JU 博客 2025-08-01 05:46

2025-08-01 05:46

🚀 桥水基金创始人雷·达里奥大幅提升比特币配置至15%!

亿万富翁投资者雷·达里奥(Ray Dalio)将比特币投资组合配置建议从2%大幅提升至15%,原因是美国债务危机加剧,可能引发类似1930年代和1970年代的历史性货币崩溃风险。

💰 核心观点:

-

美国政府年支出7万亿美元,收入仅5万亿美元,赤字达2万亿

联邦债务已达年收入6倍,年利息支出高达1万亿美元

面临"债务末日循环":只能靠印钞或发债偿还现有债务

建议比特币+黄金组合配置15%作为法币贬值对冲

🎯 达里奥的投资逻辑: 1️⃣ 比特币供应有限(2100万枚上限)提供稀缺性保护 2️⃣ 在全球央行协调扩张背景下,比特币抗通胀特性显著 3️⃣ 与传统法币相关性低,适合多元化配置 4️⃣ 15%配置实现最佳风险回报平衡

⚠️ 达里奥的担忧:

-

政府监控能力强,透明度带来隐私风险

潜在监管控制和技术漏洞风险

央行不太可能将比特币作为储备货币

"比特币最大的风险是它的成功"

🏆 配置策略建议:

-

更保守投资者:偏重黄金配置

风险承受力高者:增加比特币比重

采用定期定额投资,避免一次性大额买入

根据个人风险偏好灵活调整比例

💡 市场影响:

-

机构对比特币兴趣持续提升

主要交易所报告机构活跃度增加

比特币目前交易价约119,000美元

受益于宏观经济因素和美联储鸽派预期

这标志着达里奥从加密货币怀疑者转变为战略支持者,反映出在前所未有的财政风险时代,对传统法币投资替代品的迫切需求。

阅读完整深度分析和投资策略指导:👇

https://blog.jucoin.com/zh-hans/ray-dalio-bitcoin-portfolio-allocation/?utm_source=blog

#雷达里奥 #比特币 #投资组合 #债务危机 #桥水基金 #加密货币 #投资策略 #风险对冲 #货币贬值 #财富保值 #JuCoin #区块链 #数字资产 #机构投资

34

0

0

0

JU 博客

2025-08-01 05:47

🚀 桥水基金创始人雷·达里奥大幅提升比特币配置至15%!

[{"type":"paragraph","children":[{"text":"\n"}]},{"type":"paragraph","children":[{"text":"亿万富翁投资者雷·达里奥(Ray Dalio)将比特币投资组合配置建议从2%大幅提升至15%,原因是美国债务危机加剧,可能引发类似1930年代和1970年代的历史性货币崩溃风险。"}]},{"type":"paragraph","children":[{"text":"💰 核心观点:"}]},{"type":"bulleted-list","children":[{"text":"\n美国政府年支出7万亿美元,收入仅5万亿美元,赤字达2万亿\n联邦债务已达年收入6倍,年利息支出高达1万亿美元\n面临\"债务末日循环\":只能靠印钞或发债偿还现有债务\n建议比特币+黄金组合配置15%作为法币贬值对冲\n"}]},{"type":"paragraph","children":[{"text":"🎯 达里奥的投资逻辑:\n1️⃣ 比特币供应有限(2100万枚上限)提供稀缺性保护\n2️⃣ 在全球央行协调扩张背景下,比特币抗通胀特性显著\n3️⃣ 与传统法币相关性低,适合多元化配置\n4️⃣ 15%配置实现最佳风险回报平衡"}]},{"type":"paragraph","children":[{"text":"⚠️ 达里奥的担忧:"}]},{"type":"bulleted-list","children":[{"text":"\n政府监控能力强,透明度带来隐私风险\n潜在监管控制和技术漏洞风险\n央行不太可能将比特币作为储备货币\n\"比特币最大的风险是它的成功\"\n"}]},{"type":"paragraph","children":[{"text":"🏆 配置策略建议:"}]},{"type":"bulleted-list","children":[{"text":"\n更保守投资者:偏重黄金配置\n风险承受力高者:增加比特币比重\n采用定期定额投资,避免一次性大额买入\n根据个人风险偏好灵活调整比例\n"}]},{"type":"paragraph","children":[{"text":"💡 市场影响:"}]},{"type":"bulleted-list","children":[{"text":"\n机构对比特币兴趣持续提升\n主要交易所报告机构活跃度增加\n比特币目前交易价约119,000美元\n受益于宏观经济因素和美联储鸽派预期\n"}]},{"type":"paragraph","children":[{"text":"这标志着达里奥从加密货币怀疑者转变为战略支持者,反映出在前所未有的财政风险时代,对传统法币投资替代品的迫切需求。"}]},{"type":"paragraph","children":[{"text":"阅读完整深度分析和投资策略指导:👇\n"}]},{"type":"paragraph","children":[{"text":""},{"type":"link","url":"https://blog.jucoin.com/zh-hans/ray-dalio-bitcoin-portfolio-allocation/?utm_source=blog","children":[{"text":"https://blog.jucoin.com/zh-hans/ray-dalio-bitcoin-portfolio-allocation/?utm_source=blog"}]},{"text":""}]},{"type":"paragraph","children":[{"text":"#雷达里奥 #比特币 #投资组合 #债务危机 #桥水基金 #加密货币 #投资策略 #风险对冲 #货币贬值 #财富保值 #JuCoin #区块链 #数字资产 #机构投资"}]},{"type":"paragraph","children":[{"text":"\n\n\n\n\n\n\n\n\n\n\n\n\n\n\n"}]}]

JuCoin Square

免责声明:含第三方内容,非财务建议。

详见《条款和条件》

相关文章

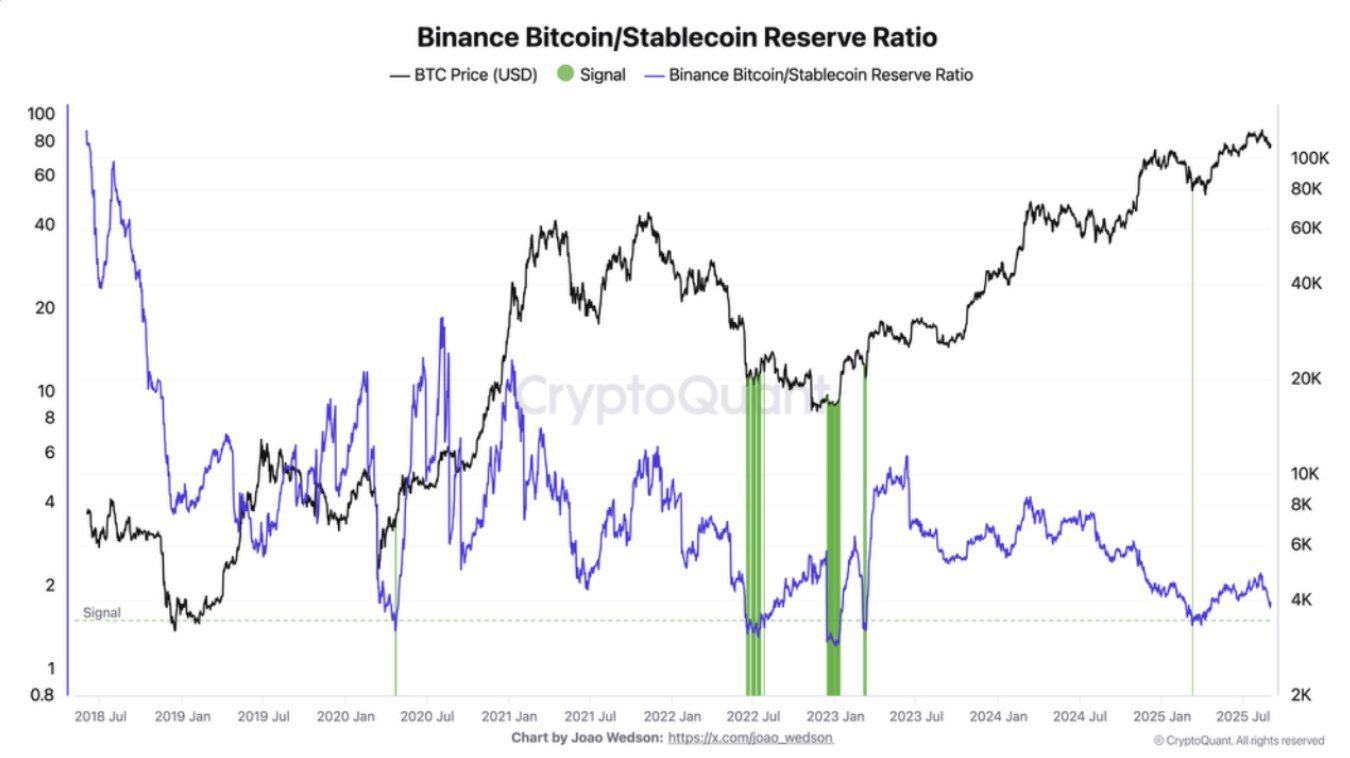

🚨 Alerte Binance : Réserve $BTC vs stablecoins au bord du signal d’achat rare[{"type":"paragraph","children":[{"text":"Le ratio atteint un niveau critique, un "},{"text":"signal historique observé seulement 2 fois depuis le dernier bear market","bold":true},{"text":". 📊\n\n👉 À surveiller de près pour anticiper un possible rebond."}]},{"type":"paragraph","children":[{"text":""},{"type":"topic","character":"Bitcoin","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"CryptoSignals","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"cryptocurrency","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"blockchain","children":[{"text":""}]},{"text":" "}]},{"type":"paragraph","children":[{"text":"\n\n\n\n"}]}]

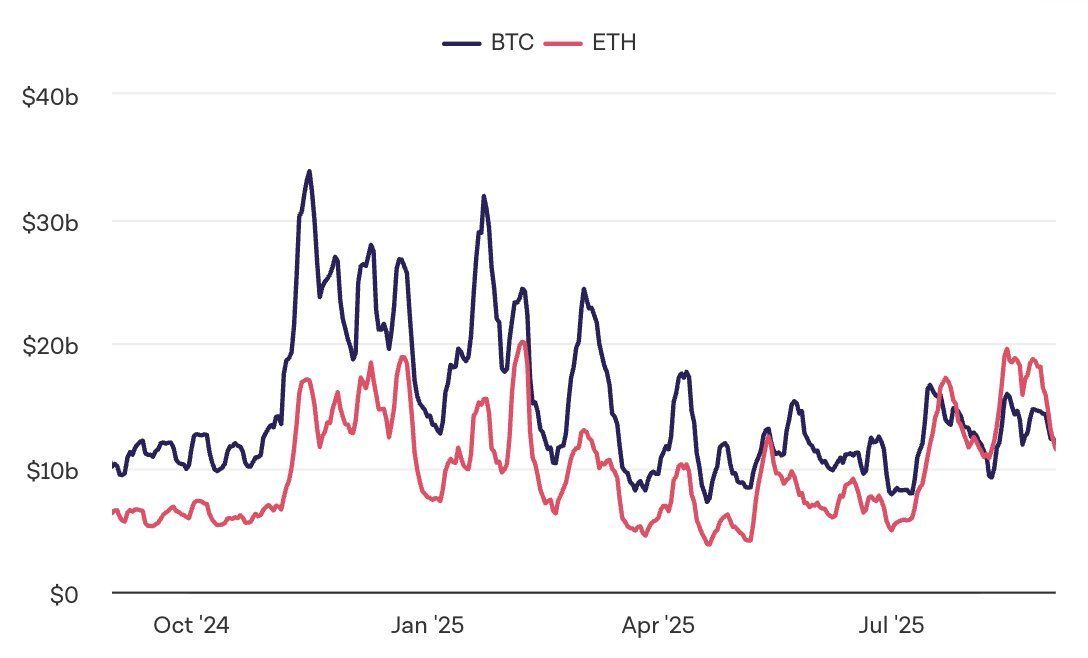

🚨 Historic Shift on CEXs[{"type":"paragraph","children":[{"text":"","bold":true}]},{"type":"paragraph","children":[{"text":"For the "},{"text":"first time in 7 years","bold":true},{"text":", "},{"text":"$ETH > $BTC","bold":true},{"text":" in 7-day spot volume, per "},{"text":"The Block","italic":true},{"text":". 🔁\n\n👉 Bitcoin whales are rotating heavily into Ethereum."}]},{"type":"paragraph","children":[{"text":"With "},{"text":"capital reallocating","bold":true},{"text":" + "},{"text":"rate cut anticipation","bold":true},{"text":", analysts now eye "},{"text":"fresh ATHs in Q4","bold":true},{"text":" for majors. "}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":""},{"type":"topic","character":"Ethereum","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"Bitcoin","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"cryptocurrency","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"blockchain","children":[{"text":""}]},{"text":" "}]},{"type":"paragraph","children":[{"text":"\n\n\n\n\n"}]}]

🔥 Mouvement stratégique de BlackRock aujourd’hui[{"type":"paragraph","children":[{"text":"➡️ Achat de "},{"text":"2,588 ","bold":true},{"type":"coin","currencyId":7,"currency":"btc","symbolId":6,"symbol":"btc_usdt","logo":"https://web.jucoin.online/cdn/coin/logo/btc.png","fullName":"Bitcoin","character":"BTC/USDT","children":[{"text":""}]},{"text":" pour "},{"text":"258,8 M$","bold":true},{"text":" 🟢\n\n➡️ Vente de "},{"text":"35,009 ","bold":true},{"type":"coin","currencyId":8,"currency":"eth","symbolId":7,"symbol":"eth_usdt","logo":"https://web.jucoin.online/cdn/coin/logo/eth.png","fullName":"Ethereum","character":"ETH/USDT","children":[{"text":""}]},{"text":" pour "},{"text":"152,7 M$","bold":true},{"text":" 🔴"}]},{"type":"paragraph","children":[{"text":"Un rééquilibrage massif qui en dit long sur leur vision court-terme du marché. 👀"}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":""},{"type":"topic","character":"Bitcoin","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"Ethereum","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"cryptocurrency","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"blockchain","children":[{"text":""}]},{"text":" "}]},{"type":"paragraph","children":[{"text":"\n\n\n\n\n"}]}]

Qu’est-ce que le jeton $JU ?[{"type":"paragraph","children":[{"text":"Le jeton "},{"text":"$JU","bold":true},{"text":" est le "},{"text":"token natif de l’écosystème JuCoin","bold":true},{"text":", un échange de cryptomonnaies fondé en 2013 et basé à Singapour. Depuis sa transformation en 2024, JuCoin se positionne comme une plateforme axée sur l’expérience utilisateur, intégrant des services tels que "},{"text":"JuChain","bold":true},{"text":" (blockchain publique), "},{"text":"JuChat","bold":true},{"text":" (application sociale Web3), "},{"text":"JuGame","bold":true},{"text":" (plateforme GameFi) et "},{"text":"JuOne","bold":true},{"text":" (smartphone Web3) ."},{"type":"link","url":"https://blog.jucoin.com/jucoin-vs-kucoin/?utm_source=chatgpt.com","children":[{"text":""}]},{"text":""}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":"Le jeton $JU est au cœur de l’écosystème "},{"text":"JuCoin","bold":true},{"text":". Il offre plusieurs utilités :\n\n"},{"text":"Réductions sur les frais de trading","bold":true},{"text":" : Les détenteurs de $JU bénéficient de frais réduits sur la plateforme.\n\n\n"},{"text":"Staking","bold":true},{"text":" : Les utilisateurs peuvent staker leurs $JU pour obtenir des récompenses, avec des rendements allant jusqu’à 10% APY.\n\n\n"},{"text":"Gouvernance","bold":true},{"text":" : $JU permet aux détenteurs de participer aux décisions importantes de la plateforme.\n\n\n"},{"text":"Accès prioritaire","bold":true},{"text":" : Les détenteurs ont un accès privilégié aux nouveaux lancements de projets sur JuCoin ."},{"type":"link","url":"https://blog.jucoin.com/jucoin-vs-kucoin/?utm_source=chatgpt.com","children":[{"text":""}]},{"text":"\n\nPerformance du $JUEn août 2025, le $JU a franchi un cap important en dépassant les "},{"text":"20 $","bold":true},{"text":", enregistrant une croissance de "},{"text":"200x","bold":true},{"text":" par rapport à son prix initial. Actuellement, il est coté à environ "},{"text":"22,45 $","bold":true},{"text":" avec un volume de trading sur 24 heures dépassant "},{"text":"1,25 milliard de dollars","bold":true},{"text":" ."},{"type":"link","url":"https://coinmarketcap.com/currencies/juchain/?utm_source=chatgpt.com","children":[{"text":""}]},{"text":""}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":"Comment acheter du $JU ?","bold":true}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":"$JU est disponible à l’achat sur plusieurs plateformes, dont :\n\n"},{"text":"JuCoin","bold":true},{"text":" : La plateforme officielle de JuCoin.\n\n\n"},{"text":"Pourquoi s’intéresser au $JU ?","bold":true}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":"$JU se distingue par son intégration profonde dans l’écosystème JuCoin, offrant des avantages tangibles aux utilisateurs. Avec son approche axée sur l’expérience utilisateur et son écosystème diversifié, il représente une opportunité intéressante pour ceux qui souhaitent s’impliquer dans un projet crypto innovant."}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":""},{"type":"topic","character":"cryptocurrency","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"JU","children":[{"text":""}]},{"text":" \n"}]}]

💎 A Crypto Gem Turned into a Pump and Dump Cryptocurrency 😱[{"type":"paragraph","children":[{"text":""},{"type":"topic","character":"CryptoMeme","children":[{"text":""}]},{"text":" "},{"type":"topic","character":"CryptoHumor","children":[{"text":""}]},{"text":" "}]},{"type":"paragraph","children":[{"text":"\n"}]},{"type":"paragraph","children":[{"text":""},{"type":"link","url":"https://www.youtube.com/@JuCoin_Exchange/shorts","children":[{"text":" Check out our YouTube Channel 👉 "}]},{"text":""}]}]

Top Coins by Bullish Period & Performance [{"type":"paragraph","children":[{"text":"📈 Top Coins by Bullish Period & Performance "}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":"3m % and Bullish Period:"}]},{"type":"paragraph","children":[{"text":"• $TROLL $37.1 +1,004% (44d)"}]},{"type":"paragraph","children":[{"text":""},{"type":"coin","currencyId":45,"currency":"ena","symbolId":46,"symbol":"ena_usdt","logo":"https://web.jucoin.online/cdn/coin/logo/ena.png","fullName":"Ethena","character":"ENA/USDT","children":[{"text":""}]},{"text":" $0.49 +107.2% (36d)"}]},{"type":"paragraph","children":[{"text":""},{"type":"coin","currencyId":156,"currency":"ldo","symbolId":71,"symbol":"ldo_usdt","logo":"https://storage.jucoin.online/1/currency/760b050f-5181-4a70-af3f-e9eefd567a0c-1737531592300.png","fullName":"Lido DAO","character":"LDO/USDT","children":[{"text":""}]},{"text":" $1.34 +39.8% (34d)"}]},{"type":"paragraph","children":[{"text":"• $SYRUP $0.22 +17.1% (34d)"}]},{"type":"paragraph","children":[{"text":""}]},{"type":"paragraph","children":[{"text":"This metric shows how often a coin has been bullish in the last 100 days. Daily growth above 5% taken only. "}]},{"type":"paragraph","children":[{"text":"💧 "},{"type":"link","url":"https://t.me/JioCoinsX","children":[{"text":"More details "}]},{"text":""}]}]