A Technical Rebound Amid Persistent Fear - Daily Market Report | February 9, 2026

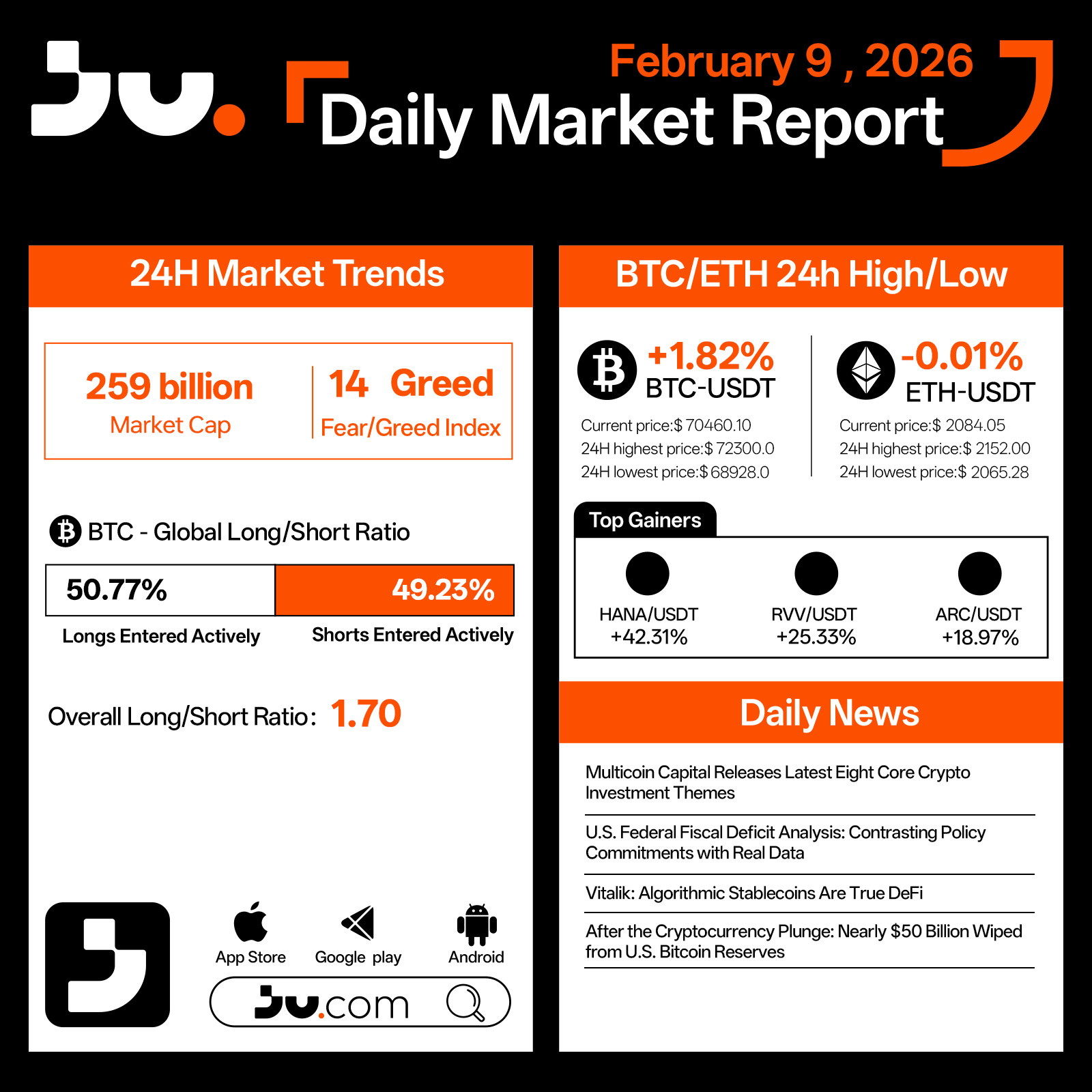

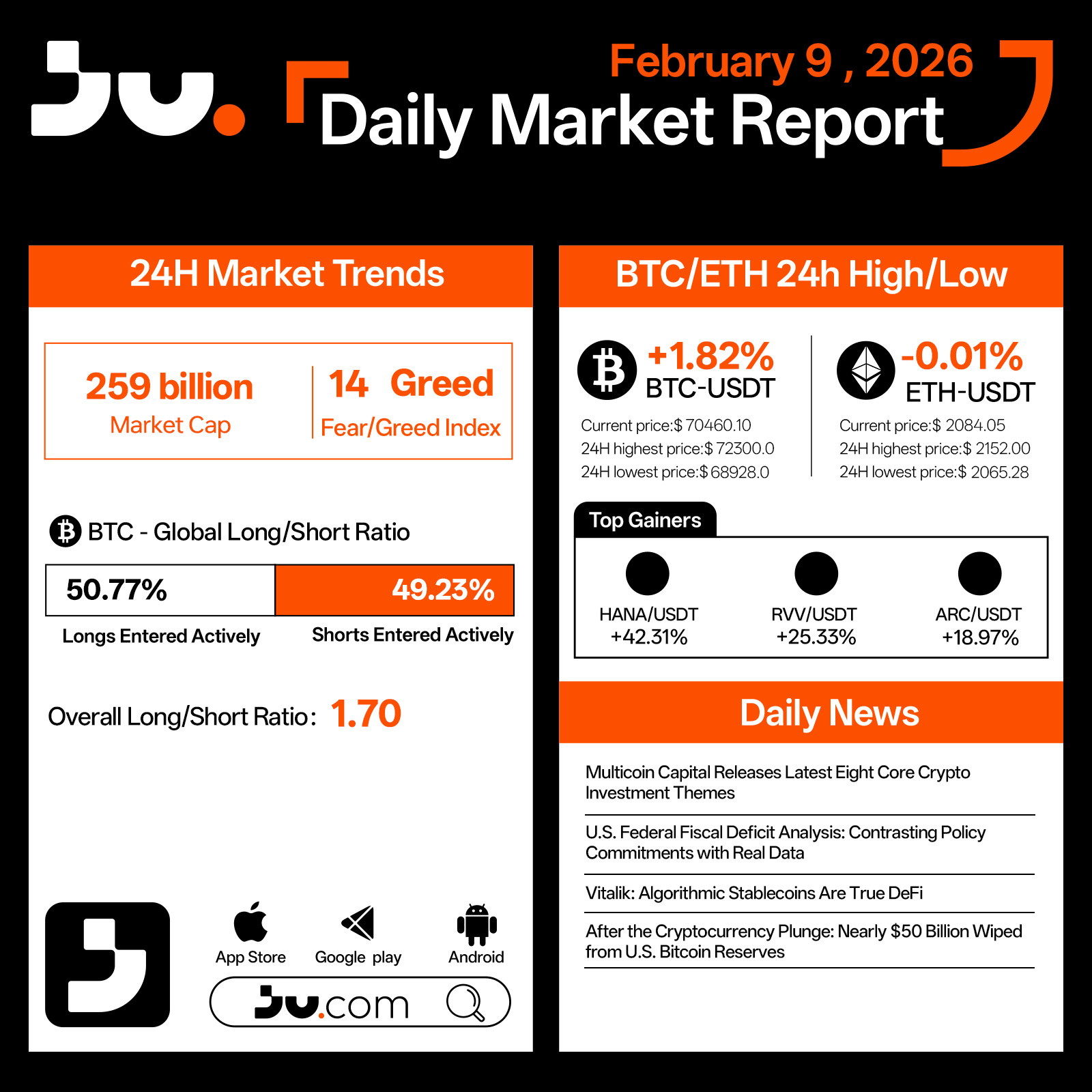

On February 9, the crypto market staged a modest rebound following the recent wave of extreme panic. Total market capitalization recovered to $259 billion, while the Fear & Greed Index remained depressed at 14, indicating that sentiment is still cautious even as selling pressure begins to ease.

Bitcoin rose 1.82% to $70,460.10, trading within a $68,928–$72,300 range. After last week’s aggressive deleveraging, downside momentum has clearly slowed. Positioning data shows BTC long exposure edging up to 50.77%, but with the aggregate long–short ratio at just 1.70, the move appears driven primarily by short covering and tentative dip-buying rather than conviction-based inflows. Ethereum lagged the rebound, finishing nearly flat at $2,084.05, underscoring continued weakness in higher-beta assets while risk appetite remains fragile.

Among smaller-cap tokens, names such as PIPPIN, RVV, and ARCU posted outsized gains, reflecting opportunistic trading in a liquidity recovery phase rather than a broad-based improvement in market sentiment.

From a narrative perspective, attention is shifting from post-crash blame to structural reflection. Multicoin Capital’s release of eight core crypto investment themes offers a refreshed framework for long-term positioning, while renewed scrutiny of the U.S. federal fiscal deficit highlights the growing gap between policy commitments and fiscal reality. Vitalik’s assertion that algorithmic stablecoins represent “true DeFi” has also resurfaced, prompting deeper discussion about the fundamental direction of decentralized finance.

Notably, following the recent sell-off, nearly $5 billion was wiped from U.S. Bitcoin reserves, reinforcing the idea that crypto assets are now intertwined with macro balance sheets rather than isolated from them.

Overall, February 9 appears to mark a technical rebound after extreme fear, not a confirmed trend reversal. While prices have stabilized, true recovery will depend on further deleveraging, improving liquidity conditions, and clearer macro signals. Until then, the market is likely to remain range-bound and fragile as it searches for a new equilibrium.

#cryptocurrency #blockchain #technical analysis #JU #Jucom

JU Blog

2026-02-09 03:52

A Technical Rebound Amid Persistent Fear - Daily Market Report | February 9, 2026

免責聲明:含第三方內容,非財務建議。

詳見《條款和條件》

On February 9, the crypto market staged a modest rebound following the recent wave of extreme panic. Total market capitalization recovered to $259 billion, while the Fear & Greed Index remained depressed at 14, indicating that sentiment is still cautious even as selling pressure begins to ease.

Bitcoin rose 1.82% to $70,460.10, trading within a $68,928–$72,300 range. After last week’s aggressive deleveraging, downside momentum has clearly slowed. Positioning data shows BTC long exposure edging up to 50.77%, but with the aggregate long–short ratio at just 1.70, the move appears driven primarily by short covering and tentative dip-buying rather than conviction-based inflows. Ethereum lagged the rebound, finishing nearly flat at $2,084.05, underscoring continued weakness in higher-beta assets while risk appetite remains fragile.

Among smaller-cap tokens, names such as PIPPIN, RVV, and ARCU posted outsized gains, reflecting opportunistic trading in a liquidity recovery phase rather than a broad-based improvement in market sentiment.

From a narrative perspective, attention is shifting from post-crash blame to structural reflection. Multicoin Capital’s release of eight core crypto investment themes offers a refreshed framework for long-term positioning, while renewed scrutiny of the U.S. federal fiscal deficit highlights the growing gap between policy commitments and fiscal reality. Vitalik’s assertion that algorithmic stablecoins represent “true DeFi” has also resurfaced, prompting deeper discussion about the fundamental direction of decentralized finance.

Notably, following the recent sell-off, nearly $5 billion was wiped from U.S. Bitcoin reserves, reinforcing the idea that crypto assets are now intertwined with macro balance sheets rather than isolated from them.

Overall, February 9 appears to mark a technical rebound after extreme fear, not a confirmed trend reversal. While prices have stabilized, true recovery will depend on further deleveraging, improving liquidity conditions, and clearer macro signals. Until then, the market is likely to remain range-bound and fragile as it searches for a new equilibrium.

#cryptocurrency #blockchain #technical analysis #JU #Jucom