Banks Deepen Bitcoin Exposure as BTC Rebounds Modestly and Markets Stabilize – December 17, 2025

On December 17, the crypto market entered a consolidation phase following the sharp volatility seen earlier in the week. Bitcoin led a mild rebound, while Ethereum remained relatively subdued, reflecting a cautious recovery across risk assets. Total liquidations over the past 24 hours declined to $102.13 billion, and the Fear & Greed Index rebounded to 25, indicating easing panic but still restrained risk appetite.

Bitcoin rose 1.54% to $87,313.61, trading between a daily high of $88,161.72 and a low of $85,272.69, establishing a tentative base above prior support levels. Ethereum, by contrast, slipped slightly by 0.08% to $2,945.44, with intraday fluctuations ranging from $2,979.27 to $2,881.13. The divergence suggests that capital remains selective, with ETH yet to attract decisive inflows following recent drawdowns.

Positioning data continues to show a slight bearish tilt. Bitcoin’s global long–short ratio stands at 49.04% longs versus 50.96% shorts, while Ethereum’s ratio is more skewed at 48.48% longs against 51.52% shorts. Although the imbalance is not extreme, it underscores a market still pricing the current move as a rebound rather than a confirmed trend reversal.

Speculative activity remains concentrated in smaller-cap tokens. Among top performers, PTB/USDT surged 87.82%, EVER/USDT climbed 86.55%, and ASTB/USDT gained 76.98%, highlighting short-term capital rotation into high-volatility assets as traders seek opportunities amid major-asset consolidation.

From a structural perspective, integration between traditional finance and crypto continues to advance. Reports indicate that the top 25 U.S. banks are actively developing Bitcoin-related business capabilities, reinforcing the asset’s growing relevance within mainstream financial strategy. Visa has begun supporting transaction settlements for U.S. financial institutions using USDC on the Solana network, further strengthening stablecoin use cases in real-world payment infrastructure. Meanwhile, the UK regulator launched a consultation on new cryptocurrency rules, signaling continued progress toward regulatory clarity.

Narrative discussions also influenced sentiment. Michael Saylor argued that quantum computing will not undermine Bitcoin’s security, but may instead reinforce its scarcity and long-term value proposition, a view that resonated with long-term holders. Conversely, political uncertainty remains a headwind, as Senator Elizabeth Warren called for an investigation into a Trump-linked DeFi project, delaying progress on the U.S. crypto market structure bill and weighing on short-term confidence.

Overall, while institutional adoption signals and payment infrastructure developments provide constructive long-term support, the crypto market remains in a cautious stabilization phase. With regulatory debates ongoing and macro uncertainty unresolved, near-term price action is likely to remain range-bound, with sustained upside dependent on clearer liquidity and policy tailwinds.

#cryptocurrency #blockchain #finance #Blockchain

JU Blog

2025-12-17 07:25

Banks Deepen Bitcoin Exposure as BTC Rebounds Modestly and Markets Stabilize – December 17, 2025

Tuyên bố miễn trừ trách nhiệm:Chứa nội dung của bên thứ ba. Không phải lời khuyên tài chính.

Xem Điều khoản và Điều kiện.

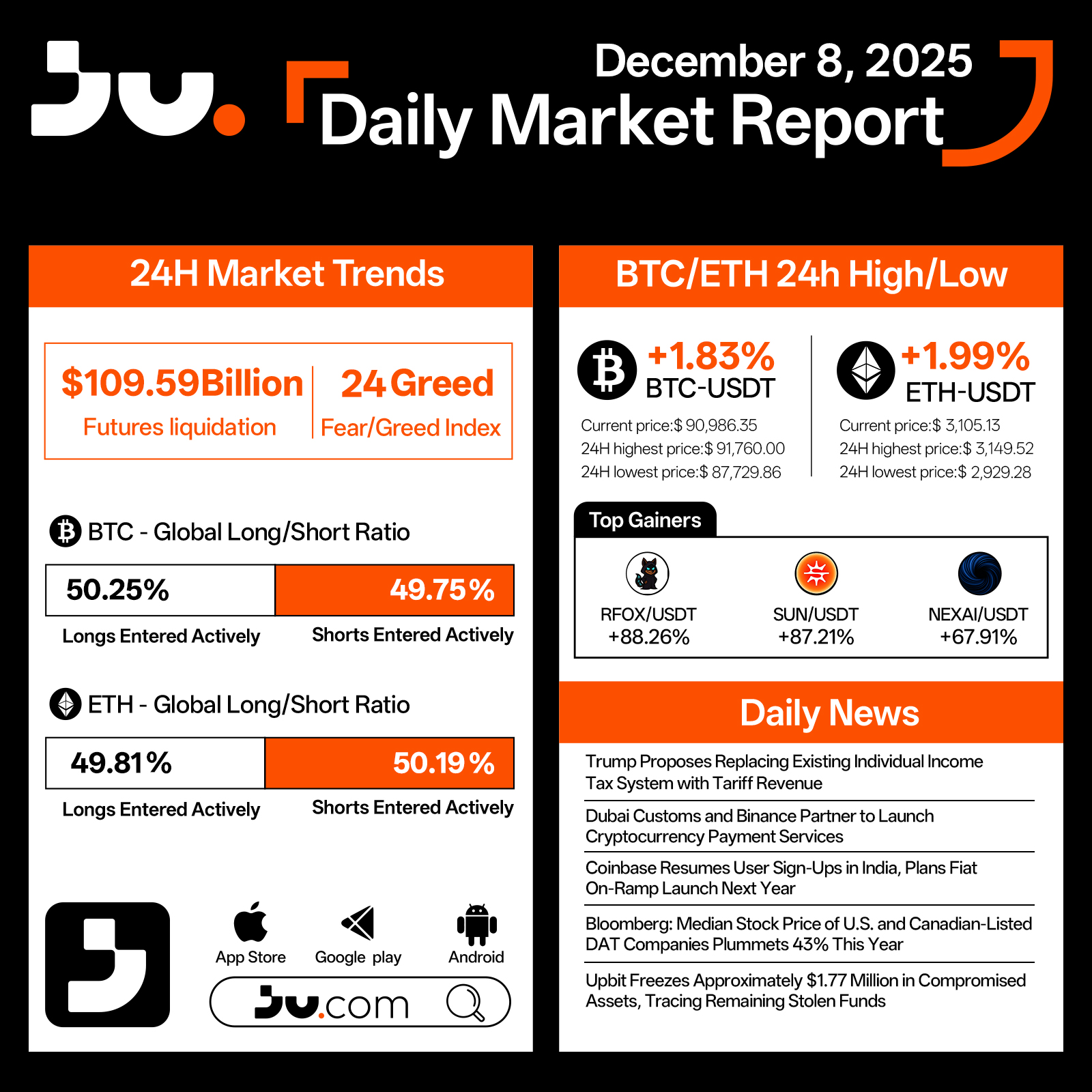

Crypto markets posted another day of modest gains on December 8, with major assets trending higher. Over the past 24 hours, total liquidations reached $109.59 billion, while the Fear & Greed Index held at 24, indicating gradually strengthening sentiment without signs of overheating. Bitcoin (BTC) rose 1.83% to $90,986.35, trading between $91,760.00 at the high and $87,729.86 at the low. Ethereum (ETH) outpaced BTC slightly, climbing 1.99% to $3,105.13, with intraday movement spanning from $3,149.52 to $2,929.28.

Derivatives data showed balanced positioning, with BTC at 50.25% longs and 49.75% shorts, while ETH recorded 49.81% longs versus 50.19% shorts. This equilibrium suggests an uncertain but gradually improving market outlook. A number of altcoins posted strong performances, led by RFOX/USDT with +88.26%, SUN/USDT with +87.21%, and NEXAI/USDT with +67.91%, highlighting ongoing speculative momentum.

In broader developments, Trump proposed replacing the current individual income tax system with tariff revenue, a policy shift that could significantly impact U.S. economic dynamics. Dubai Customs partnered with Binance to introduce cryptocurrency payment services, marking a major step for regulated digital payments in the region. Coinbase resumed sign-ups in India and announced plans to roll out fiat on-ramps next year. Bloomberg reported that the median stock price of U.S. and Canadian-listed DAT companies has plunged 43% this year, underscoring persistent market stress in high-rate environments. Upbit froze approximately $1.77 million in compromised assets and continues tracing remaining stolen funds.

Overall, the steady climb of BTC and ETH reflects improving confidence across the crypto market. With regulatory developments, payment integrations, and major platforms reactivating services, structural support for year-end market strength is gradually building.

#cryptocurrency #blockchain #finance #Blockchain

On December 17, the crypto market entered a consolidation phase following the sharp volatility seen earlier in the week. Bitcoin led a mild rebound, while Ethereum remained relatively subdued, reflecting a cautious recovery across risk assets. Total liquidations over the past 24 hours declined to $102.13 billion, and the Fear & Greed Index rebounded to 25, indicating easing panic but still restrained risk appetite.

Bitcoin rose 1.54% to $87,313.61, trading between a daily high of $88,161.72 and a low of $85,272.69, establishing a tentative base above prior support levels. Ethereum, by contrast, slipped slightly by 0.08% to $2,945.44, with intraday fluctuations ranging from $2,979.27 to $2,881.13. The divergence suggests that capital remains selective, with ETH yet to attract decisive inflows following recent drawdowns.

Positioning data continues to show a slight bearish tilt. Bitcoin’s global long–short ratio stands at 49.04% longs versus 50.96% shorts, while Ethereum’s ratio is more skewed at 48.48% longs against 51.52% shorts. Although the imbalance is not extreme, it underscores a market still pricing the current move as a rebound rather than a confirmed trend reversal.

Speculative activity remains concentrated in smaller-cap tokens. Among top performers, PTB/USDT surged 87.82%, EVER/USDT climbed 86.55%, and ASTB/USDT gained 76.98%, highlighting short-term capital rotation into high-volatility assets as traders seek opportunities amid major-asset consolidation.

From a structural perspective, integration between traditional finance and crypto continues to advance. Reports indicate that the top 25 U.S. banks are actively developing Bitcoin-related business capabilities, reinforcing the asset’s growing relevance within mainstream financial strategy. Visa has begun supporting transaction settlements for U.S. financial institutions using USDC on the Solana network, further strengthening stablecoin use cases in real-world payment infrastructure. Meanwhile, the UK regulator launched a consultation on new cryptocurrency rules, signaling continued progress toward regulatory clarity.

Narrative discussions also influenced sentiment. Michael Saylor argued that quantum computing will not undermine Bitcoin’s security, but may instead reinforce its scarcity and long-term value proposition, a view that resonated with long-term holders. Conversely, political uncertainty remains a headwind, as Senator Elizabeth Warren called for an investigation into a Trump-linked DeFi project, delaying progress on the U.S. crypto market structure bill and weighing on short-term confidence.

Overall, while institutional adoption signals and payment infrastructure developments provide constructive long-term support, the crypto market remains in a cautious stabilization phase. With regulatory debates ongoing and macro uncertainty unresolved, near-term price action is likely to remain range-bound, with sustained upside dependent on clearer liquidity and policy tailwinds.

#cryptocurrency #blockchain #finance #Blockchain

On December 30, crypto markets experienced a broad pullback during the final full trading session of the year, with major assets declining amid year-end position adjustments. Total liquidations over the past 24 hours rose to $110.51 billion, while the Fear & Greed Index slipped to 29, reflecting a more cautious tone as investors reduced exposure ahead of the year’s close.

Bitcoin fell 2.25% to $87,088.07, after briefly rallying to an intraday high of $90,406.08 before reversing lower and testing support near $86,814.52. Ethereum mirrored the move, declining 2.32% to $2,930.84, failing to hold above $3,056.10 and retreating toward $2,910.92, placing prices back in the middle of their recent consolidation range.

Positioning data remained tightly balanced, with BTC long positions at 50.23% and ETH longs at 49.97%. However, the sharp intraday reversals suggest limited follow-through from bulls at higher levels. Combined with the spike in liquidations, price action points to a wave of leveraged position unwinding rather than a deterioration in broader market fundamentals.

Despite pressure on major assets, speculative activity persisted in select small-cap tokens. TERRA/USDT surged 541.33%, while AA/USDT and ZBT/USDT gained 43.52% and 42.60%, respectively. These moves highlight ongoing short-term risk-taking in isolated pockets, though such rallies remain vulnerable in an unstable liquidity environment.

Macro and industry developments added further context. Spot gold and silver extended their declines amid a sharp year-end sell-off, indicating that traditional safe-haven assets were also affected by portfolio rebalancing. Coinbase reported that crypto open interest reached record highs in 2025, underscoring how elevated leverage has become a key driver of amplified market swings. On the security front, on-chain investigator ZachXBT uncovered a $2 million scam targeting Canadian users via fake Coinbase support, reinforcing the need for heightened vigilance during volatile periods.

At the same time, long-term infrastructure investment continues. BitMine announced that its Ethereum staking operations have surpassed the $1 billion milestone, with plans to launch the MAVAN validator network in Q1 2026. This development highlights that, despite near-term volatility, institutional capital continues to build exposure to core blockchain infrastructure.

Overall, the late-December pullback appears driven by year-end profit-taking and leverage normalization rather than a shift in the market’s longer-term trajectory. With open interest elevated and liquidity thinning, volatility is likely to remain high into the turn of the year, leaving the market poised for clearer directional signals as 2026 begins.

#cryptocurrency #blockchain #finance #Blockchain