TVL Alienation: Web3's Hidden Crisis Exposed

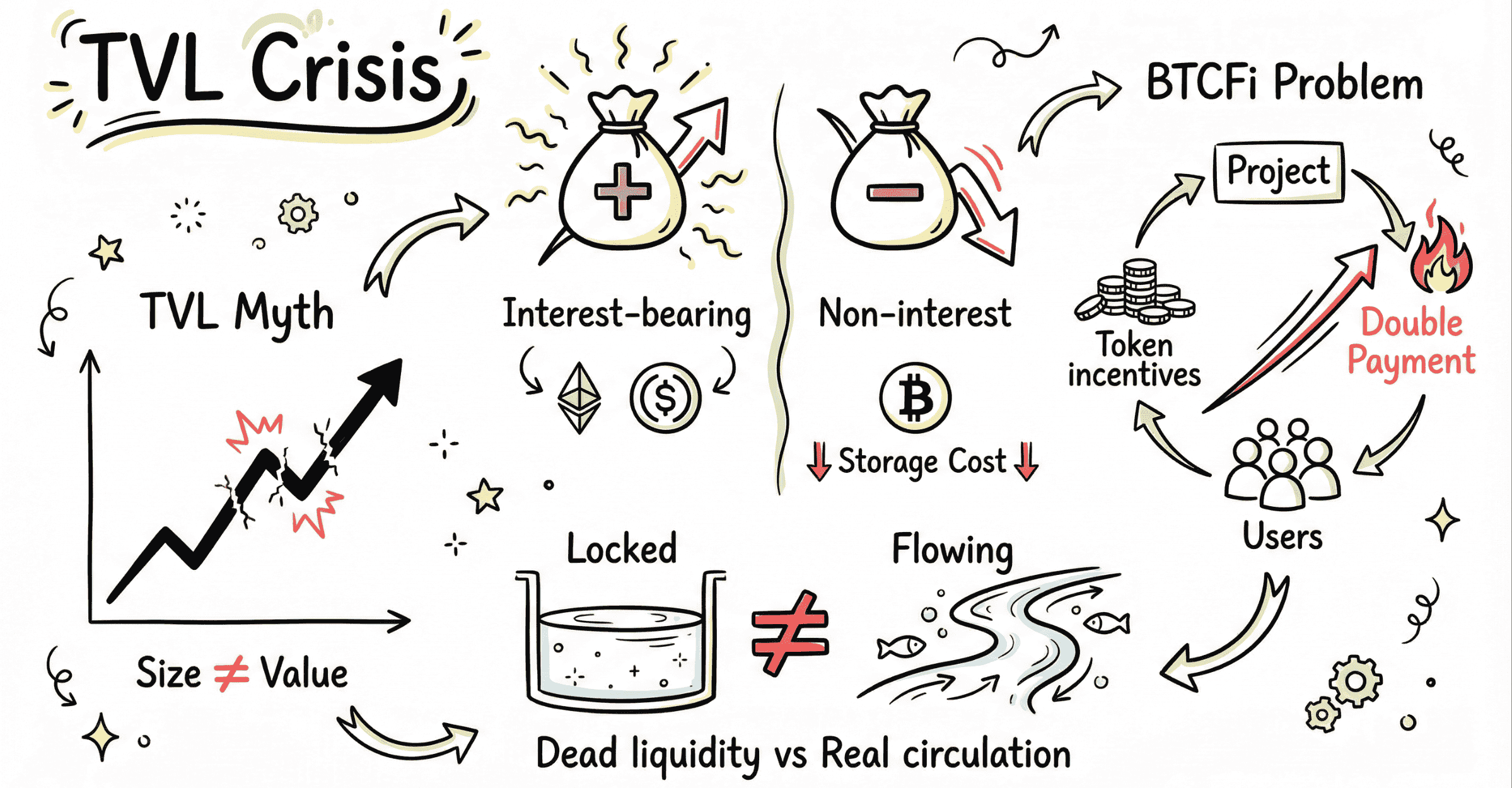

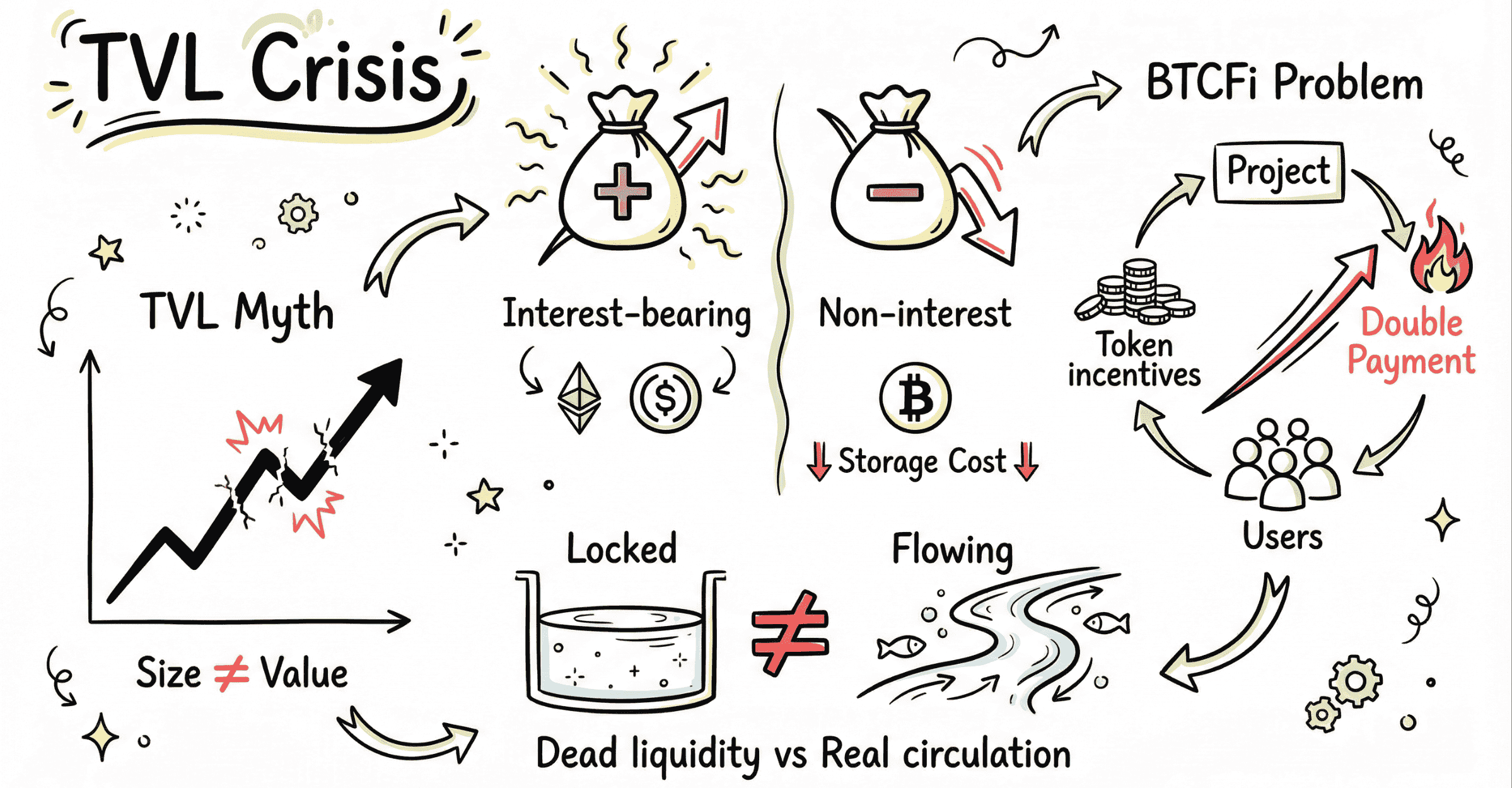

The crypto market's obsession with Total Value Locked (TVL) has transformed from a healthy ecosystem metric into a destructive force driving internal competition. Ju.com's latest research reveals how this "vanity metric" is crushing innovation and pushing projects into unsustainable debt cycles.

💰 The Core Problem:

TVL has evolved from a simple activity indicator into a heavy financial burden for project teams. "Dead assets" locked without internal circulation fail to generate real value, while borrowing costs to meet exchange listing requirements are creating a vicious cycle of data manipulation and opaque fee structures.

🚨 Three Critical Issues Uncovered:

Asset Mismatch & Negative Yield Trap: The 2025 BTCFi sector collapse proved that forcibly converting non-yielding assets like BTC into TVL metrics is fundamentally flawed. Projects with over $5 billion in TVL still failed because they couldn't generate intrinsic value, instead burning capital through unsustainable token incentives. The difference between yield-bearing assets like staked ETH and negative-yield assets like BTC has been deliberately ignored, creating hollow liquidity that looks impressive on dashboards but provides zero ecosystem value.

Exchange Listing's Hidden Taxes: To meet CEX listing requirements, projects are forced to "purchase" TVL through hired capital at predatory rates of 20%+ annual returns versus normal DeFi rates of 5-15%. Combined with listing fees, market-maker deposits, and data service costs, projects enter TGE already deep in debt. This forces them to become market extractors rather than builders, with token prices peaking at launch and rapidly declining as teams desperately sell to recover costs.

Traffic Illusions & Primary-Secondary Inversion: Platform token holders are overwhelmingly yield farmers who dump immediately after airdrops, providing zero long-term liquidity support. Meanwhile, OTC whales acquire positions at 50%+ discounts before listings, creating severe misalignment. In January 2026 alone, major unlocks totaling $314 million for Hyperliquid and Sui exerted crushing pressure on markets, normalizing a system where "bad money drives out good."

🔄 The TVL 2.0 Solution:

The industry must pivot from "scale-first" to "profit-first" thinking. Ethena's October 2025 collapse from $14.8B to $7.4B TVL in weeks proved that leverage without intrinsic value generation is poison. Next-generation protocols must demonstrate real yield capacity through trading fees, lending spreads, and node rewards rather than token subsidies.

💡 Key Takeaway:

Only when capital circulates through ecosystems like blood through veins—rather than sitting idle mining yields—can crypto escape the current zero-sum liquidity trap. Projects must abandon vanity metrics and focus on sustainable business models with genuine user retention.

The path forward requires rebuilding trust through market-based interest rates and closed-loop systems where TVL actually generates value instead of consuming it.

Read the complete analysis with detailed case studies and data: 👇 https://blog.ju.com/tvl-alienation-web3-competition/?utm_source=blog #TVL #DeFi #Web3 #Crypto #Blockchain

JU Blog

2026-01-16 05:31

TVL Alienation: Web3's Hidden Crisis Exposed

Sorumluluk Reddi:Üçüncü taraf içeriği içerir. Finansal tavsiye değildir.

Hüküm ve Koşullar'a bakın.

The crypto market's obsession with Total Value Locked (TVL) has transformed from a healthy ecosystem metric into a destructive force driving internal competition. Ju.com's latest research reveals how this "vanity metric" is crushing innovation and pushing projects into unsustainable debt cycles.

💰 The Core Problem:

TVL has evolved from a simple activity indicator into a heavy financial burden for project teams. "Dead assets" locked without internal circulation fail to generate real value, while borrowing costs to meet exchange listing requirements are creating a vicious cycle of data manipulation and opaque fee structures.

🚨 Three Critical Issues Uncovered:

Asset Mismatch & Negative Yield Trap: The 2025 BTCFi sector collapse proved that forcibly converting non-yielding assets like BTC into TVL metrics is fundamentally flawed. Projects with over $5 billion in TVL still failed because they couldn't generate intrinsic value, instead burning capital through unsustainable token incentives. The difference between yield-bearing assets like staked ETH and negative-yield assets like BTC has been deliberately ignored, creating hollow liquidity that looks impressive on dashboards but provides zero ecosystem value.

Exchange Listing's Hidden Taxes: To meet CEX listing requirements, projects are forced to "purchase" TVL through hired capital at predatory rates of 20%+ annual returns versus normal DeFi rates of 5-15%. Combined with listing fees, market-maker deposits, and data service costs, projects enter TGE already deep in debt. This forces them to become market extractors rather than builders, with token prices peaking at launch and rapidly declining as teams desperately sell to recover costs.

Traffic Illusions & Primary-Secondary Inversion: Platform token holders are overwhelmingly yield farmers who dump immediately after airdrops, providing zero long-term liquidity support. Meanwhile, OTC whales acquire positions at 50%+ discounts before listings, creating severe misalignment. In January 2026 alone, major unlocks totaling $314 million for Hyperliquid and Sui exerted crushing pressure on markets, normalizing a system where "bad money drives out good."

🔄 The TVL 2.0 Solution:

The industry must pivot from "scale-first" to "profit-first" thinking. Ethena's October 2025 collapse from $14.8B to $7.4B TVL in weeks proved that leverage without intrinsic value generation is poison. Next-generation protocols must demonstrate real yield capacity through trading fees, lending spreads, and node rewards rather than token subsidies.

💡 Key Takeaway:

Only when capital circulates through ecosystems like blood through veins—rather than sitting idle mining yields—can crypto escape the current zero-sum liquidity trap. Projects must abandon vanity metrics and focus on sustainable business models with genuine user retention.

The path forward requires rebuilding trust through market-based interest rates and closed-loop systems where TVL actually generates value instead of consuming it.

Read the complete analysis with detailed case studies and data: 👇 https://blog.ju.com/tvl-alienation-web3-competition/?utm_source=blog #TVL #DeFi #Web3 #Crypto #Blockchain