Winter Solstice is here

Treat yourself to something warm. Keep warm. Stay grounded. Ju.com is with you.

#Jucom

JU Blog

2025-12-21 07:19

Winter Solstice is here

免責聲明:含第三方內容,非財務建議。

詳見《條款和條件》

To seize the global opportunities brought about by the rapid development of artificial intelligence (AI) technology and to further promote the deep integration of cutting-edge technology with the real economy and the digital economy, Ju.com officially announces the establishment of a $30 million AI special investment fund.

This fund will systematically invest around core AI technologies and the next generation of intelligent product forms. Key investment areas include, but are not limited to: • AI foundational models and underlying technologies • AI Agent products and solutions, encompassing autonomous decision-making, task execution, and automation scenarios • Intelligent robotics-related products, including software-driven robots, Embodied AI, and human-robot collaboration systems • Convergent applications of AI and Blockchain / Web3, such as smart contract automation, on-chain governance and risk control, and decentralized intelligent execution systems • Commercialization and implementation of AI in fields like fintech, enterprise services, content generation, and data analytics

This special fund will invite several listed companies and industrial capital to co-invest. By leveraging synergies from industrial resources, application scenarios, and financial support, it aims to provide portfolio projects with full-cycle empowerment, from technology validation and commercial implementation to long-term strategic partnerships.

Ju.com has always adhered to a long-term value and technological innovation-oriented approach, continuously building an open, robust, and sustainable technology investment ecosystem. The establishment of this AI special fund represents a crucial strategic move by Ju.com in the context of cutting-edge technology and the intelligent trend, and also reflects our high recognition of the long-term industrial value of AI, AI Agent, and robotics technologies.

In the future, Ju.com will collaborate with outstanding entrepreneurial teams, technical talent, and industrial partners worldwide to jointly promote the large-scale application and industrial upgrading of the next generation of intelligent products.

This is hereby announced.

#AI #Jucom

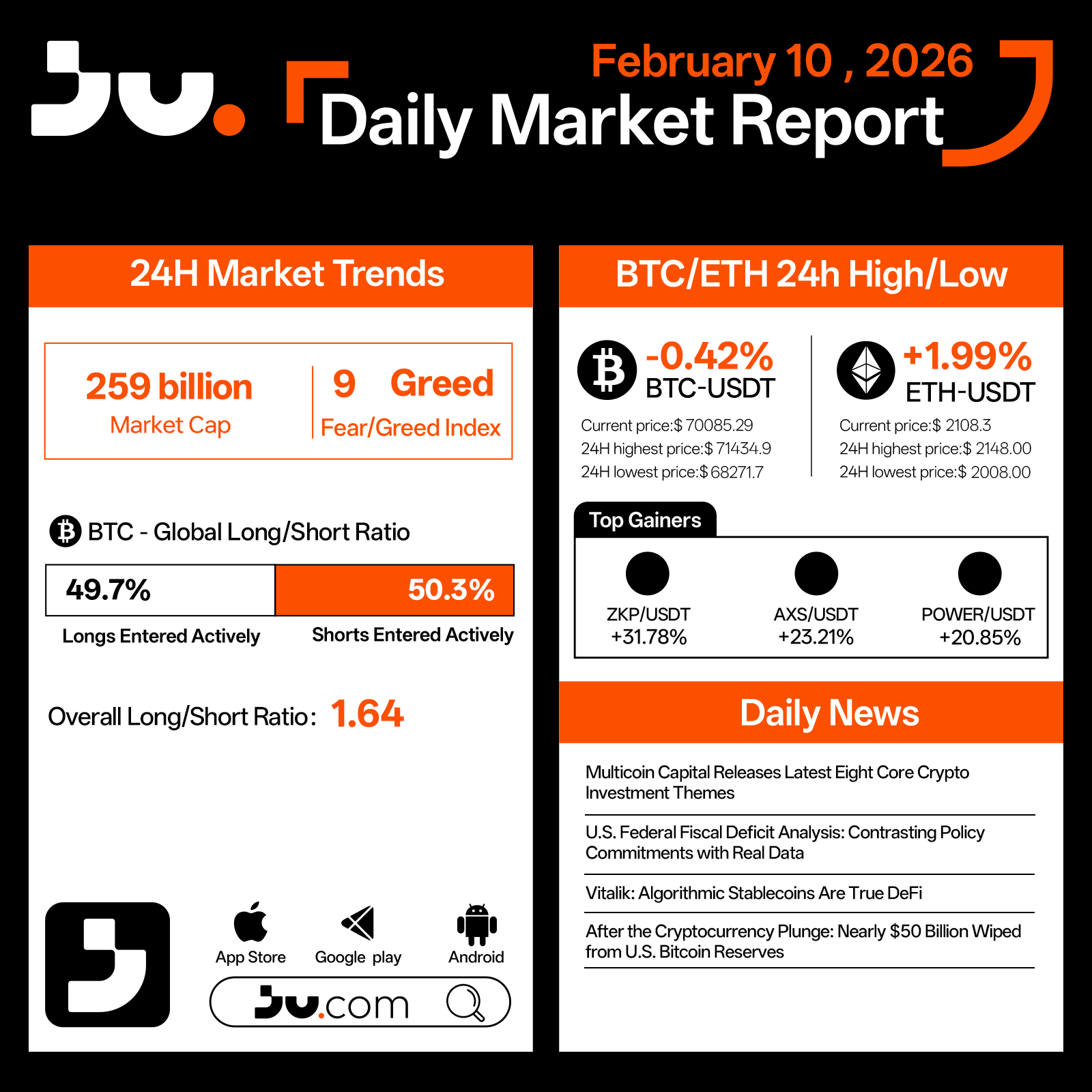

On February 10, the crypto market continued to trade within extreme fear territory, with total market capitalization holding at $259 billion and the Fear & Greed Index slipping further to 9. While sentiment remains deeply risk-averse, the pace of downside acceleration has clearly slowed compared with last week’s sell-off.

Bitcoin edged down 0.42% to $70,085.29, fluctuating between $68,271.7 and $71,434.9 throughout the session. Positioning data shows longs at 49.7% versus shorts at 50.3%, with the aggregate long–short ratio falling to 1.64. This reflects continued deleveraging and shrinking speculative exposure, suggesting the market is transitioning from a high-volatility liquidation phase to a low-leverage consolidation period.

Ethereum showed relative resilience, gaining 1.99% to $2,108.30 after briefly dipping to $2,008 before rebounding. This divergence indicates selective dip-buying in core assets even as overall risk appetite remains constrained.

Among smaller-cap tokens, ZKP, AXS, and POWER led gains, driven largely by short-term positioning and tactical rebounds rather than a broad-based improvement in sentiment. Market dynamics remain characterized by selective recovery rather than a full risk-on rotation.

Narrative focus continues to shift away from price action toward structural and long-term considerations. Variant’s reflections on insider trading in prediction markets highlight governance and transparency challenges in decentralized platforms. a16z reiterated its long-term philosophy for crypto, emphasizing that cyclical drawdowns do not negate the structural trajectory of the industry. At the same time, Goldman Sachs’ evolving crypto strategy and renewed discussion around the strategic role of gold underscore how digital assets and traditional safe havens are increasingly evaluated within the same macro allocation framework.

Overall, February 10 reflects a phase of late-stage fear and tentative stabilization. While selling pressure has eased, confidence remains fragile. Without clearer signals from liquidity conditions, macro policy, or regulation, the market is likely to remain range-bound near the lows as it searches for a durable base.

#JU #Jucom #cryptocurrency #blockchain #technical analysis

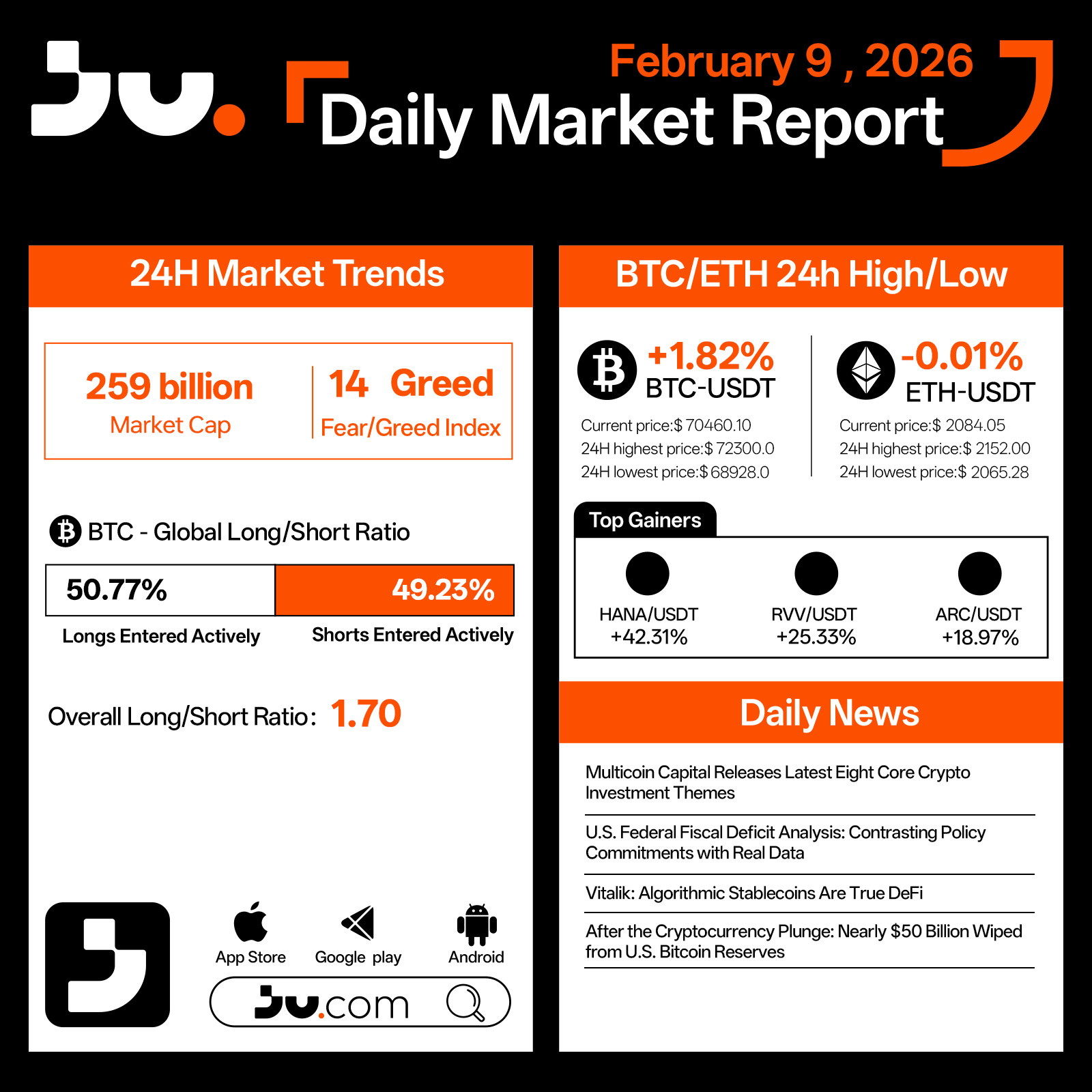

On February 9, the crypto market staged a modest rebound following the recent wave of extreme panic. Total market capitalization recovered to $259 billion, while the Fear & Greed Index remained depressed at 14, indicating that sentiment is still cautious even as selling pressure begins to ease.

Bitcoin rose 1.82% to $70,460.10, trading within a $68,928–$72,300 range. After last week’s aggressive deleveraging, downside momentum has clearly slowed. Positioning data shows BTC long exposure edging up to 50.77%, but with the aggregate long–short ratio at just 1.70, the move appears driven primarily by short covering and tentative dip-buying rather than conviction-based inflows. Ethereum lagged the rebound, finishing nearly flat at $2,084.05, underscoring continued weakness in higher-beta assets while risk appetite remains fragile.

Among smaller-cap tokens, names such as PIPPIN, RVV, and ARCU posted outsized gains, reflecting opportunistic trading in a liquidity recovery phase rather than a broad-based improvement in market sentiment.

From a narrative perspective, attention is shifting from post-crash blame to structural reflection. Multicoin Capital’s release of eight core crypto investment themes offers a refreshed framework for long-term positioning, while renewed scrutiny of the U.S. federal fiscal deficit highlights the growing gap between policy commitments and fiscal reality. Vitalik’s assertion that algorithmic stablecoins represent “true DeFi” has also resurfaced, prompting deeper discussion about the fundamental direction of decentralized finance.

Notably, following the recent sell-off, nearly $5 billion was wiped from U.S. Bitcoin reserves, reinforcing the idea that crypto assets are now intertwined with macro balance sheets rather than isolated from them.

Overall, February 9 appears to mark a technical rebound after extreme fear, not a confirmed trend reversal. While prices have stabilized, true recovery will depend on further deleveraging, improving liquidity conditions, and clearer macro signals. Until then, the market is likely to remain range-bound and fragile as it searches for a new equilibrium.

#cryptocurrency #blockchain #technical analysis #JU #Jucom

Bitcoin bags are getting blown out today, as the price of BTC falls to nearly $80,000 and marks a new seven-month low.

- The continued downward pressure on its price has pushed Bitcoin into a so-called death cross—when the average price of an asset over the short term falls below the average price over the long term. It’s a technical pattern that typically signals extended bearish momentum. For traders who study charts, it confirms what permabulls don’t want to hear: It’s over—at least for now.

- It’s happening as the crypto market as a whole shrinks to $2.91 trillion, shedding nearly $60 billion in the past 24 hours alone. Almost every single coin in the top 100 by market cap is bleeding red.

- The Fear and Greed Index, which measures market sentiment on a scale from 0 to 100, has cratered to 14 points—just four points above the year's low of 10 back in February. When this index drops below 20, it signals "extreme fear," and right now, traders are absolutely terrified.

- But it's not just crypto drama driving the market selloff. The macro picture is turning nasty. Just weeks ago, markets were pricing in a 97% chance the Federal Reserve would cut interest rates in December. Now? Those odds have collapsed to somewhere between 22% and 43%, depending on which metric you check.

- Fed officials are openly divided, with many signaling they'd prefer to keep rates unchanged through year-end. For risk assets like crypto that thrive on easy money, this is poison.

- On Myriad, a prediction market developed by Decrypt’s parent company Dastan, traders are now overwhelmingly convinced that Bitcoin will not mark a new all-time high this year, placing odds at almost 90% that BTC will not top the $126K mark that it hit on October 6.

- The bearish vibes are so strong, Myriad traders also currently place 40% odds that Bitcoin falls as low as $69K. So how low will it go? Here’s what the charts say.

- Bitcoin opened today at $86,691 and immediately sold off, hitting an intraday low of $80,620 before bouncing slightly to its current price at $85,187. That's a 1.61% drop on the day after being almost 5% down over the last 24 hours. More importantly, for traders, it further confirms the death cross pattern that's been progressively forming since its all-time high in early October. The death cross pattern was first confirmed on Wednesday as Bitcoin slid to around $88,000—now it’s fallen deeper.

- Here's what's happening on the charts: Exponential Moving Averages, or EMAs, help traders identify trend direction by tracking the average price of an asset over the short, medium, and long term. When the short-term 50-day EMA falls below the longer-term 200-day EMA, it means bears are in control and the longer-term bull market structure has been broken.

- For Bitcoin, the 50-day EMA has now decisively crossed below the 200-day EMA. In short, this tells traders market momentum has shifted from bullish to bearish. The gap between both EMAs increases the more the price of BTC trades below those targets—and the bigger the gap, the stronger the trend.

- The price of Bitcoin is now trading well below both EMAs, which creates a situation where each bounce attempt faces immediate resistance, increasing the gap between the two EMAs, making the bearish trend even stronger. Bulls trying to push higher will need to first reclaim the 50-day EMA, then tackle the 200-day—a double wall of resistance that's historically tough to crack in one go.

- As for other technical indicators, the Average Directional Index, or ADX, sits at 41, which is considered "strong." ADX measures trend strength regardless of direction, with readings above 25 indicating a clear trend is in place. At 41, this tells us we’re not seeing just a minor correction, but a potentially extended move lower.

- The Relative Strength Index, or RSI, has plunged to 23.18, placing Bitcoin deep in oversold territory. RSI measures momentum on a scale from 0 to 100, with readings below 30 signaling oversold conditions where assets are potentially undervalued. However, "oversold" doesn't mean the selling has to stop—in strong downtrends, RSI can remain in oversold territory for extended periods as prices continue grinding lower. But, yes, this also provides hopium for momentum traders as it signals that the worst of it may be over. (The worst being an accelerated crash, not necessarily a steady drop.)

- The Squeeze Momentum Indicator is flashing "bearish impulse," meaning selling pressure is intensifying rather than easing. Meanwhile, the Volume Profile Visible Range (VPVP) shows the price of Bitcoin trading "below" key volume nodes, suggesting there's not much buying interest at current levels.

- So, everything is bearish, clearly. But where's the next support? How low can the price of BTC go? The chart reveals several key horizontal levels to watch.

- The immediate danger zone is $80,697, which briefly held today but looked shaky. If that breaks, the next major support sits at $74,555, followed by $65,727, and potentially all the way down to $53,059 if panic really sets in during a crypto winter. Those price levels have previous consolidation zones where significant trading volume accumulated, making them natural landing spots for oversold bounces.

- For resistances, traders will watch for BTC’s price breaking past $90,000 again and look at $100,000 as the major psychological target.

- Ethereum opened at $2,830.7 and dropped as low as $2,621 intraday before stabilizing around $2,798—a 1.16% loss on the day. While not as dramatic as Bitcoin's selloff, ETH's technical picture is equally concerning.

- Unlike Bitcoin, Ethereum hasn't fully confirmed its death cross yet—the 50-day EMA is still technically above the 200-day, giving it a "long" signal on an indicator that is obviously hours away from changing to bearish. The gap is razor-thin and closing fast. More importantly, ETH’s price is trading well below both EMAs, rendering that technical distinction somewhat meaningless. The bearish momentum is clearly established.

- A good way to see the natural support zones is using the Fibonacci retracements: a set of natural clusters that appear during a trend, showing supports and resistances in a specific timeframe—not because of price, but because of natural proportions.

- Right now, ETH is testing the 0.618 Fibonacci level at approximately $2,755. If this level breaks, the next Fibonacci support doesn't appear until $2,180, which would represent a massive 22% drop from current prices, and would resolve a price market on Myriad betting on ETH’s moon or doom.

- The ADX for Ethereum is even stronger than Bitcoin's at 46, indicating the downtrend is rock-solid. Meanwhile, RSI sits at 28.46—not quite as oversold as Bitcoin but definitely in stressed territory. The Squeeze Momentum Indicator shows "bearish impulse" here too, confirming sellers are in control.

- XRP is showing relative strength compared to its larger peers, down just 0.50% to close at $1.98 after opening at $1.99 and hitting an intraday low of $1.81796. Don't let that modest percentage fool you though—the technical damage is real.

- Like Bitcoin, the Ripple-linked XRP has confirmed a full death cross with its 50-day EMA now below the 200-day. The price of XRP is trading beneath both EMAs, and with an ADX of 32, the downtrend has enough strength to continue. While 32 isn't as extreme as Bitcoin's 41 or Ethereum's 46, it's still well above the 25 threshold that confirms a trend is in place rather than just random chop.

- The RSI at 32.86 shows XRP is approaching oversold territory but hasn't quite reached the extreme stress levels of Bitcoin and Ethereum. This could mean two things: either XRP has more downside before finding equilibrium, or it's showing genuine relative strength that could make it a safer harbor if the broader market continues tanking.

- XRP had such a crazy year that its price action shows only two major horizontal support levels that should concern XRP holders—and that would be very painful for hodlers, considering the movement from the all-time high to those targets.

- The next major support zone sits at $1.589, which represents a potential 20% drop from current levels. If that breaks, there's very little support until $0.66, a catastrophic 67% plunge from current prices and almost 80% from all-time high zone that would take XRP back to early 2024 levels.

The Squeeze Momentum Indicator is showing "bearish impulse," and like the other coins, the volume profile indicates XRP’s price is trading below key volume levels, meaning there's not much buying interest stepping in to defend current prices.

#Bitcoin #BitcoinDeathCross #Jucom #cryptocurrency #blockchain $BTC/USDT $JU/USDT $ETH/USDT

While discussions are growing that Bitcoin-focused company Strategy (formerly MicroStrategy) could be removed from MSCI indices, the company’s chairman, Michael Saylor, maintained that the operating model is robust and that this possibility will not affect the company’s roadmap.

- MSCI has proposed removing “digital asset treasury companies” whose portfolios consist largely of cryptocurrencies from its indexes. While it noted that such companies “may exhibit characteristics similar to mutual funds,” it stated that these structures are not suitable for the indexes. The final decision will be announced on January 15th.

- In his latest post, Saylor explained that Strategy is an operating company. He pointed out that, in addition to its Bitcoin reserves, it also has a $500 million enterprise software division that has been serving corporations and public institutions for over 20 years.

- Saylor stated, “We understand that index providers periodically review their methodologies, but Strategy is not an ETF, it is not a closed-end fund, and it is certainly not a passive proxy for Bitcoin. We produce, operate, and grow just like any other business.” He added that inclusion or removal from the index would not change the company's strategy, operations, or long-term belief in BTC.

- JPMorgan issued a note this week warning that Strategy's removal from the index could lead to billions of dollars in passive outflows. Analysts estimate that a potential removal from MSCI could lead to a $2.8 billion outflow from passive funds. Overall, approximately $9 billion of Strategy's market capitalization is estimated to be tied to passive, index-tracking ETFs and mutual funds.

The sharp decline in Bitcoin's price is also putting pressure on Strategy shares, which have lost nearly 40% of their value this year.

#Bitcoin #MicroStrategy #MichaelSaylor #Jucom #cryptocurrency $BTC/USDT $JU/USDT $ETH/USDT

The price of Cardano (ADA) was down on Friday after the blockchain suffered an unexpected chain split, which was caused by a malformed delegation transaction that triggered a software flaw. That created problems for Cardano users, and prompted a public apology from the user who claimed that they caused it.

- Intersect, the Cardano ecosystem’s governance organization, said in an incident report that the divergence began when the malformed transaction passed validation on newer node versions, but nodes running older software rejected it.

- “This exploited a bug in an underlying software library that was not trapped by validation code,” Intersect wrote. “The execution of this transaction caused a divergence in the blockchain, effectively splitting the network into two distinct chains: one containing the ‘poisoned’ transaction and a ‘healthy’ chain without it.”

- Earlier that day, Cardano co-founder Charles Hoskinson posted on X that it was a “premeditated attack from a disgruntled [stake pool operator]” who was “actively looking at ways to harm the brand and reputation of [Cardano developer Input/Output Global].”

- According to Hoskinson, all Cardano users were impacted. The price of Cardano’s token ADA was down more than 6% recently, following the incident.

- According to the incident report, the mismatch caused operators to build blocks on different branches of the chain until patched node software was deployed. Developers and service providers coordinated an emergency response, and operators were urged to upgrade to rejoin the main chain.

- Intersect said the wallet responsible for the malformed transaction has been identified, while Hoskinson said it will take weeks to clean up the mess.

- “Forensic analysis suggests links to a participant from the Incentivized Testnet (ITN) era,” Intersect wrote. “As this incident constitutes a potential cyberattack on a digital network, relevant authorities, including the Federal Bureau of Investigation, are being engaged to investigate.”

- Hours after the incident, an X user posting under the name Homer J. said they were responsible for submitting the transaction that triggered the split.

- “Sorry Cardano folks, it was me who endangered the network with my careless action yesterday evening,” they wrote, describing the attempt as a personal challenge to reproduce the “bad transaction” and said he relied on AI-generated instructions while blocking traffic on their server.

- “I've felt awful as soon as I realized the scale of what I've caused. I know there's nothing I can do to make up for all the pain and stress I've caused over the past X hours,” they added. “Difficult to quantify the negligence on my behalf. I am sorry, I truly am. I didn't have evil intentions.”

- Homer wrote that he did not sell or short ADA, did not coordinate with anyone else, and did not act for financial gain. “I'm ashamed of my carelessness and take full responsibility for it and whatever consequences will follow,” he said.

- According to Intersect, no user funds were lost, and most retail wallets were unaffected because they were running node components that handled the malformed transaction safely.

- Hoskinson, the outspoken co-founder of Cardano, claimed in a video message that the network “didn’t go down,” though users did encounter issues before the problem was fixed.

“It is important to note that the network did not stall. Block production continued on both chains throughout the incident, and at least some identical transactions appeared on both chains,” Intersect wrote. “However, to ensure the integrity of the ledger, exchanges and third-party providers largely paused deposits and withdrawals as a precautionary measure.”

#Cardano #CardanoNetwork #Jucom #cryptocurrency #blockchain $ADA/USDT $JU/USDT $BTC/USDT