BTC Slips While ETH Holds Flat; Risk Appetite Stays Cautiously Constructive – December 15, 2025

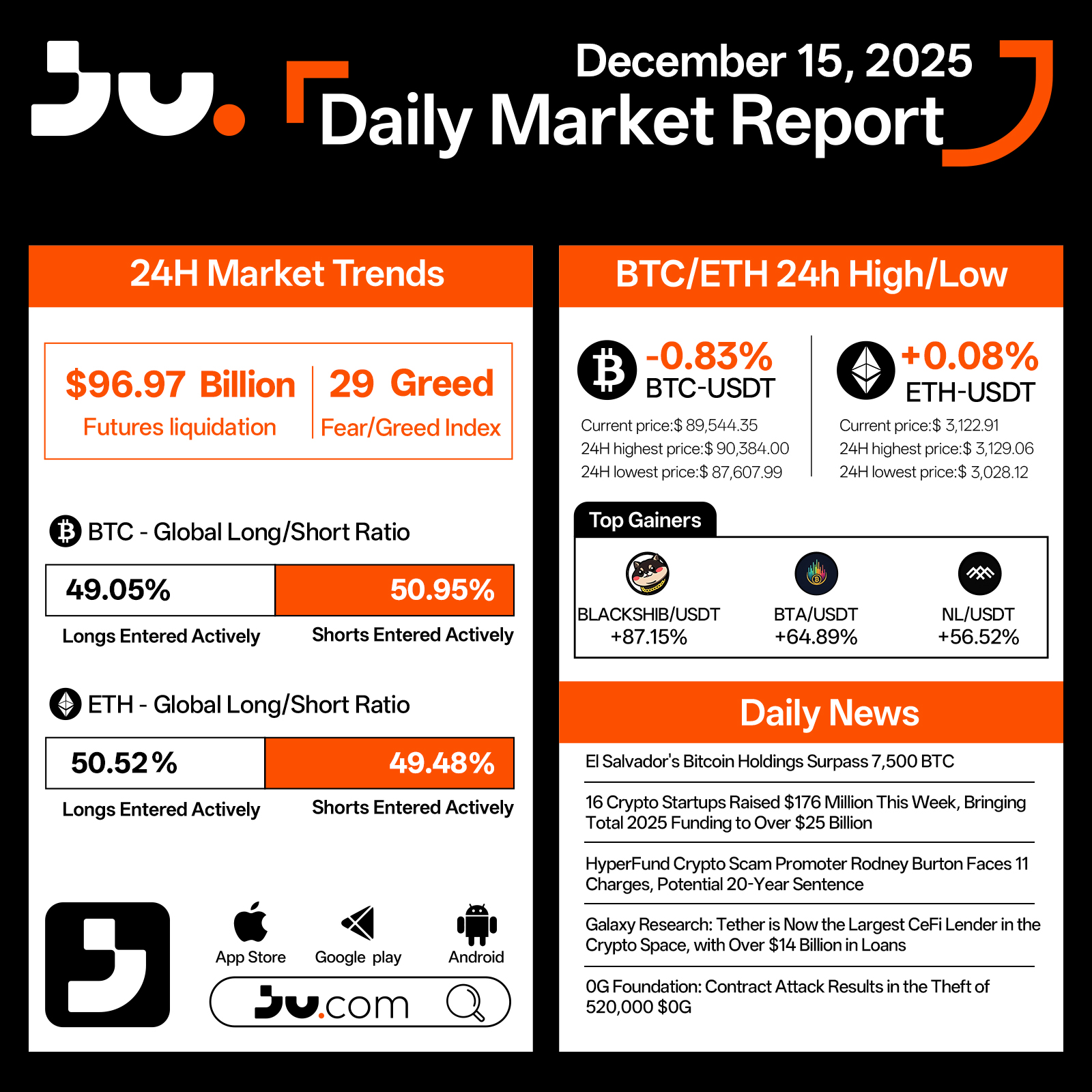

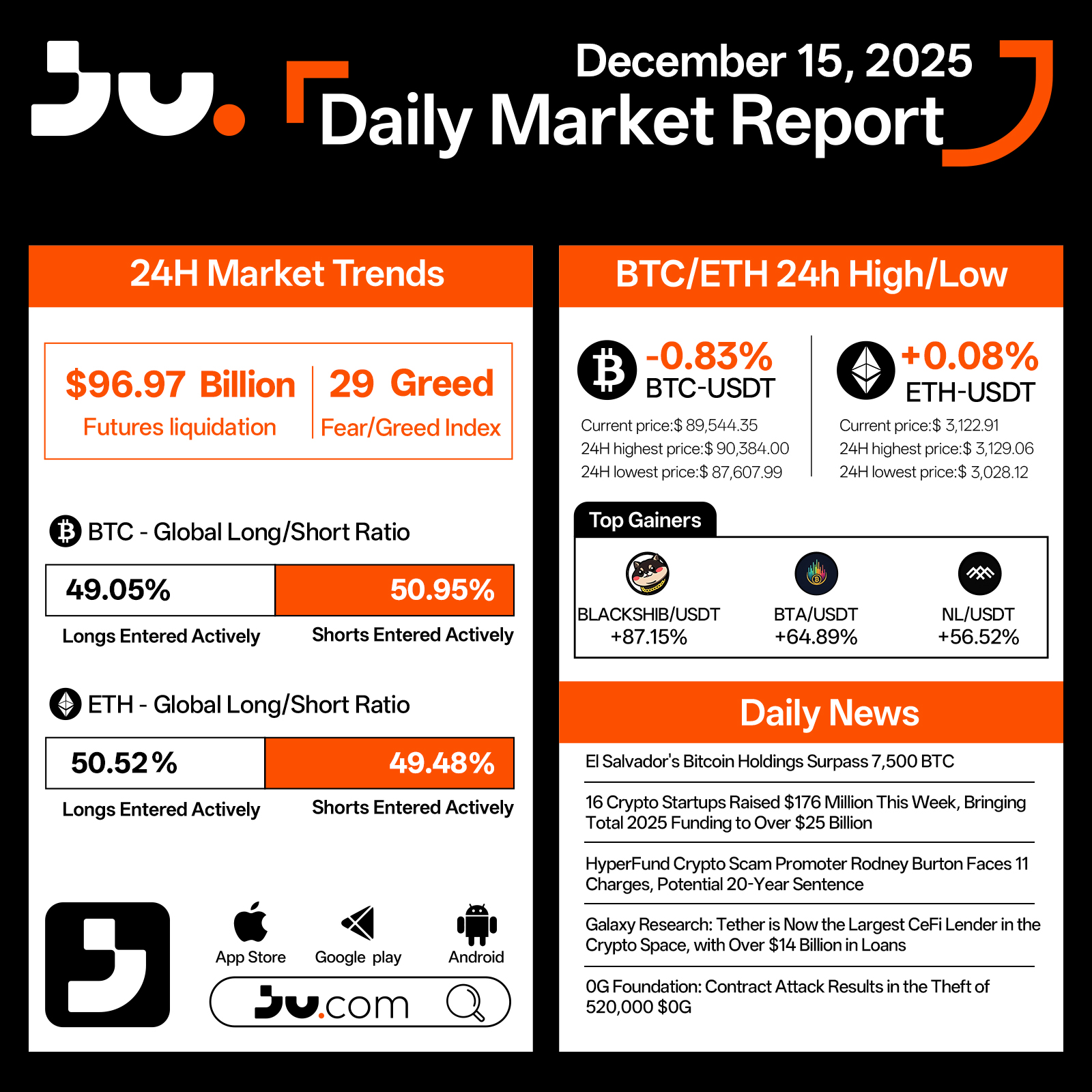

Crypto markets traded sideways on December 15 with a mild defensive tone. Twenty-four hour liquidations totaled $96.97 billion, and the Fear & Greed Index printed 29. Bitcoin(BTC) fell 0.83% to $89,544.35, moving within a $90,384.00–$87,607.99 range, while Ethereum(ETH) edged 0.08% higher to $3,122.91 after fluctuating between $3,129.06 and $3,028.12. Positioning remained balanced but slightly bearish for BTC at 49.05% longs vs. 50.95% shorts, whereas ETH leaned modestly bullish at 50.52% longs vs. 49.48% shorts. High-beta names outperformed, with BLACKSHIB/USDT +87.15%, BTA/USDT +64.89%, and NL/USDT +56.52%, pointing to a rebound in short-term speculation.

News flow was neutral to supportive. El Salvador’s sovereign Bitcoin stash surpassed 7,500 BTC, extending its accumulation trend. Sixteen crypto startups raised $176 million this week, pushing total 2025 funding above $25 billion, a sign of resilient primary-market activity. In enforcement, alleged “HyperFund” promoter Rodney Burton faces 11 charges with potential sentencing of up to 20 years. Galaxy Research reported that Tether is now the largest CeFi lender in crypto with more than $14 billion in outstanding loans. Meanwhile, OG Foundation suffered a contract exploit resulting in the theft of roughly 520,000 $OG. With no major macro shocks and steady institutional signals, sentiment remains cautiously constructive; the next directional cue hinges on BTC reclaiming and holding above the $90K handle and ETH pressing through the $3,150–$3,200 band.

#cryptocurrency #blockchain #technical analysis #Cryptocurrency #finance

JU Blog

2025-12-15 07:30

BTC Slips While ETH Holds Flat; Risk Appetite Stays Cautiously Constructive – December 15, 2025

Penafian:Berisi konten pihak ketiga. Bukan nasihat keuangan.

Lihat Syarat dan Ketentuan.

Crypto markets traded sideways on December 15 with a mild defensive tone. Twenty-four hour liquidations totaled $96.97 billion, and the Fear & Greed Index printed 29. Bitcoin(BTC) fell 0.83% to $89,544.35, moving within a $90,384.00–$87,607.99 range, while Ethereum(ETH) edged 0.08% higher to $3,122.91 after fluctuating between $3,129.06 and $3,028.12. Positioning remained balanced but slightly bearish for BTC at 49.05% longs vs. 50.95% shorts, whereas ETH leaned modestly bullish at 50.52% longs vs. 49.48% shorts. High-beta names outperformed, with BLACKSHIB/USDT +87.15%, BTA/USDT +64.89%, and NL/USDT +56.52%, pointing to a rebound in short-term speculation.

News flow was neutral to supportive. El Salvador’s sovereign Bitcoin stash surpassed 7,500 BTC, extending its accumulation trend. Sixteen crypto startups raised $176 million this week, pushing total 2025 funding above $25 billion, a sign of resilient primary-market activity. In enforcement, alleged “HyperFund” promoter Rodney Burton faces 11 charges with potential sentencing of up to 20 years. Galaxy Research reported that Tether is now the largest CeFi lender in crypto with more than $14 billion in outstanding loans. Meanwhile, OG Foundation suffered a contract exploit resulting in the theft of roughly 520,000 $OG. With no major macro shocks and steady institutional signals, sentiment remains cautiously constructive; the next directional cue hinges on BTC reclaiming and holding above the $90K handle and ETH pressing through the $3,150–$3,200 band.

#cryptocurrency #blockchain #technical analysis #Cryptocurrency #finance