Happiness Is...

Ju.com Media

2025-10-23 13:08

Happiness Is...

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

To seize the global opportunities brought about by the rapid development of artificial intelligence (AI) technology and to further promote the deep integration of cutting-edge technology with the real economy and the digital economy, Ju.com officially announces the establishment of a $30 million AI special investment fund.

This fund will systematically invest around core AI technologies and the next generation of intelligent product forms. Key investment areas include, but are not limited to: • AI foundational models and underlying technologies • AI Agent products and solutions, encompassing autonomous decision-making, task execution, and automation scenarios • Intelligent robotics-related products, including software-driven robots, Embodied AI, and human-robot collaboration systems • Convergent applications of AI and Blockchain / Web3, such as smart contract automation, on-chain governance and risk control, and decentralized intelligent execution systems • Commercialization and implementation of AI in fields like fintech, enterprise services, content generation, and data analytics

This special fund will invite several listed companies and industrial capital to co-invest. By leveraging synergies from industrial resources, application scenarios, and financial support, it aims to provide portfolio projects with full-cycle empowerment, from technology validation and commercial implementation to long-term strategic partnerships.

Ju.com has always adhered to a long-term value and technological innovation-oriented approach, continuously building an open, robust, and sustainable technology investment ecosystem. The establishment of this AI special fund represents a crucial strategic move by Ju.com in the context of cutting-edge technology and the intelligent trend, and also reflects our high recognition of the long-term industrial value of AI, AI Agent, and robotics technologies.

In the future, Ju.com will collaborate with outstanding entrepreneurial teams, technical talent, and industrial partners worldwide to jointly promote the large-scale application and industrial upgrading of the next generation of intelligent products.

This is hereby announced.

#AI #Jucom

On January 4, the crypto market carried forward its early-year momentum, with Bitcoin decisively breaking through a key resistance level and lifting overall sentiment. Over the past 24 hours, market activity expanded notably, with total turnover and liquidations reaching $107.27 billion, while the Fear & Greed Index climbed to 40, signaling a clear rebound in risk appetite compared with year-end conditions.

Bitcoin rose 1.13% to $91,144.55, posting an intraday high of $91,574.40 and a low of $89,314.02. The successful break above the $91,000 level and subsequent consolidation suggest sustained bullish momentum. Ethereum followed with a 0.77% gain to $3,145.37, trading within a $3,166.41–$3,076.75 range and maintaining a steady correlation with BTC’s upward move. Positioning remained balanced, with BTC longs at 49.88% and ETH longs at 49.62%, indicating that the advance has been driven more by spot demand and trend-following capital than by excessive leverage.

Structural opportunities remained active across smaller-cap assets. FMC/X surged 70.24%, while NEXAI/USDT and PIPPIN/USDT advanced 41.53% and 24.14%, respectively. These moves reflect selective capital rotation as traders respond to Bitcoin’s breakout without broad-based risk expansion.

Macro and fundamental signals added depth to the move. The U.S. government disclosed that its cryptocurrency holdings now exceed $30 billion, with Bitcoin accounting for 97% of the total, reinforcing BTC’s status as the dominant digital reserve asset. On the Ethereum front, Vitalik Buterin stated that ZK-EVM and PeerDAS will transform Ethereum into a new form of high-performance decentralized network, strengthening long-term scalability and data availability narratives. Despite heightened geopolitical headlines, including reports of U.S. military strikes in Venezuela, Bitcoin prices remained resilient, underscoring its growing role as an asset capable of withstanding external shocks.

Overall, the opening days of 2026 show a market regaining directional clarity. Bitcoin’s breakout provides a clear technical anchor, while Ethereum’s roadmap supports medium-term confidence. With liquidity and sentiment improving in tandem, the crypto market appears to be entering the early phase of a new structural advance.

#cryptocurrency #blockchain

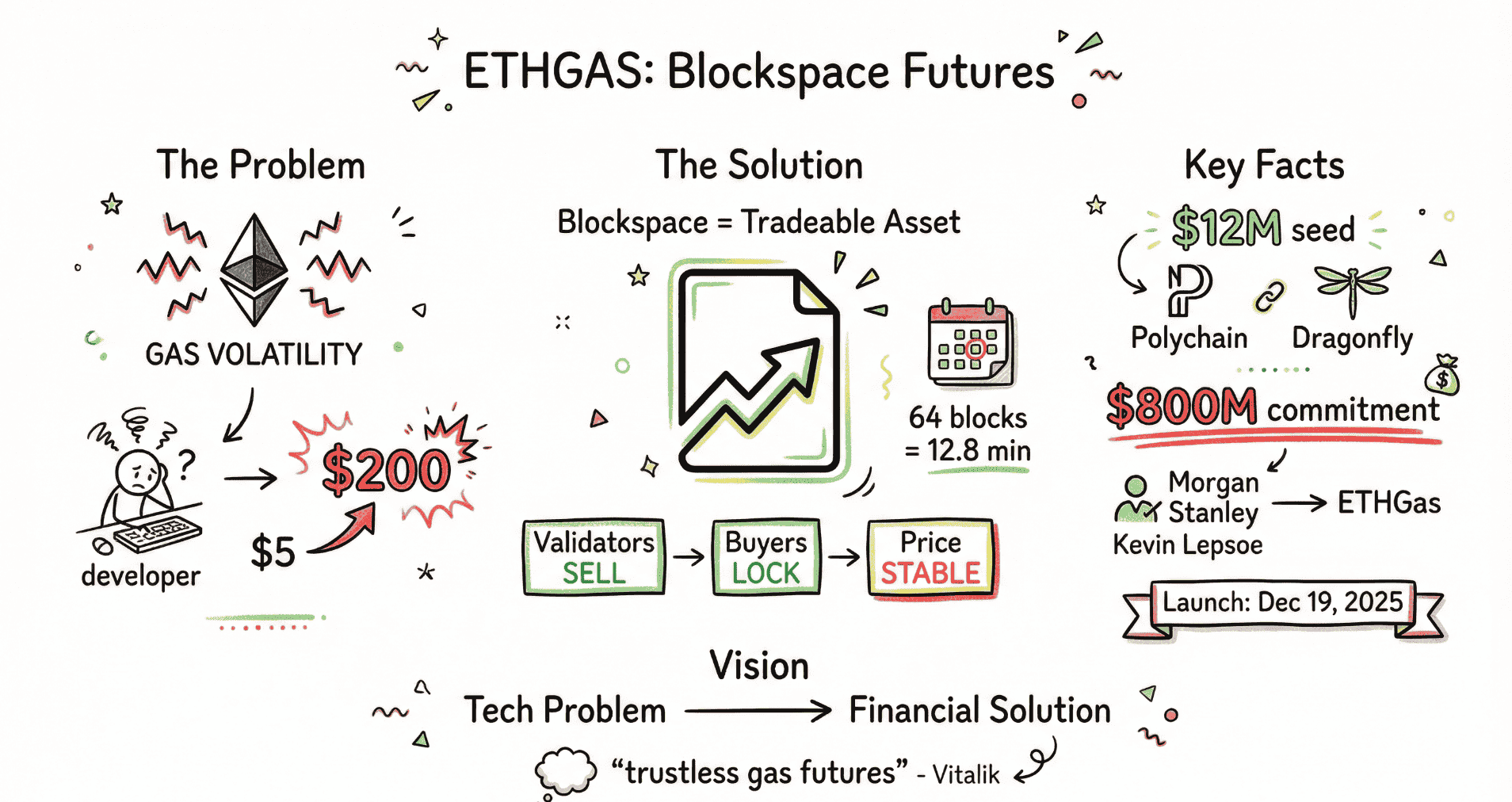

Ethereum generated $2.48 billion in gas fees in 2024, but behind this impressive figure lies a critical problem plaguing the entire ecosystem. Gas costs can fluctuate from $5 to over $200 for a single transaction during network congestion, making it nearly impossible for applications to build sustainable business models. ETHGas officially launched on December 19, 2025, transforming this uncertainty into opportunity by turning block space itself into a tradable financial asset.

💰 Groundbreaking Approach

Founded by Kevin Lepsoe, former Morgan Stanley Executive Director, ETHGas raised $12 million in seed funding led by Polychain Capital and Dragonfly Capital. More significantly, the project secured $800 million in block space liquidity commitments from Ethereum validators and block builders. This massive commitment represents the total amount of future block space that validators are willing to sell on the platform, providing immediate market liquidity that covers roughly 5% to 10% of Ethereum's total annual block space supply.

⚡ Dual Mechanism Innovation

ETHGas operates through two interconnected systems that address both price and time uncertainty. The block space futures mechanism allows validators to sell their next 64 blocks of space in advance, creating a roughly 12.8-minute trading window. Layer 2 sequencers and protocols can now purchase all the block space they need for an entire week upfront, converting unpredictable floating costs into fixed, manageable expenses. This is revolutionary for protocols that currently spend 60% to 80% of their operating budget on gas fees, where a sudden price spike can exhaust an entire monthly budget within hours.

🎯 3-Millisecond Pre-Confirmation

The second mechanism tackles time uncertainty by compressing traditional 12-second confirmation times down to just 3 milliseconds. When users submit transactions, validators in the ETHGas network immediately evaluate and provide cryptographically signed commitments guaranteeing inclusion in the next block. Validators who default on these commitments face economic penalties, ensuring reliability. This creates unprecedented user experiences where decentralized exchanges can offer both instant confirmation and predictable costs simultaneously.

🏆 Strategic Market Position

ETHGas doesn't compete with Layer 2 scaling solutions but complements them perfectly. While Arbitrum and Optimism reduce per-transaction costs by moving computation off-chain, they don't eliminate price volatility. The relationship is analogous to building highways that lower transportation costs versus providing freight insurance that reduces price risk. ETHGas is already in discussions with multiple Layer 2 teams to offer mainnet gas hedging tools, and early data shows that applications integrating pre-confirmation achieve over 30% higher user retention than traditional apps.

💡 Two-Phase Growth Strategy

The project's Open Gas program partners with major protocols like ether.fi, EigenLayer, and Pendle to provide direct gas rebates to users during the initial market education phase. This strategic approach converts market education costs into valuable data assets, as every transaction processed feeds real pricing data into ETHGas' futures algorithms. Once users experience zero-gas convenience, applications will naturally seek sustainable solutions through the futures market in phase two.

🌐 Ecosystem Transformation

Beyond commercial success, ETHGas is building a crucial price discovery mechanism for Ethereum's block space market. The futures curve can signal whether the market expects gas prices to rise or fall, providing valuable insights that could guide investment in scaling solutions. Following mainnet validation, ETHGas plans to expand to major Layer 2 networks, potentially creating a cross-chain block space financial hub that offers unified risk management tools across the entire Ethereum ecosystem.

With Vitalik Buterin repeatedly calling for trustless on-chain gas futures markets, ETHGas is actively turning this vision into reality. The project is now live on mainnet with testing available on the Hoodi testnet. As the blockchain industry matures from focusing purely on technical performance to managing economic risk, ETHGas may establish an entirely new category of infrastructure that proves financial engineering can solve technical problems more efficiently than technical solutions alone.

Read the complete research report with detailed analysis of mechanism design, economic logic, and ecosystem impact: 👇 https://blog.ju.com/ethgas-research-report/?utm_source=blog

#ETHGas #Ethereum #DeFi #Layer2 #Blockchain

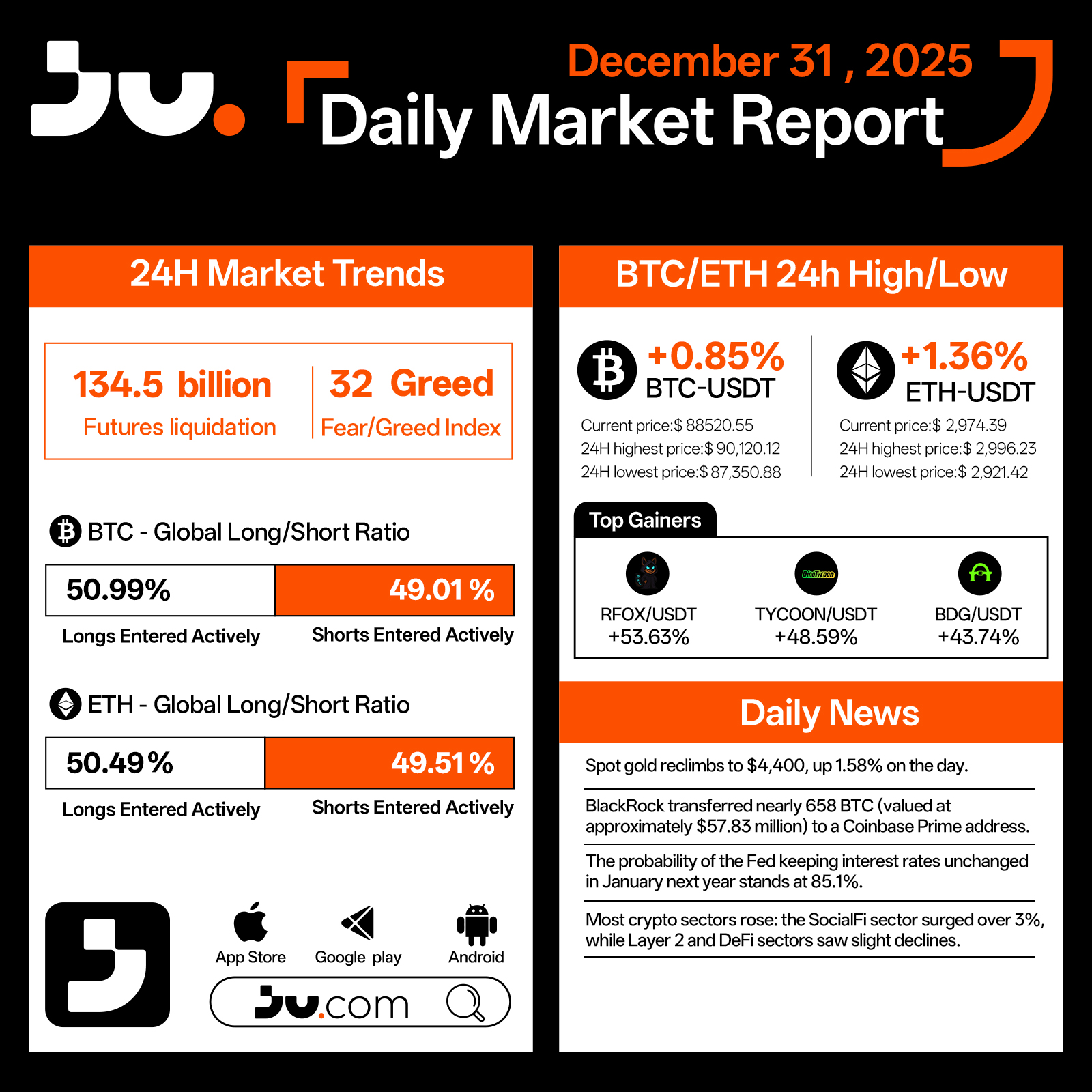

On December 31, crypto markets closed out 2025 with a modest recovery, as major assets rebounded and overall sentiment improved into year-end. Total liquidations over the past 24 hours rose to $134.5 billion, reflecting continued position adjustments as investors rebalanced exposure. The Fear & Greed Index climbed to 32, marking a recent high and signaling a gradual return of risk appetite following prior volatility.

Bitcoin gained 0.85% to $88,520.55, trading within an intraday range of $90,120.12 to $87,350.88, maintaining a constructive consolidation pattern. Ethereum showed comparatively steadier strength, rising 1.36% to $2,974.39, with prices holding between $2,996.23 and $2,921.42, preserving key support levels into the close of the year. Positioning data reflected a slight bullish bias, with BTC longs at 50.99% and ETH longs at 50.49%, though overall market conviction remains measured rather than decisive.

Structural activity remained active beneath the surface. RFOX/USDT advanced 53.63%, while TYCOON/USDT and BDG/USDT posted gains of 48.59% and 43.74%, respectively. Sector performance was broadly positive, led by the SocialFi segment, which rose more than 3%, while Layer 2 and DeFi sectors saw mild pullbacks. The rotation highlights continued selectivity as capital favors narrative-driven opportunities over broad-based exposure.

From a macro and institutional perspective, safe-haven assets also rebounded. Spot gold reclaimed the $4,400/oz level, gaining 1.58% on the day, underscoring persistent demand for inflation and uncertainty hedges. On-chain flows drew attention as BlackRock transferred nearly 658 BTC, valued at approximately $57.83 million, to a Coinbase Prime address, fueling speculation around institutional custody and portfolio management activity. Interest-rate expectations remained supportive, with the probability of the Federal Reserve holding rates steady in January 2026 rising to 85.1%, providing a relatively stable macro backdrop for risk assets.

Overall, the final trading session of 2025 reflects a market ending the year on a steadier footing, characterized by recovering prices, improving sentiment, and ongoing structural divergence. While no single narrative dominated year-end trading, the groundwork appears set for more differentiated, theme-driven market behavior as crypto enters 2026 under clearer macro and institutional conditions.

#cryptocurrency #blockchain #finance

The evolution path of the prediction market is highly representative: from crypto-native applications (Polymarket), to obtaining traditional financial regulatory licenses (Kalshi) , and then to being integrated by top exchanges and brokerage giants (ICE, Robinhood) . The key to its success lies in meeting the needs of different levels.

Value to different stakeholders:

- For users: the "bet" into a "expression of views" with economic incentives , both entertainment and potential benefits.

- For platforms (such as Robinhood) : It is the perfect tool to increase user engagement rate and achieve cross selling , and can seamlessly integrate into trading apps.

- For institutions (such as ICE): The probability of market generation is high-value alternative Data assets that can be packaged and sold to clients such as hedge funds.

Competitive core: It has been upgraded from simple product experience to comprehensive competition in regulatory status, traffic entrance and data distribution network . Even if newcomers (such as DraftKings) enter the market, it is difficult to shake the ecosystem position of the duopoly.

Thinking: When a track is taken over by traditional financial giants with capital and channel advantages, is there still a chance for crypto-native innovation teams?

Evolution of the competition landscape: https://blog.ju.com/prediction-markets-2026-growth/?utm_source=blog #Competition #TraditionalFinance #Evolution #WallStreet #Track

The consolidation of major crypto assets within key price ranges does not necessarily signal the end of a trend. It more likely reflects a shift in market rhythm following increased institutional participation.

ETF flows have allocation characteristics, and their behavioral patterns differ significantly from retail sentiment. When volatility declines and options markets become more cautious, it often indicates that the market is waiting for new external variables.

In such phases, emotion-driven trading strategies tend to be less effective.