structures.

🚨 Three Critical Issues Uncovered:

Asset Mismatch & Negative Yield Trap: The 2025 BTCFi sector collapse proved that forcibly converting non-yielding assets like BTC into TVL metrics is fundamentally flawed. Projects with over $5 billion in TVL still failed because they couldn't generate intrinsic value, instead burning capital through unsustainable token incentives. The difference between yield-bearing assets like staked ETH and negative-yield assets like BTC has been deliberately ignored, creating hollow liquidity that looks impressive on dashboards but provides zero ecosystem value.

Exchange Listing's Hidden Taxes: To meet CEX listing requirements, projects are forced to "purchase" TVL through hired capital at predatory rates of 20%+ annual returns versus normal DeFi rates of 5-15%. Combined with listing fees, market-maker deposits, and data service costs, projects enter TGE already deep in debt. This forces them to become market extractors rather than builders, with token prices peaking at launch and rapidly declining as teams desperately sell to recover costs.

Traffic Illusions & Primary-Secondary Inversion: Platform token holders are overwhelmingly yield farmers who dump immediately after airdrops, providing zero long-term liquidity support. Meanwhile, OTC whales acquire positions at 50%+ discounts before listings, creating severe misalignment. In January 2026 alone, major unlocks totaling $314 million for Hyperliquid and Sui exerted crushing pressure on markets, normalizing a system where "bad money drives out good."

🔄 The TVL 2.0 Solution:

The industry must pivot from "scale-first" to "profit-first" thinking. Ethena's October 2025 collapse from $14.8B to $7.4B TVL in weeks proved that leverage without intrinsic value generation is poison. Next-generation protocols must demonstrate real yield capacity through trading fees, lending spreads, and node rewards rather than token subsidies.

💡 Key Takeaway:

Only when capital circulates through ecosystems like blood through veins—rather than sitting idle mining yields—can crypto escape the current zero-sum liquidity trap. Projects must abandon vanity metrics and focus on sustainable business models with genuine user retention.

The path forward requires rebuilding trust through market-based interest rates and closed-loop systems where TVL actually generates value instead of consuming it.

Read the complete analysis with detailed case studies and data: 👇 https://blog.ju.com/tvl-alienation-web3-competition/?utm_source=blog #TVL #DeFi #Web3 #Crypto #Blockchain

JU Blog

2026-01-16 05:31

TVL Alienation: Web3's Hidden Crisis Exposed

Penafian:Berisi konten pihak ketiga. Bukan nasihat keuangan.

Lihat Syarat dan Ketentuan.

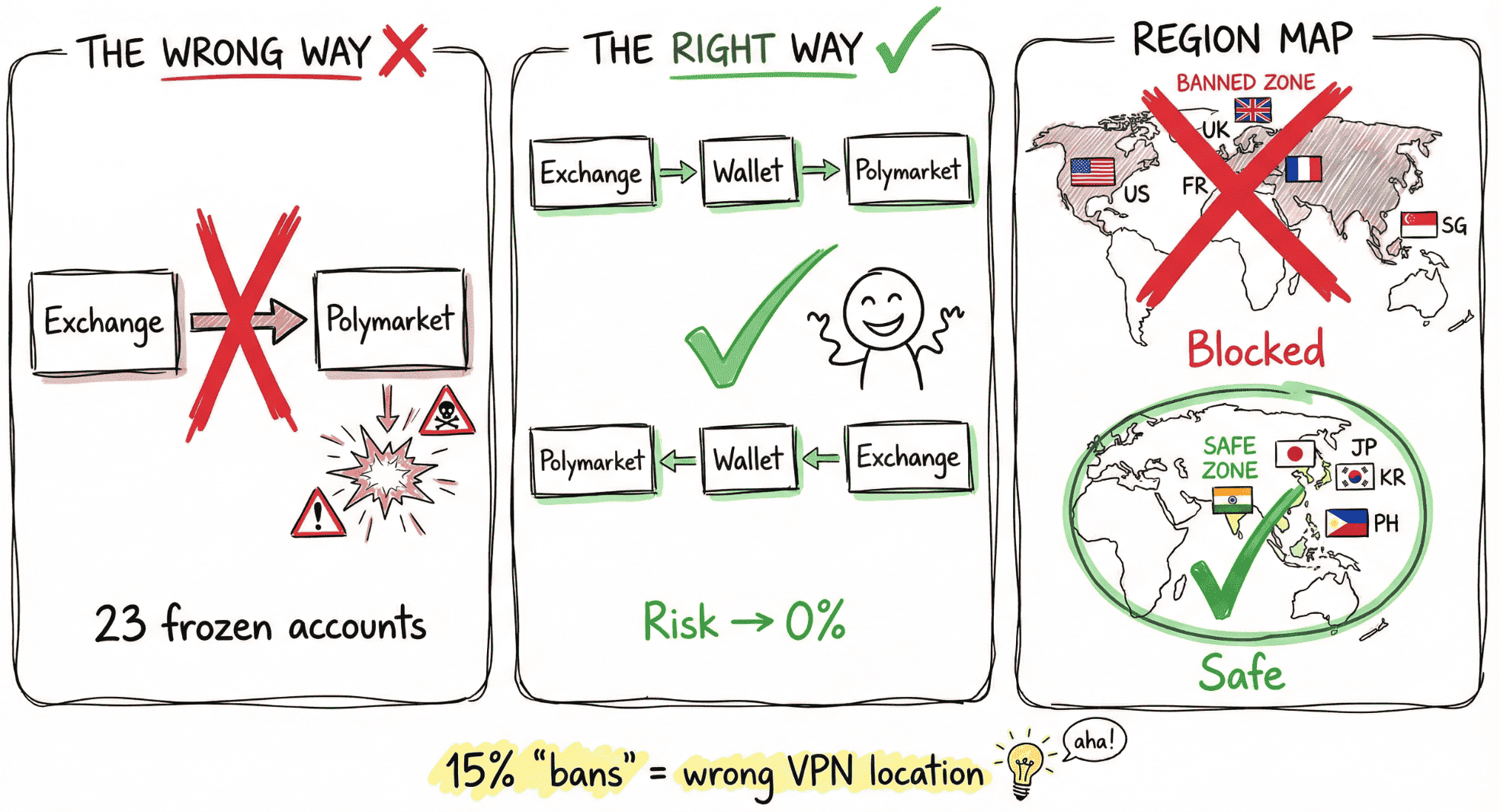

2025 marked prediction markets' breakthrough into mainstream consciousness. Polymarket alone processed over 95 million trades with $21.5 billion in volume, while the entire ecosystem reached $40-44 billion. With 1.77 million total users and monthly actives stabilizing at 400,000-500,000, these numbers dwarf many DeFi protocols.

💰 The Reality Check: Why 95% Lose

Only 5.08% of wallets realized profits over $1,000, with just 30.2% profitable overall. The top 0.04% of addresses captured over 70% of total profits, accumulating $4 billion in realized gains. This zero-sum game demands strategy over speculation.

🔄 The Turning Point: ICE's $2B Investment

In October 2025, the NYSE parent company ICE valued Polymarket at $9 billion with a $2 billion investment. The platform acquired a CFTC-licensed exchange for U.S. market re-entry and announced migration from Polygon to its own Ethereum L2 (POLY). Market expects token generation event after the 2026 World Cup.

🚨 Risk Controls: The Zero Line of Defense

Never withdraw directly from exchanges to Polymarket. The correct flow is Exchange → Wallet → Polymarket for deposits, and reverse for withdrawals. This extra step costs minimal gas but eliminates account freeze risks. Explicitly prohibited regions include USA, UK, France, Ontario, Singapore, Poland, Thailand, and Taiwan. Recommended regions are Japan, Korea, India, Philippines, Spain, Portugal, and Netherlands.

📊 Airdrop Positioning: Become a High-Quality User

The platform values users who keep markets efficient and participate in price discovery. Key weight factors include Maker orders over Taker orders, Split/Merge operations for ~4% annual position rewards, diverse market participation across crypto/politics/sports/culture/economics, multiple time horizons from short-term to long-term markets, and sustained holding periods. The optimal trade size is $50-$500, with behavioral diversity and holding time carrying the highest weights.

🎯 Six Arbitrage Strategies for Profit

Cross-platform arbitrage exploits price differences where YES on Platform A plus NO on Platform B totals under $1. Multi-outcome arbitrage buys all mutually exclusive options when their combined YES prices sum below $1. Cross-event arbitrage identifies semantically identical events priced differently on the same platform. Term structure spread trades mispriced time value, buying longer-dated options while selling shorter ones. Rule-edge trading focuses on settlement criteria rather than headlines, finding value in the fine print. High-probability compounding targets events over 90% probability with under 72 hours to settlement, generating 80-150% annualized returns through disciplined execution.

💡 The Long-Term Builder's Edge

Prediction markets are approaching their "iPhone moment." Technology is ready, early user education is complete, and breakout events are imminent. Success rewards those who build information advantages, understand underlying mechanics, and prepare systematically. Don't chase short-term gains—build repeatable edges through compliant fund flows, line-by-line rule verification, and disciplined execution from low-risk arbitrage to late-stage strategies.

Read the complete survival guide with advanced strategies and risk mitigation: 👇 https://blog.ju.com/polymarket-prediction-markets/?utm_source=blog

#Polymarket #PredictionMarkets #Crypto #DeFi

JU Blog

2026-01-14 05:26

Polymarket Survival Guide: Your Edge in the $40B Prediction Markets Boom

Penafian:Berisi konten pihak ketiga. Bukan nasihat keuangan.

Lihat Syarat dan Ketentuan.

On January 4, the crypto market carried forward its early-year momentum, with Bitcoin decisively breaking through a key resistance level and lifting overall sentiment. Over the past 24 hours, market activity expanded notably, with total turnover and liquidations reaching $107.27 billion, while the Fear & Greed Index climbed to 40, signaling a clear rebound in risk appetite compared with year-end conditions.

Bitcoin rose 1.13% to $91,144.55, posting an intraday high of $91,574.40 and a low of $89,314.02. The successful break above the $91,000 level and subsequent consolidation suggest sustained bullish momentum. Ethereum followed with a 0.77% gain to $3,145.37, trading within a $3,166.41–$3,076.75 range and maintaining a steady correlation with BTC’s upward move. Positioning remained balanced, with BTC longs at 49.88% and ETH longs at 49.62%, indicating that the advance has been driven more by spot demand and trend-following capital than by excessive leverage.

Structural opportunities remained active across smaller-cap assets. FMC/X surged 70.24%, while NEXAI/USDT and PIPPIN/USDT advanced 41.53% and 24.14%, respectively. These moves reflect selective capital rotation as traders respond to Bitcoin’s breakout without broad-based risk expansion.

Macro and fundamental signals added depth to the move. The U.S. government disclosed that its cryptocurrency holdings now exceed $30 billion, with Bitcoin accounting for 97% of the total, reinforcing BTC’s status as the dominant digital reserve asset. On the Ethereum front, Vitalik Buterin stated that ZK-EVM and PeerDAS will transform Ethereum into a new form of high-performance decentralized network, strengthening long-term scalability and data availability narratives. Despite heightened geopolitical headlines, including reports of U.S. military strikes in Venezuela, Bitcoin prices remained resilient, underscoring its growing role as an asset capable of withstanding external shocks.

Overall, the opening days of 2026 show a market regaining directional clarity. Bitcoin’s breakout provides a clear technical anchor, while Ethereum’s roadmap supports medium-term confidence. With liquidity and sentiment improving in tandem, the crypto market appears to be entering the early phase of a new structural advance.

#cryptocurrency #blockchain

JU Blog

2026-01-09 04:40

Bitcoin Breaks Above $91K as Risk Appetite Rebounds Amid Geopolitical Noise - Jan 4, 2026

Penafian:Berisi konten pihak ketiga. Bukan nasihat keuangan.

Lihat Syarat dan Ketentuan.

To seize the global opportunities brought about by the rapid development of artificial intelligence (AI) technology and to further promote the deep integration of cutting-edge technology with the real economy and the digital economy, Ju.com officially announces the establishment of a $30 million AI special investment fund.

This fund will systematically invest around core AI technologies and the next generation of intelligent product forms. Key investment areas include, but are not limited to: • AI foundational models and underlying technologies • AI Agent products and solutions, encompassing autonomous decision-making, task execution, and automation scenarios • Intelligent robotics-related products, including software-driven robots, Embodied AI, and human-robot collaboration systems • Convergent applications of AI and Blockchain / Web3, such as smart contract automation, on-chain governance and risk control, and decentralized intelligent execution systems • Commercialization and implementation of AI in fields like fintech, enterprise services, content generation, and data analytics

This special fund will invite several listed companies and industrial capital to co-invest. By leveraging synergies from industrial resources, application scenarios, and financial support, it aims to provide portfolio projects with full-cycle empowerment, from technology validation and commercial implementation to long-term strategic partnerships.

Ju.com has always adhered to a long-term value and technological innovation-oriented approach, continuously building an open, robust, and sustainable technology investment ecosystem. The establishment of this AI special fund represents a crucial strategic move by Ju.com in the context of cutting-edge technology and the intelligent trend, and also reflects our high recognition of the long-term industrial value of AI, AI Agent, and robotics technologies.

In the future, Ju.com will collaborate with outstanding entrepreneurial teams, technical talent, and industrial partners worldwide to jointly promote the large-scale application and industrial upgrading of the next generation of intelligent products.

This is hereby announced.

#AI #Jucom

JU Blog

2026-01-09 04:40

Ju.com Announcement on the Establishment of a $30 Million AI Special Investment Fund

Penafian:Berisi konten pihak ketiga. Bukan nasihat keuangan.

Lihat Syarat dan Ketentuan.

— An End-of-Year Letter to Global Users from Sammi, Founder & CEO of Ju.com

Dear Ju.com users, partners, and peers across the industry,

Wishing you all a Happy New Year in advance!

As we stand at the close of 2025 and look back on a year marked by volatility and change, I want to begin by thanking every user who chose Ju.com and placed their trust in us. It is your confidence that has given us the opportunity to stay true to our principles and move forward steadily in an industry full of both challenges and opportunities.

For Ju.com, 2025 was a year of renewal—and, more importantly, a year of delivering on our promises. Beyond completing a brand upgrade, we focused on turning the words “user first” into concrete, verifiable actions.

User Protection: Not a Slogan, but a Verifiable Commitment

In January, on the first day of the JU platform token launch, we faced a difficult decision. Subscription demand far exceeded expectations, and we could have easily secured short-term revenue—but doing so would have meant some users bearing losses. My team and I made a decisive choice: we distributed free token airdrops to all participants and issued full refunds.

That decision established Ju.com’s core principle: user protection takes priority over platform revenue.

During the sharp market downturn in October, we launched a network-wide 1.9 billion hashrate subsidy program to provide meaningful support for derivatives traders who needed a fresh start. We believe that a trading platform should grow alongside its users’ success—not profit from their inevitable losses.

From full refunds during the IEO to hashrate subsidies, this comprehensive user protection framework demonstrates a simple truth: in crypto, user protection and commercial success are not contradictory. The real question is whether you are truly willing to put users first.

Ecosystem Building: From a Trading Platform to Full-Stack Infrastructure

This year, we completed a major strategic shift—evolving from a single trading platform into a comprehensive ecosystem.

The launch of JuChain marked a critical step in this journey. In December, we announced the establishment of a $100 million JuChain Venture Fund. This is more than a capital commitment—it is a long-term promise to the developer community. Through sustained funding, technical support, and real-world integration, we aim to help more projects move from “being possible” to “scaling meaningfully.”

On the product innovation front, the launch of 01959.HK represents our exploration into bridging traditional finance with on-chain innovation. By connecting real stock custody with on-chain liquidity incentive mechanisms, we enable traditional assets to participate in blockchain-native incentive models. Our goal is to better reward long-term contributors while making real stock ownership more accessible, seamless, and user-friendly.

Updates to JuPay are also accelerating. We are working to connect trading, asset management, and everyday use into one smooth, coherent flow—so that Ju.com feels less like a pure trading tool and more like part of daily life.

Brand Renewal: The Transformation from JuCoin to Ju.com

Our brand renewal journey in the Maldives this September was deeply meaningful for both me and the entire team. In our in-depth discussions with KOLs and partners, the most consistent feedback we heard was clear: the experience needs to be smoother, and the service needs to be more solid.

This is also the context behind our message of “Rewrite the Impossible”—and a reminder to ourselves: break down hard problems, refine details patiently, and get things done with steady execution.

The shift from JuCoin to Ju.com is not just a name change; it is a clarification of our positioning. We want Ju.com to be the starting point for global users entering the digital asset world—where processes feel intuitive, experiences resemble everyday applications, and users take one less step of friction and gain more certainty.

Global Engagement: Advancing International Expansion with Pragmatism

In 2025, we attended TOKEN2049 twice—Dubai in the first half of the year, and Singapore in the second. Both events highlighted a clear shift toward pragmatism in the industry. Conversations are no longer just about concepts and visions, but about whether products truly work and whether they can retain long-term users.

Through these opportunities, we clearly communicated Ju.com’s product direction and core philosophy, and put our details on display for the industry to examine. Long-term users come from long-term experiences—this is something we will continue to stand by.

I often say that as Ju.com grows globally, our sense of responsibility must grow with it. After a major fire in Tai Po, Hong Kong, in November, we promptly donated HKD 2 million through accredited charitable channels to support relief and reconstruction efforts. A platform that can step up for society at critical moments is fulfilling a basic obligation.

JU Platform Token: Continued Buybacks and Burns

Since the JU platform token launched earlier this year, we have consistently used platform revenue to advance our buyback and burn mechanism. This is about taking responsibility in a long-term way, and allowing ecosystem participants to see that we are serious about honoring our commitments.

The true value of a platform lies not in what it promises, but in what it delivers.

2026: Moving Forward, Side by Side

Looking back on 2025, we have delivered verifiable results across user protection, ecosystem development, product innovation, brand renewal, and social responsibility. But I know this is only the beginning.

In the year ahead, we will:

- Continue to deepen the ecosystem and integrate more real-world use cases

- Further solidify the Point.Click.Trade. experience

- Continuously optimize trading experience and service stability

- Ensure every promise is reflected in verifiable details

At its core, the crypto industry is about rebuilding trust through technological innovation. But technology is only a tool. Real trust is built through reliable delivery, day after day, and through decisions that consistently put users first.

This is my commitment to every Ju.com user—and my expectation of our team.

May 2026 bring you greater stability and more confidence in your choices. Ju.com wishes you a smooth and successful year ahead. Let us continue moving forward, side by side.

Sammi Li Founder & CEO, Ju.com December 31, 2025

#cryptocurrency #blockchain #Jucom

JU Blog

2025-12-31 10:00

2026: Making Every Choice Trustworthy

Penafian:Berisi konten pihak ketiga. Bukan nasihat keuangan.

Lihat Syarat dan Ketentuan.

Ethereum co-founder Vitalik Buterin's December 2025 "Balance of Power" analysis reveals how rapid technological advancement threatens the decentralization principles fundamental to blockchain. His groundbreaking article identifies three converging forces—Big Business, Big Government, and Big Mob—that now consolidate control at unprecedented speeds, demanding new strategies to preserve pluralism in crypto and beyond.

⚡ The Core Problem

Modern economies of scale have shattered traditional power balances. When actors control 2x the resources, they generate more than 2x the progress, creating compounding advantages that inevitably lead to monopolistic control. Buterin describes today's digital landscape as a "dense jungle" where automation enables global-scale operations with minimal human involvement, proprietary software prevents reverse-engineering that once facilitated catch-up growth, and rapid technological progress accelerates winner-take-all dynamics before countervailing forces can emerge.

The blockchain sector demonstrates these patterns clearly, with data showing insider allocations in new cryptocurrency projects climbing from minimal levels in 2009-2014 to dominant positions by 2021. A single billion-dollar company invests far more in regulatory capture and market control than one hundred smaller competitors combined, explaining why the crypto industry increasingly mirrors traditional finance's power concentration.

💡 Two-Part Solution: Mandatory Diffusion and D/acc

Buterin proposes "mandatory diffusion" as the primary defense mechanism, forcing powerful systems to share their capabilities through government mandates (like EU's USB-C standardization), adversarial interoperability (custom clients for existing platforms), and plurality infrastructure that enables cooperation across difference without requiring unified goals. This approach targets the generators of wealth concentration rather than redistributing wealth after it concentrates.

Complementing this is d/acc (defensive/decentralized/democratic acceleration), building defensive technologies that reduce security-driven centralization pressure. The framework spans biological defense through open-source vaccines, cyber defense via zero-knowledge proofs for privacy, information defense using community notes systems, and physical defense through resilient local supply chains. Prediction markets built on blockchain exemplify how defensive tools can enhance collective decision-making without concentrating control.

🎯 Crypto's Critical Choice

The blockchain industry faces a pivotal decision between two paths. The concerning direction sees powerful crypto CEOs and investors abandoning libertarian principles to directly influence government policy, merging two forces that should balance each other. Buterin contrasts 2013's decentralized crypto ethos with 2025's troubling convergence of tech power and state authority.

The preferred alternative maintains blockchain as a counterbalance to both corporate and governmental power, funding public goods that markets won't support, building infrastructure that government consensus hasn't reached, and enabling individual sovereignty through self-custody and permissionless participation. Buterin points to Ethereum's Lido protocol as a model: despite controlling 24% of staked ETH, its internal decentralization across dozens of operators prevents it from functioning as a single actor.

🚀 Key Implementation Strategy

Projects should implement explicit "decentralization models" alongside business models, defining how they avoid concentrating power and mitigate risks of wielding such power. Buterin's synthesis morality proposes: you are encouraged to be impactful and empower others, but not allowed to be hegemonic. For decentralized blockchain projects, this means designing systems that deliver scale benefits while distributing control, ensuring crypto fulfills its promise as infrastructure for human freedom rather than becoming another tool of concentrated power.

Read the complete analysis with detailed examples and implementation strategies: 👇 https://blog.ju.com/vitalik-buterin-balance-of-power-crypto/?utm_source=blog

#VitalikButerin #Ethereum #Decentralization #Crypto #Blockchain

JU Blog

2026-01-05 13:34

Vitalik Buterin Warns: 3 Forces Threatening Crypto Decentralization in 2026

Penafian:Berisi konten pihak ketiga. Bukan nasihat keuangan.

Lihat Syarat dan Ketentuan.

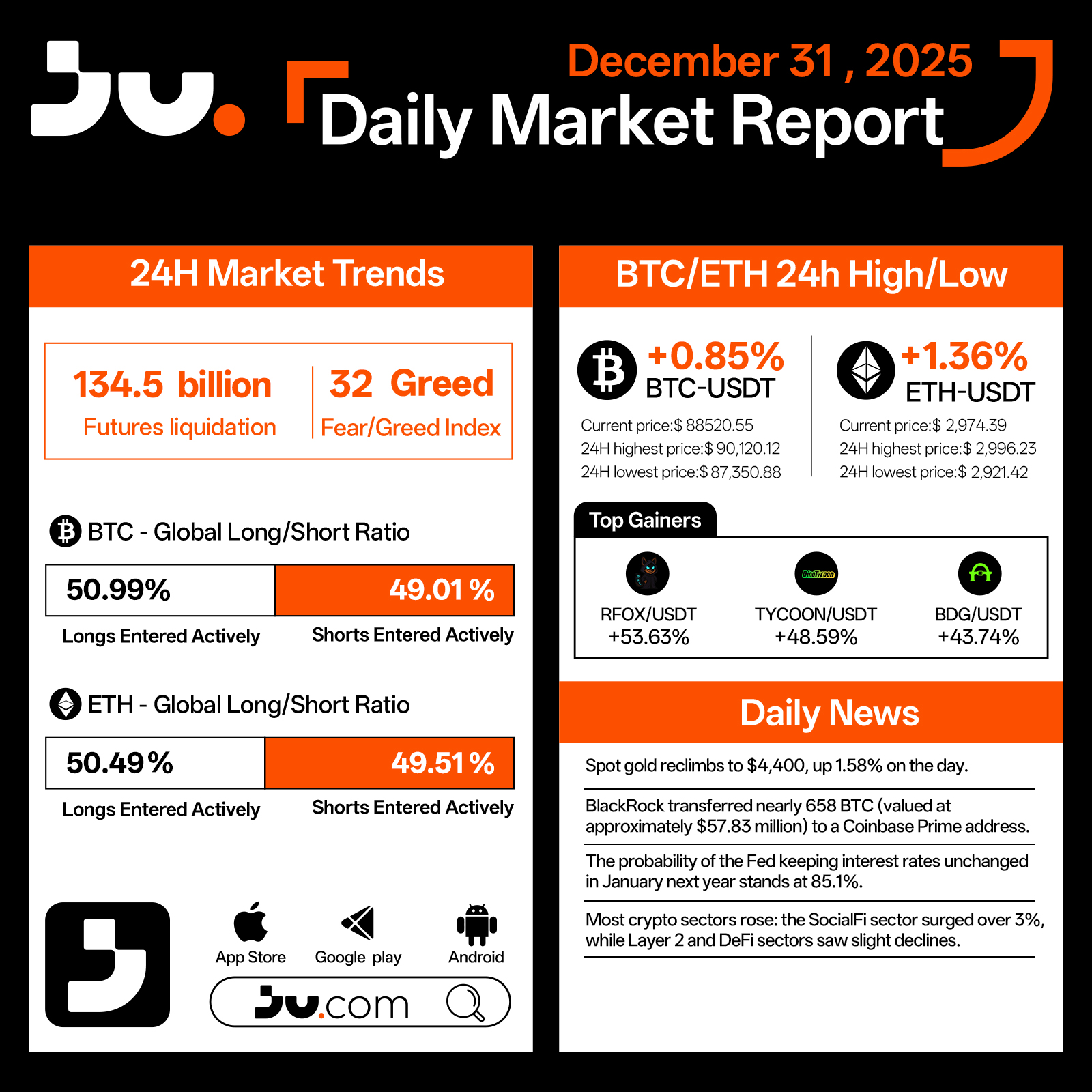

On December 31, crypto markets closed out 2025 with a modest recovery, as major assets rebounded and overall sentiment improved into year-end. Total liquidations over the past 24 hours rose to $134.5 billion, reflecting continued position adjustments as investors rebalanced exposure. The Fear & Greed Index climbed to 32, marking a recent high and signaling a gradual return of risk appetite following prior volatility.

Bitcoin gained 0.85% to $88,520.55, trading within an intraday range of $90,120.12 to $87,350.88, maintaining a constructive consolidation pattern. Ethereum showed comparatively steadier strength, rising 1.36% to $2,974.39, with prices holding between $2,996.23 and $2,921.42, preserving key support levels into the close of the year. Positioning data reflected a slight bullish bias, with BTC longs at 50.99% and ETH longs at 50.49%, though overall market conviction remains measured rather than decisive.

Structural activity remained active beneath the surface. RFOX/USDT advanced 53.63%, while TYCOON/USDT and BDG/USDT posted gains of 48.59% and 43.74%, respectively. Sector performance was broadly positive, led by the SocialFi segment, which rose more than 3%, while Layer 2 and DeFi sectors saw mild pullbacks. The rotation highlights continued selectivity as capital favors narrative-driven opportunities over broad-based exposure.

From a macro and institutional perspective, safe-haven assets also rebounded. Spot gold reclaimed the $4,400/oz level, gaining 1.58% on the day, underscoring persistent demand for inflation and uncertainty hedges. On-chain flows drew attention as BlackRock transferred nearly 658 BTC, valued at approximately $57.83 million, to a Coinbase Prime address, fueling speculation around institutional custody and portfolio management activity. Interest-rate expectations remained supportive, with the probability of the Federal Reserve holding rates steady in January 2026 rising to 85.1%, providing a relatively stable macro backdrop for risk assets.

Overall, the final trading session of 2025 reflects a market ending the year on a steadier footing, characterized by recovering prices, improving sentiment, and ongoing structural divergence. While no single narrative dominated year-end trading, the groundwork appears set for more differentiated, theme-driven market behavior as crypto enters 2026 under clearer macro and institutional conditions.

#cryptocurrency #blockchain #finance

JU Blog

2026-01-09 04:42

Year-End Recovery Closes 2025 as Sentiment Improves Amid Ongoing Market Divergence - Dec 31, 2025

Penafian:Berisi konten pihak ketiga. Bukan nasihat keuangan.

Lihat Syarat dan Ketentuan.

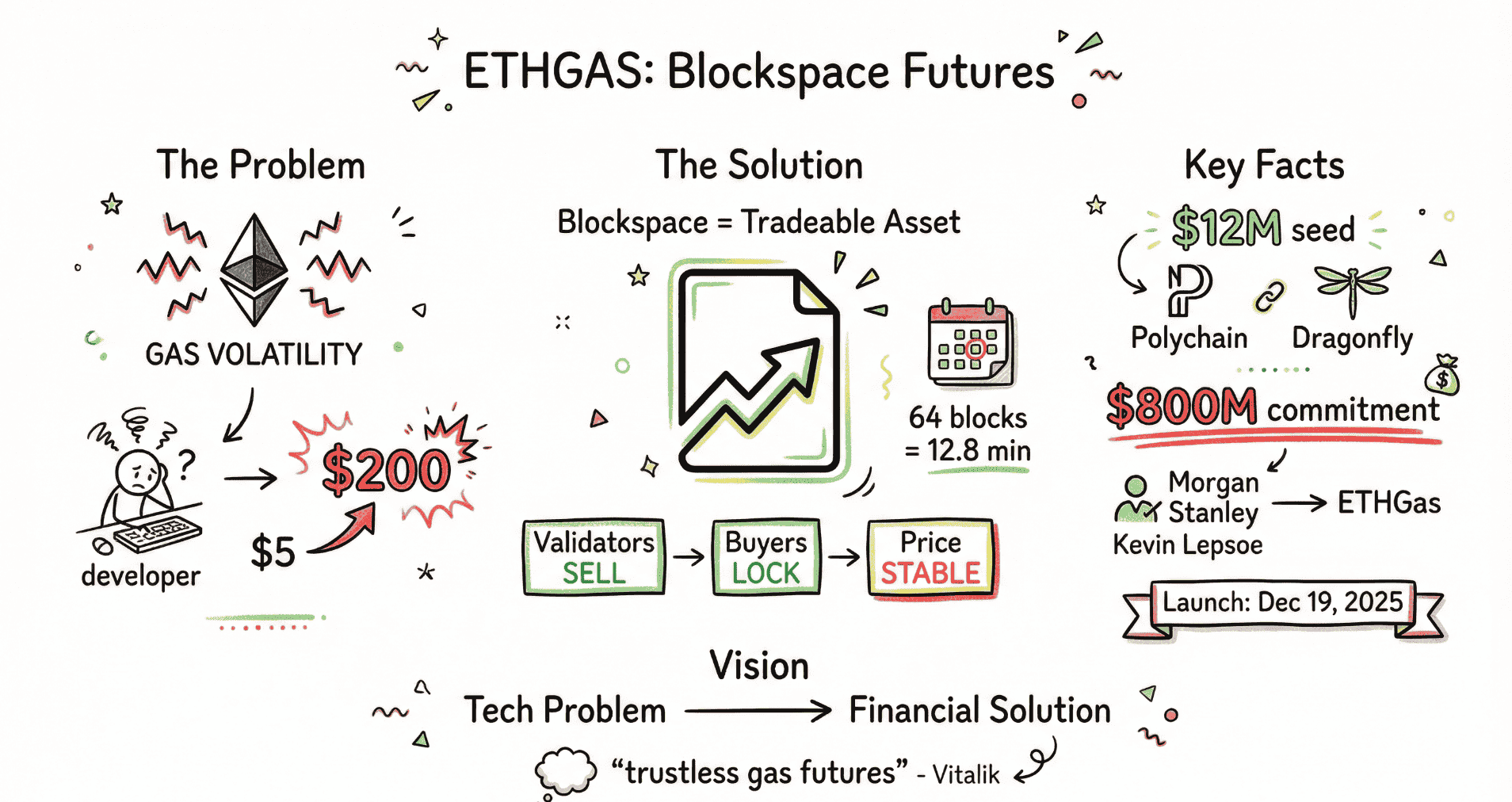

Ethereum generated $2.48 billion in gas fees in 2024, but behind this impressive figure lies a critical problem plaguing the entire ecosystem. Gas costs can fluctuate from $5 to over $200 for a single transaction during network congestion, making it nearly impossible for applications to build sustainable business models. ETHGas officially launched on December 19, 2025, transforming this uncertainty into opportunity by turning block space itself into a tradable financial asset.

💰 Groundbreaking Approach

Founded by Kevin Lepsoe, former Morgan Stanley Executive Director, ETHGas raised $12 million in seed funding led by Polychain Capital and Dragonfly Capital. More significantly, the project secured $800 million in block space liquidity commitments from Ethereum validators and block builders. This massive commitment represents the total amount of future block space that validators are willing to sell on the platform, providing immediate market liquidity that covers roughly 5% to 10% of Ethereum's total annual block space supply.

⚡ Dual Mechanism Innovation

ETHGas operates through two interconnected systems that address both price and time uncertainty. The block space futures mechanism allows validators to sell their next 64 blocks of space in advance, creating a roughly 12.8-minute trading window. Layer 2 sequencers and protocols can now purchase all the block space they need for an entire week upfront, converting unpredictable floating costs into fixed, manageable expenses. This is revolutionary for protocols that currently spend 60% to 80% of their operating budget on gas fees, where a sudden price spike can exhaust an entire monthly budget within hours.

🎯 3-Millisecond Pre-Confirmation

The second mechanism tackles time uncertainty by compressing traditional 12-second confirmation times down to just 3 milliseconds. When users submit transactions, validators in the ETHGas network immediately evaluate and provide cryptographically signed commitments guaranteeing inclusion in the next block. Validators who default on these commitments face economic penalties, ensuring reliability. This creates unprecedented user experiences where decentralized exchanges can offer both instant confirmation and predictable costs simultaneously.

🏆 Strategic Market Position

ETHGas doesn't compete with Layer 2 scaling solutions but complements them perfectly. While Arbitrum and Optimism reduce per-transaction costs by moving computation off-chain, they don't eliminate price volatility. The relationship is analogous to building highways that lower transportation costs versus providing freight insurance that reduces price risk. ETHGas is already in discussions with multiple Layer 2 teams to offer mainnet gas hedging tools, and early data shows that applications integrating pre-confirmation achieve over 30% higher user retention than traditional apps.

💡 Two-Phase Growth Strategy

The project's Open Gas program partners with major protocols like ether.fi, EigenLayer, and Pendle to provide direct gas rebates to users during the initial market education phase. This strategic approach converts market education costs into valuable data assets, as every transaction processed feeds real pricing data into ETHGas' futures algorithms. Once users experience zero-gas convenience, applications will naturally seek sustainable solutions through the futures market in phase two.

🌐 Ecosystem Transformation

Beyond commercial success, ETHGas is building a crucial price discovery mechanism for Ethereum's block space market. The futures curve can signal whether the market expects gas prices to rise or fall, providing valuable insights that could guide investment in scaling solutions. Following mainnet validation, ETHGas plans to expand to major Layer 2 networks, potentially creating a cross-chain block space financial hub that offers unified risk management tools across the entire Ethereum ecosystem.

With Vitalik Buterin repeatedly calling for trustless on-chain gas futures markets, ETHGas is actively turning this vision into reality. The project is now live on mainnet with testing available on the Hoodi testnet. As the blockchain industry matures from focusing purely on technical performance to managing economic risk, ETHGas may establish an entirely new category of infrastructure that proves financial engineering can solve technical problems more efficiently than technical solutions alone.

Read the complete research report with detailed analysis of mechanism design, economic logic, and ecosystem impact: 👇 https://blog.ju.com/ethgas-research-report/?utm_source=blog

#ETHGas #Ethereum #DeFi #Layer2 #Blockchain

JU Blog

2026-01-14 05:27

ETHGas: The Financialization Revolution of Ethereum Block Space

Penafian:Berisi konten pihak ketiga. Bukan nasihat keuangan.

Lihat Syarat dan Ketentuan.

Paradigm, once the gold standard of crypto venture capital, experienced unprecedented upheaval with seven senior executives departing since April 2025. The research-driven investment firm is now repositioning itself through strategic bets on payment infrastructure and prediction markets to reclaim industry dominance.

💰 What Went Wrong in 2025:

Paradigm's $850 million Fund III faced mounting pressure after missing high-return projects like Pump.fun and Ethena while suffering severe portfolio devaluations. Babylon dropped from $800M to $180M FDV, and Monad fell from $3B to $1.7B FDV. The executive exodus began in April with research partner samczsun and engineering head Loren Siebert, followed by general partner Charlie Noyes and market development lead Nick Martitsch in December. This turnover rate proved unprecedented among tier-one crypto venture firms, reflecting fundamental strategic disagreements about investment direction.

🔄 Strategic Pivot Underway:

The firm dramatically shifted from missing entire high-growth sectors (derivatives protocols, RWA tokenization, meme infrastructure) to aggressive early-stage deployment. Investment frequency doubled from one monthly deal in 2023-2024 to two per month in 2025, with renewed focus on identifying breakthrough opportunities before competitors establish dominance.

🚀 Tempo Blockchain - The Make-or-Break Project:

In September 2025, Paradigm and Stripe launched Tempo, a Layer-1 blockchain purpose-built for stablecoin payments processing over 100,000 transactions per second with sub-second finality. Co-founder Matt Huang serves as CEO while maintaining his Paradigm role, representing the firm's deepest operational involvement in any project. The public testnet launched December 2025 with major institutional partners including Deutsche Bank, UBS, Mastercard, OpenAI, and Anthropic. Tempo's success becomes existential for Paradigm's reputation after previous incubations like Shadow and Yield Protocol failed.

📊 Aggressive Kalshi Investment Thesis:

After missing Polymarket's early rounds, Paradigm adopted a dramatic catch-up strategy with Kalshi. Starting with a $185 million Series C at $2 billion valuation in June 2025, the firm led Kalshi's rapid ascent through $300 million at $5B in October and $1 billion at $11B in December. This tripling of investment within six months signals conviction in prediction markets as the next major crypto application category, with Kalshi's weekly trading volumes now exceeding $1 billion.

🎯 Three Critical Success Factors for 2026:

Paradigm's comeback depends entirely on Tempo achieving meaningful enterprise adoption and transaction volume in 2026, effectively deploying $850 million Fund III capital into high-growth opportunities, and securing positive exits or token launches from current portfolio companies. The firm must also capitalize on AI-crypto convergence investments like the $50 million bet on Nous Research at $1B valuation. With renewed focus on early-stage opportunities and payment-first infrastructure, Paradigm positions itself for either complete vindication or confirmation that research-driven crypto investing cannot adapt quickly enough to application-layer innovation cycles.

The next twelve months will definitively answer whether Paradigm remains an industry-defining force or becomes a cautionary tale about institutional crypto venture capital's limitations.

Read the complete analysis with detailed investment data and strategic insights: 👇 https://blog.ju.com/paradigm-crypto-vc-2026-outlook/?utm_source=blog

#Paradigm #CryptoVC #Tempo #Kalshi #PredictionMarkets

JU Blog

2025-12-30 13:13

Paradigm Crypto VC Faces Critical 2026 Comeback After Turbulent 2025

Penafian:Berisi konten pihak ketiga. Bukan nasihat keuangan.

Lihat Syarat dan Ketentuan.

Coinbase's x402 protocol has processed over 100 million autonomous payments worth $24 million in just seven months, establishing itself as critical infrastructure for AI agent commerce. The December 2025 V2 upgrade transforms the protocol from a single-chain payment tool into a comprehensive financial layer enabling AI agents to operate with credit capabilities previously reserved for human consumers.

💰 What's New in V2:

The V2 upgrade introduces five revolutionary architectural changes that fundamentally reimagine AI agent commerce. Multi-chain default operations now standardize payment interfaces across Base, Solana, Ethereum mainnet, and Layer 2 networks, enabling seamless transactions without custom integration work. Deferred payment architecture supports session-based billing where services track usage across multiple API calls and settle periodically rather than per-transaction, mirroring human credit card behavior. Hybrid payment rails integration bridges cryptocurrency and traditional finance by allowing AI agents to pay in USDC while service providers receive fiat currency through payment gateways. Wallet-based identity persistence enables agents to establish persistent sessions using wallet signatures, eliminating repeated authentication overhead. Dynamic payment routing introduces programmable payment flows supporting usage-based billing, subscriptions, prepaid credits, and multi-step transactions with custom logic injection at key points in the payment lifecycle.

🏆 Market Validation & Adoption:

Cloudflare and Coinbase co-founded the x402 Foundation in September 2025 to promote protocol adoption, signaling infrastructure-level commitment beyond single-company experimentation. Google Cloud's integration of x402 into its Agent Payments Protocol demonstrates enterprise acceptance of blockchain-based settlement for AI workloads. Daily transaction volume exceeding $500,000 across autonomous API purchases, cloud compute rentals, and data subscriptions indicates genuine product-market fit, with Solana and Base networks handling the majority of live traffic due to optimal fee structures and settlement speeds.

💡 The Credit Infrastructure Opportunity:

These technical upgrades create an entirely new market opportunity in AI credit scoring and risk management. When agents can defer payments and establish recurring relationships with service providers, they require creditworthiness assessment mechanisms similar to human financial systems. Spectral Finance, which raised $23 million for its Multi-Asset Credit Risk Oracle (MACRO) scoring system, exemplifies emerging infrastructure in this space by analyzing on-chain transaction history to generate credit scores enabling undercollateralized lending. The protocol's deferred settlement capabilities require verification mechanisms ensuring services are delivered before payment triggers, creating demand for attestation layers validating work completion and integrating with decentralized proof systems and zero-knowledge computation frameworks.

⚠️ Key Risks to Consider:

Regulatory compliance concentrates at facilitator operators who implement KYC and sanctions screening, creating potential centralization pressure despite protocol-level neutrality. Speculative tokens branded "x402" without official affiliation create market confusion, requiring careful due diligence before investment decisions. The protocol's cash-like irreversibility lacks credit card chargeback mechanisms, which suits high-frequency API transactions but may limit consumer-facing applications requiring buyer protection. Projects building identity, attestation, and risk assessment layers for AI agents represent emerging investment opportunities as autonomous commerce scales beyond pilot implementations.

With production infrastructure validated by Coinbase, Cloudflare, and Google Cloud, x402 V2 positions itself as the foundational payment layer for the emerging "agentic economy" where AI systems autonomously purchase services, manage subscriptions, and establish creditworthiness at unprecedented scale.

Read the complete analysis with technical specifications and investment considerations: 👇 https://blog.ju.com/x402-v2-ai-agent-payments/?utm_source=blog

#x402 #AIAgents #Solana #DeFi

JU Blog

2025-12-30 13:09

x402 V2: 5 Game-Changing Upgrades Powering AI Agent Payments in 2025

Penafian:Berisi konten pihak ketiga. Bukan nasihat keuangan.

Lihat Syarat dan Ketentuan.

On December 30, crypto markets experienced a broad pullback during the final full trading session of the year, with major assets declining amid year-end position adjustments. Total liquidations over the past 24 hours rose to $110.51 billion, while the Fear & Greed Index slipped to 29, reflecting a more cautious tone as investors reduced exposure ahead of the year’s close.

Bitcoin fell 2.25% to $87,088.07, after briefly rallying to an intraday high of $90,406.08 before reversing lower and testing support near $86,814.52. Ethereum mirrored the move, declining 2.32% to $2,930.84, failing to hold above $3,056.10 and retreating toward $2,910.92, placing prices back in the middle of their recent consolidation range.

Positioning data remained tightly balanced, with BTC long positions at 50.23% and ETH longs at 49.97%. However, the sharp intraday reversals suggest limited follow-through from bulls at higher levels. Combined with the spike in liquidations, price action points to a wave of leveraged position unwinding rather than a deterioration in broader market fundamentals.

Despite pressure on major assets, speculative activity persisted in select small-cap tokens. TERRA/USDT surged 541.33%, while AA/USDT and ZBT/USDT gained 43.52% and 42.60%, respectively. These moves highlight ongoing short-term risk-taking in isolated pockets, though such rallies remain vulnerable in an unstable liquidity environment.

Macro and industry developments added further context. Spot gold and silver extended their declines amid a sharp year-end sell-off, indicating that traditional safe-haven assets were also affected by portfolio rebalancing. Coinbase reported that crypto open interest reached record highs in 2025, underscoring how elevated leverage has become a key driver of amplified market swings. On the security front, on-chain investigator ZachXBT uncovered a $2 million scam targeting Canadian users via fake Coinbase support, reinforcing the need for heightened vigilance during volatile periods.

At the same time, long-term infrastructure investment continues. BitMine announced that its Ethereum staking operations have surpassed the $1 billion milestone, with plans to launch the MAVAN validator network in Q1 2026. This development highlights that, despite near-term volatility, institutional capital continues to build exposure to core blockchain infrastructure.

Overall, the late-December pullback appears driven by year-end profit-taking and leverage normalization rather than a shift in the market’s longer-term trajectory. With open interest elevated and liquidity thinning, volatility is likely to remain high into the turn of the year, leaving the market poised for clearer directional signals as 2026 begins.

#cryptocurrency #blockchain #finance #Blockchain

JU Blog

2025-12-30 10:22

Year-End Profit-Taking Triggers Pullback as Elevated Leverage Amplifies Volatility - Dec 30, 2025

Penafian:Berisi konten pihak ketiga. Bukan nasihat keuangan.

Lihat Syarat dan Ketentuan.

Bitcoin faces its most divisive technical debate in 2025—quantum computing threats have split developers into two camps with dramatically different timelines. With approximately $700 billion worth of Bitcoin potentially vulnerable to quantum attacks, the question isn't whether the threat exists, but when action must begin. This controversy reveals deep fractures in Bitcoin's traditionally cautious development culture and raises existential questions about the network's ability to adapt to long-term threats.

💥 The Core Debate:

The dispute centers on urgency rather than solutions. Conservative developers led by Blockstream CEO Adam Back estimate no meaningful quantum threat for 20-40 years, calling quantum computing "ridiculously early" with fundamental problems still unresolved. The radical faction led by Nic Carter warns that Bitcoin upgrades could require 10 years to implement, meaning preparation must start immediately if quantum computers achieve cryptographic relevance by 2030-2035 as some experts predict.

Both sides agree on the vulnerability: approximately 6.5 million Bitcoin worth over $700 billion remains in older address formats with exposed public keys, including 1.1 million BTC attributed to Satoshi Nakamoto. These early "pay-to-public-key" addresses would become prime targets for quantum attacks. The disagreement lies entirely in risk assessment timeframes and whether Bitcoin's upgrade culture can respond fast enough when quantum threats materialize.

⚡ What's At Stake:

Current quantum computers fall far short of breaking Bitcoin's elliptic curve cryptography, operating with thousands of physical qubits but lacking the millions of stable, error-corrected logical qubits needed to run Shor's algorithm effectively. However, the gap between today's noisy quantum machines and cryptographically-relevant quantum computers continues to narrow. Historical Bitcoin upgrades like SegWit required 2 years and Taproot needed 3 years for full implementation. A post-quantum upgrade affecting Bitcoin's core cryptography would be orders of magnitude more complex, potentially requiring a decade from proposal to network-wide adoption.

The coordination challenge compounds technical complexity. Upgrading requires not just protocol changes but migrating tens of millions of active addresses to quantum-resistant formats. The Bitcoin community would also face unprecedented ethical questions about 1.7 million Bitcoin in abandoned wallets—should these coins be frozen to prevent quantum theft, or should the network respect the principle that anyone with valid keys, even quantum-derived ones, can move coins? These philosophical battles could delay critical security upgrades.

🛡️ Current Solutions:

Despite disagreements on timing, progress continues. Bitcoin Improvement Proposal 360 introduces new address formats using post-quantum cryptography certified by NIST, allowing gradual migration without forcing immediate network-wide changes. Users could opt into quantum-resistant addresses over time, creating a soft transition path. Several signature schemes compete for adoption: hash-based signatures like SPHINCS+ offer proven security but create larger transaction sizes, while lattice-based cryptography provides efficiency but requires additional vetting.

🔥 The Cultural Fracture:

The debate exposes deeper tensions beyond technical timelines. Hasu, a blockchain advisor, identified the root problem: Bitcoin's long-standing resistance to change has evolved from prudent conservatism into reflexive rejection of even discussing potential vulnerabilities. Community members who raise concerns about Bitcoin's future increasingly face accusations of spreading FUD rather than engaging in substantive debate. When Back accused Carter of making "uninformed noise" to manipulate markets, it exemplified how Bitcoin's culture now treats legitimate criticism as ideological betrayal.

This cultural rigidity serves Bitcoin well in normal circumstances—caution prevents reckless upgrades that could compromise the network. But when facing existential risks like quantum computing, excessive conservatism could prove fatal. The quantum debate's true test isn't technical feasibility—it's whether Bitcoin can maintain its security-first ethos while remaining adaptable enough to respond when the quantum era arrives. As institutional capital increasingly flows into Bitcoin as a long-duration asset, investors require transparent answers about how the network will address distant but potentially catastrophic threats.

Conservative developers argue that proven post-quantum solutions already exist and can be implemented long before quantum threats materialize. Radical voices counter that Bitcoin's upgrade process is so time-consuming that preparation must begin immediately to avoid being caught unprepared. Both perspectives carry validity, but the most concerning aspect isn't the technical challenge—it's whether Bitcoin's culture allows frank discussion of risks without defensive hostility.

Read the complete analysis with technical details, expert perspectives, and FAQ on quantum threats: 👇 https://blog.ju.com/bitcoin-quantum-computing-debate/?utm_source=blog

#Bitcoin #QuantumComputing #Blockchain #Cryptocurrency

JU Blog

2025-12-29 14:50

Bitcoin Quantum Computing: The $700B Crisis Dividing the Community

Penafian:Berisi konten pihak ketiga. Bukan nasihat keuangan.

Lihat Syarat dan Ketentuan.

The crypto derivatives market is entering a transformative phase in 2026, transitioning from speculation-driven cycles to institutionalized adoption. CME Group's upcoming 24/7 trading launch marks the official convergence between traditional finance and crypto-native markets, eliminating the last operational barrier for institutional capital.

💰 Market Scale & Growth:

Annual derivatives trading volume projected to exceed $10 trillion, with CME's Bitcoin futures open interest reaching $39 billion in September 2025 (95% year-over-year growth in average daily OI). Perpetual contracts now dominate 74% of global crypto trading activity, while stablecoins are forecast to break the $1 trillion milestone representing triple growth from 2025's $300 billion base.

🏦 CME's 24/7 Revolution:

Launching in early 2026, this represents the most significant upgrade since CME's December 2017 BTC futures debut. Continuous trading provides institutional investors with weekend risk management capabilities equivalent to offshore exchanges, placing regulated platforms on equal operational footing with crypto-native venues for the first time. CFTC-approved perpetual futures contracts offer institutions expiration-free exposure management tools.

📊 Four Pillars of Institutional Infrastructure:

Perpetual futures lead the charge with decentralized exchanges like Hyperliquid processing 200,000 orders per second and generating over $1 billion in annual protocol revenue. Stablecoins have evolved into core cross-border payment rails, with the GENIUS Act establishing federal regulatory frameworks requiring 100% reserve backing. Prediction markets reached $52 billion in 2025 trading volume, transitioning from experimental tools to sustainable risk-pricing infrastructure. Digital Asset Treasury companies increased BTC holdings from 600,000 to 1.05 million coins, representing 5% of total supply.

🌐 Global Regulatory Convergence:

Basel Committee's new capital standards for bank crypto exposures take effect January 2026, while the U.S. Market Structure Bill heads for Senate votes establishing the first federal-level digital asset framework. Major jurisdictions including Canada, Singapore, and UAE launched intensive regulatory frameworks in 2025-2026. Grayscale research shows 76% of global investors plan to expand digital asset allocations, with nearly 60% raising allocation ratios above 5% of AUM.

⚠️ Critical Risks & Opportunities:

Key risks include potential DAT financing model reversals triggering equity-crypto correlation, systemic liquidation hazards in concentrated CEX environments during tail events, and high-beta characteristics making crypto vulnerable to macro liquidity tightening. However, opportunities abound through low-risk basis arbitrage after compliant ETF options bridge spot and derivatives markets, functional substitution of traditional liquidity by high-performance on-chain infrastructure, and unprecedented alpha capture enabled by converging regulatory frameworks.

💡 The Bottom Line:

2026 isn't about cryptocurrency speculation anymore—it's an institutionalized race about financial infrastructure reconstruction. Success will be determined by whether trading infrastructure can maintain liquidation resilience within crowded leverage chains and whether capital can find the most efficient circulation paths between compliance and decentralization.

Read the complete analysis on how CME's 24/7 trading revolution and regulatory convergence are reshaping the $10 trillion derivatives landscape: 👇

https://blog.ju.com/2026-crypto-derivatives-outlook/?utm_source=blog

#Crypto #Derivatives #CME #Bitcoin #Ethereum

JU Blog

2025-12-29 14:48

2026 Crypto Derivatives: The Institutional Era Begins with CME 24/7 Trading

Penafian:Berisi konten pihak ketiga. Bukan nasihat keuangan.

Lihat Syarat dan Ketentuan.

On December 29, the crypto market extended its year-end rebound amid subdued holiday trading activity. Total liquidations over the past 24 hours declined to $60.99 billion, marking a recent low, while the Fear & Greed Index rose to 30. This combination reflects a modest improvement in risk appetite, though overall sentiment remains measured rather than exuberant.

Bitcoin climbed 1.62% to $89,145.38, with an intraday high of $89,383.73 and a low of $87,441.85. Price action suggests BTC has found support near the upper boundary of its recent consolidation range, allowing short-term bullish momentum to gradually reassert itself. Ethereum outperformed once again, rising 2.08% to $3,008.97 and reclaiming the $3,000 psychological level, with a session high of $3,017.33. The relative strength in ETH continues to stand out as capital selectively rotates into assets perceived to have stronger medium-term narratives.

Positioning data showed BTC longs at 50.07% and ETH longs at 50.27%, indicating a slight bullish tilt across both major assets. However, the overall long–short balance remains tightly matched, underscoring that the current rebound reflects position adjustments and technical recovery rather than a broad-based directional consensus.

Structural opportunities remained active beneath the surface. OREC/USDT surged 61.11%, while EW/USDT and BTA/USDT gained 36.66% and 30.99%, respectively. These moves highlight that, in a low-liquidity environment, traders continue to pursue selective high-beta opportunities rather than expanding risk exposure across the board.

From a capital flow and macro perspective, signals were more mixed. The total stablecoin market capitalization declined by 0.65% over the past week, and net capital inflows into the crypto market turned negative for the first time in two years. These developments suggest that despite near-term price strength, fresh capital remains cautious, with some investors opting to reduce exposure or wait on the sidelines as the year draws to a close. At the same time, analysts reiterated that Bitcoin has significantly outperformed gold and silver over the past decade, reinforcing its long-term value proposition. El Salvador added 8 BTC to its reserves over the past seven days, bringing total holdings to 7,514.37 BTC and reaffirming its commitment to Bitcoin as a strategic asset.

Looking ahead, Coinbase outlined its view that perpetual contracts, prediction markets, and stablecoin payments will define the crypto market landscape in 2026. This outlook aligns closely with current market dynamics, where trading-driven demand, real-world payment use cases, and capital efficiency are increasingly shaping growth trajectories.

Overall, the year-end crypto market is characterized by improving technical conditions alongside contracting capital flows. While major assets continue to recover, the absence of strong inflows suggests that the current rebound is likely to remain orderly and selective, setting the stage for more decisive trend development in the year ahead.

#cryptocurrency #blockchain #finance

JU Blog

2025-12-31 09:34

Year-End Rebound Continues as Price Recovery Diverges from Capital Flows - December 29, 2025

Penafian:Berisi konten pihak ketiga. Bukan nasihat keuangan.

Lihat Syarat dan Ketentuan.