Ju.com Phase 1, Third Batch Repurchase and Destruction Announcement

Dear Ju.com Users,

The Ju.com team has initiated the Phase 1, Third Batch JU Market Repurchase and Destruction Plan. We will continue to uphold the principles of "Openness, Fairness, and Sustainability," steadfastly execute the long-term repurchase mechanism, and further strengthen the deflationary logic and ecosystem value support for JU.

Phase 1, Third Batch Repurchase and Destruction Plan Execution Method: The team repurchases JU in batches from the open market and destroys JU by sending it to the JuChain burn address; Execution Action: The third batch of 1,000,000 JU has been completed. Destruction details are as follows: Time: 2025/12/3 15:10 (UTC+8) Burn Address: 0x000000000000000000000000000000000000dEaD On-chain Hash: https://explorer.juscan.io/tx/0x4e5774c34faf49f52966ac35da2d2a7ca51b096c34f2c15d4bb6ca0104e92c00

JU Ecosystem Consensus and Long-term Development The repurchase and destruction plan aims to return value to users and the community, ensuring JU continuously gains real use cases and liquidity support. We believe that under the dual influence of market cycles and consensus co-building, the long-term value of JU will be consistently verified.

Ju.com will continue to fulfill commitments through actions and earn trust through transparency. Thank you to every partner who stands firmly with us!

Ju.com Team December 3, 2025

#Jucom #JU

JU Blog

2025-12-03 09:01

Ju.com Phase 1, Third Batch Repurchase and Destruction Announcement

Tuyên bố miễn trừ trách nhiệm:Chứa nội dung của bên thứ ba. Không phải lời khuyên tài chính.

Xem Điều khoản và Điều kiện.

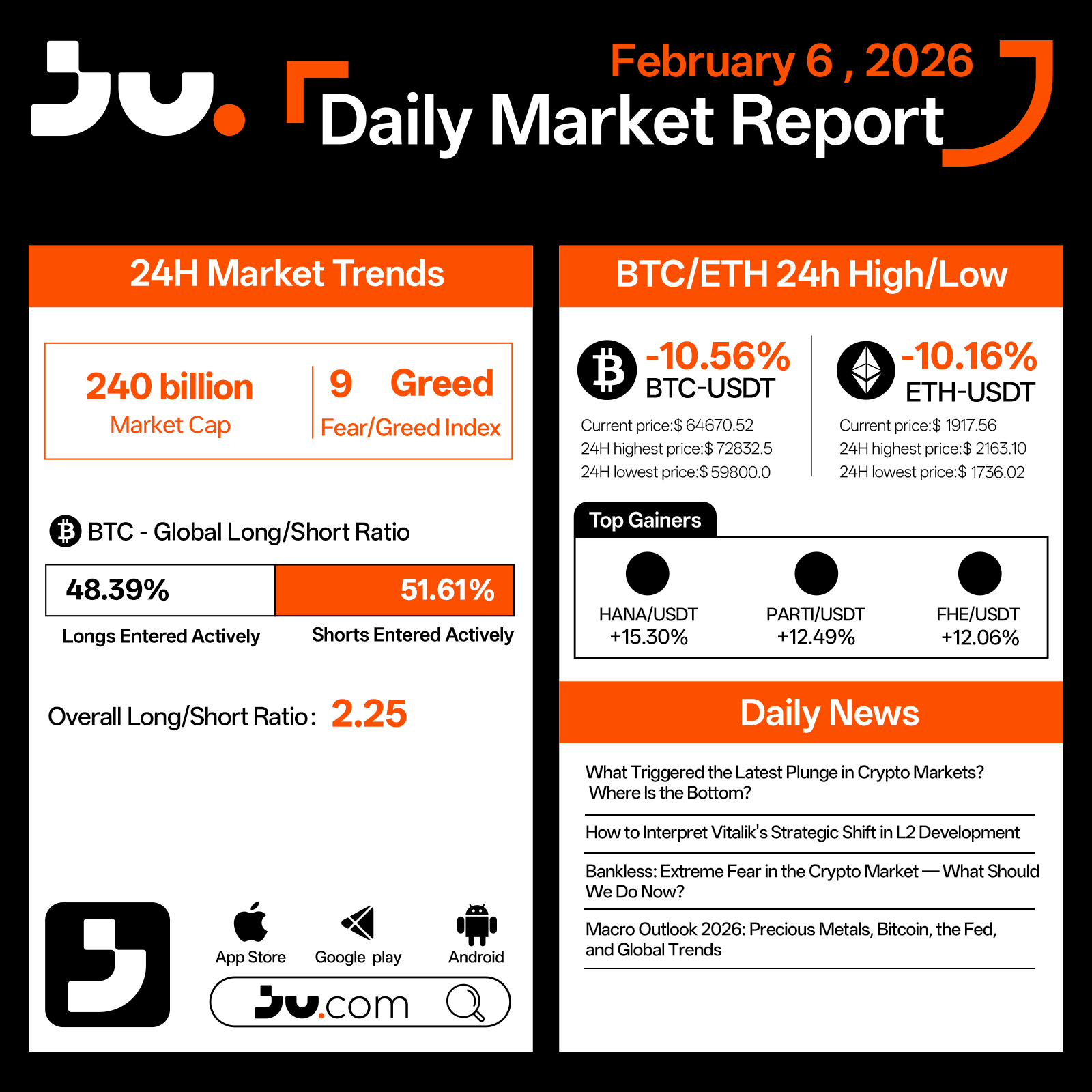

On February 6, the crypto market experienced its sharpest acceleration lower in the current downturn. Total market capitalization fell to $240 billion, while the Fear & Greed Index plunged to 9, firmly entering extreme fear territory. Sentiment and liquidity collapsed simultaneously, pushing the market into a forced, non-linear liquidation phase.

Bitcoin dropped 10.56% to $64,670.52, with an exceptionally wide intraday range from $72,832.50 down to $59,800.00, a clear sign that liquidations and forced selling dominated price action. Ethereum followed closely, falling 10.16% to $1,917.56, after briefly touching $1,736.02. High leverage and Ethereum’s higher beta amplified downside volatility. Positioning remains defensive, with BTC longs at just 48.39% and the aggregate long–short ratio easing to 2.25, suggesting some leverage has been flushed out, though risk aversion persists.

Against this systemic sell-off, a handful of small-cap tokens such as HANA, PARTI, and FHE posted double-digit gains. These moves appeared opportunistic and liquidity-driven, rather than signaling any meaningful recovery in market risk appetite.

Narratively, attention has shifted toward identifying the true trigger of the plunge. While panic selling is the visible catalyst, the underlying drivers remain tightening liquidity, sustained ETF outflows, and mounting macro uncertainty. Discussions around Vitalik’s strategic adjustments to Layer 2 development are increasingly framed as long-term structural shifts, not near-term bullish catalysts.

Notably, voices like Bankless are steering the conversation away from “buying the bottom” toward survival and risk management, emphasizing capital preservation over directional conviction during periods of extreme fear. At the macro level, the ongoing repricing between precious metals, Bitcoin, and Federal Reserve policy expectations continues to pressure risk assets.

In summary, February 6 marks a phase defined by extreme fear and forced deleveraging. Whether the market is approaching a local bottom will depend less on isolated news and more on whether fear is fully exhausted and liquidity conditions stabilize. Until then, violent volatility is likely to remain the market’s dominant feature.

#JU #Jucom #cryptocurrency #blockchain

Dear Ju.com Users,

The Ju.com team has initiated the Phase 1, Third Batch JU Market Repurchase and Destruction Plan. We will continue to uphold the principles of "Openness, Fairness, and Sustainability," steadfastly execute the long-term repurchase mechanism, and further strengthen the deflationary logic and ecosystem value support for JU.

Phase 1, Third Batch Repurchase and Destruction Plan Execution Method: The team repurchases JU in batches from the open market and destroys JU by sending it to the JuChain burn address; Execution Action: The third batch of 1,000,000 JU has been completed. Destruction details are as follows: Time: 2025/12/3 15:10 (UTC+8) Burn Address: 0x000000000000000000000000000000000000dEaD On-chain Hash: https://explorer.juscan.io/tx/0x4e5774c34faf49f52966ac35da2d2a7ca51b096c34f2c15d4bb6ca0104e92c00

JU Ecosystem Consensus and Long-term Development The repurchase and destruction plan aims to return value to users and the community, ensuring JU continuously gains real use cases and liquidity support. We believe that under the dual influence of market cycles and consensus co-building, the long-term value of JU will be consistently verified.

Ju.com will continue to fulfill commitments through actions and earn trust through transparency. Thank you to every partner who stands firmly with us!

Ju.com Team December 3, 2025

#Jucom #JU