Testing the Lower Range as Fear Persists - Daily Market Report | February 11, 2026

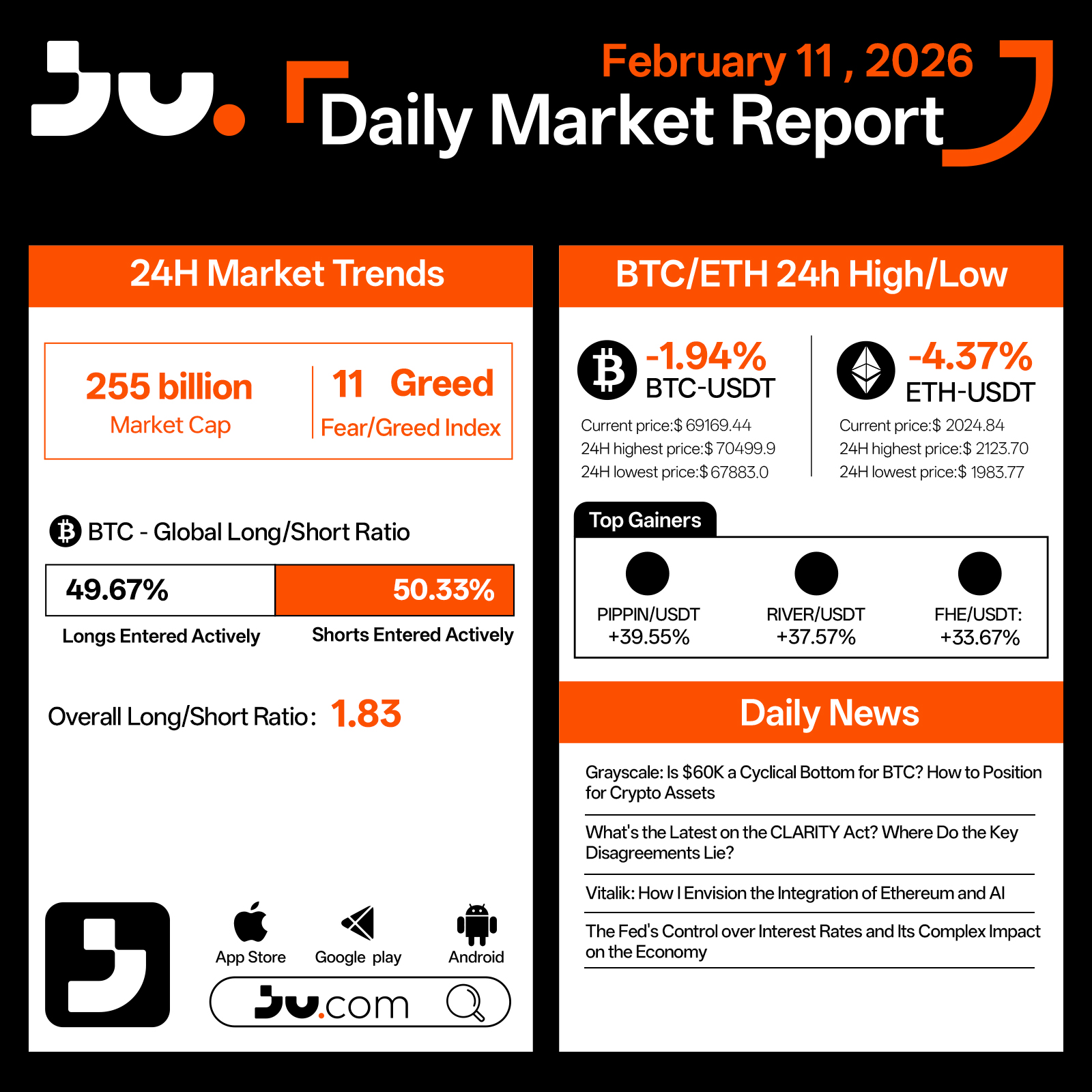

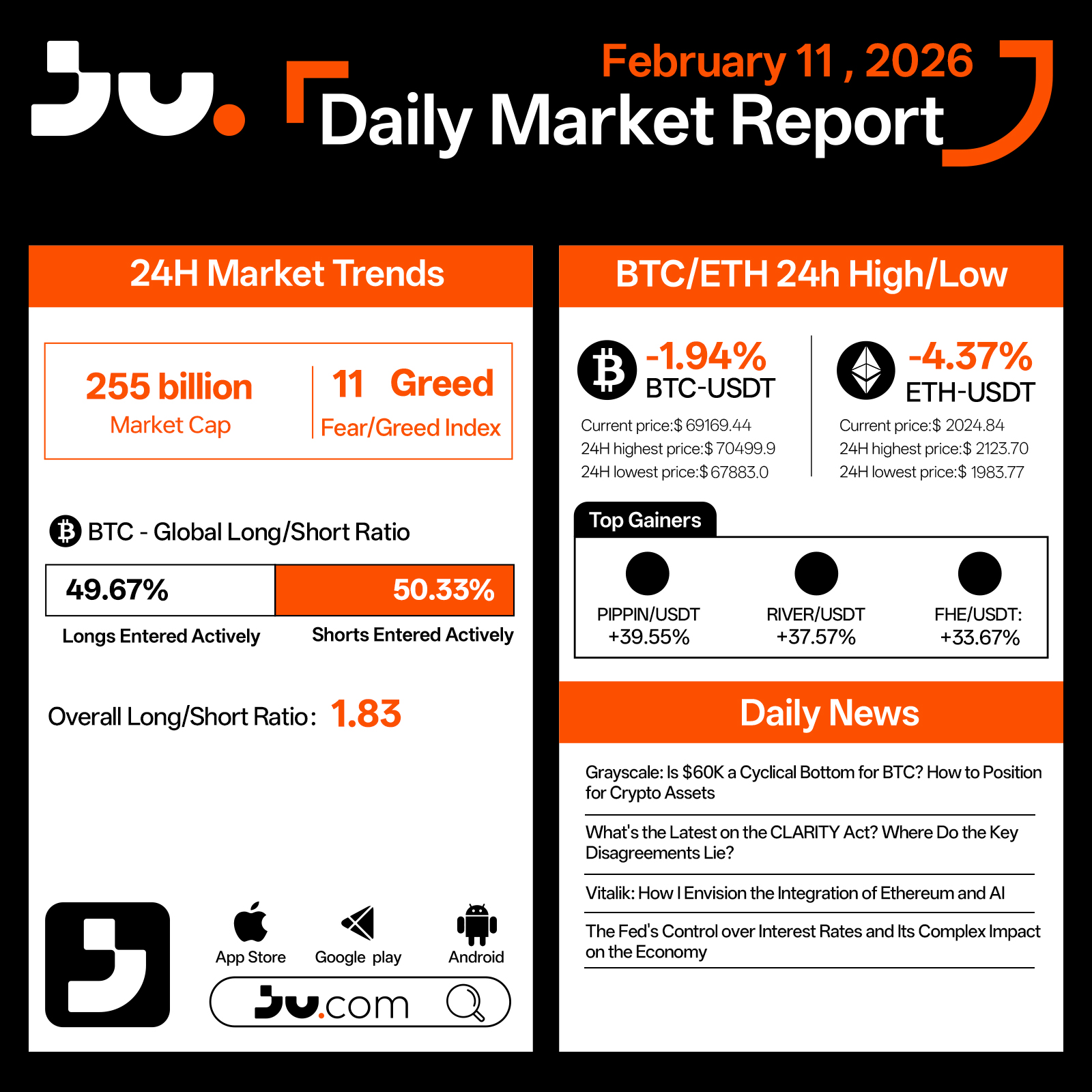

On February 11, the crypto market extended its pullback, with total market capitalization declining to $255 billion. The Fear & Greed Index ticked slightly higher to 11, yet remains firmly within extreme fear territory. Sentiment continues to be fragile, and risk appetite remains constrained.

Bitcoin fell 1.94% to $69,169.44, trading between $67,883.0 and $70,499.9 during the session. Long positions account for 49.67%, while shorts stand at 50.33%, with the aggregate long–short ratio rising to 1.83. This suggests selective positioning for a bounce at lower levels, though the broader structure still leans defensive. With BTC slipping below the $70,000 threshold, debate around whether $60,000 could represent a cyclical bottom has intensified.

Ethereum experienced sharper pressure, dropping 4.37% to $2,024.84, after briefly touching $1,983.77 intraday. Compared with Bitcoin, ETH displayed greater downside sensitivity, reflecting the market’s tendency to reduce exposure to higher-beta assets during risk contraction phases.

Among outperformers, PIPPIN, RIVER, and FHE posted notable gains, largely driven by short-term tactical positioning rather than a broad improvement in sentiment.

Narrative focus shifted toward structural and macro themes. Grayscale raised the question of whether $60,000 may serve as a cyclical base for Bitcoin, prompting renewed discussions on strategic positioning. Progress and disagreements surrounding the CLARITY Act remain a key regulatory variable in the United States. Meanwhile, Vitalik Buterin’s vision for Ethereum’s integration with AI highlights longer-term innovation pathways beyond current volatility. The Federal Reserve’s influence over interest rates continues to shape broader economic expectations, leaving markets attentive to future liquidity signals.

Overall, February 11 reflects a phase of continued fear with moderating selling intensity. While a decisive reversal has yet to emerge, downside momentum appears to be narrowing. In the absence of clearer macro or regulatory catalysts, markets are likely to remain range-bound near recent lows as participants search for a more durable base.

#cryptocurrency #blockchain #technical analysis #JU #Jucom

JU Blog

2026-02-11 04:22

Testing the Lower Range as Fear Persists - Daily Market Report | February 11, 2026

Penafian:Mengandungi kandungan pihak ketiga. Bukan nasihat kewangan.

Sila lihat Terma dan Syarat.

On February 11, the crypto market extended its pullback, with total market capitalization declining to $255 billion. The Fear & Greed Index ticked slightly higher to 11, yet remains firmly within extreme fear territory. Sentiment continues to be fragile, and risk appetite remains constrained.

Bitcoin fell 1.94% to $69,169.44, trading between $67,883.0 and $70,499.9 during the session. Long positions account for 49.67%, while shorts stand at 50.33%, with the aggregate long–short ratio rising to 1.83. This suggests selective positioning for a bounce at lower levels, though the broader structure still leans defensive. With BTC slipping below the $70,000 threshold, debate around whether $60,000 could represent a cyclical bottom has intensified.

Ethereum experienced sharper pressure, dropping 4.37% to $2,024.84, after briefly touching $1,983.77 intraday. Compared with Bitcoin, ETH displayed greater downside sensitivity, reflecting the market’s tendency to reduce exposure to higher-beta assets during risk contraction phases.

Among outperformers, PIPPIN, RIVER, and FHE posted notable gains, largely driven by short-term tactical positioning rather than a broad improvement in sentiment.

Narrative focus shifted toward structural and macro themes. Grayscale raised the question of whether $60,000 may serve as a cyclical base for Bitcoin, prompting renewed discussions on strategic positioning. Progress and disagreements surrounding the CLARITY Act remain a key regulatory variable in the United States. Meanwhile, Vitalik Buterin’s vision for Ethereum’s integration with AI highlights longer-term innovation pathways beyond current volatility. The Federal Reserve’s influence over interest rates continues to shape broader economic expectations, leaving markets attentive to future liquidity signals.

Overall, February 11 reflects a phase of continued fear with moderating selling intensity. While a decisive reversal has yet to emerge, downside momentum appears to be narrowing. In the absence of clearer macro or regulatory catalysts, markets are likely to remain range-bound near recent lows as participants search for a more durable base.

#cryptocurrency #blockchain #technical analysis #JU #Jucom

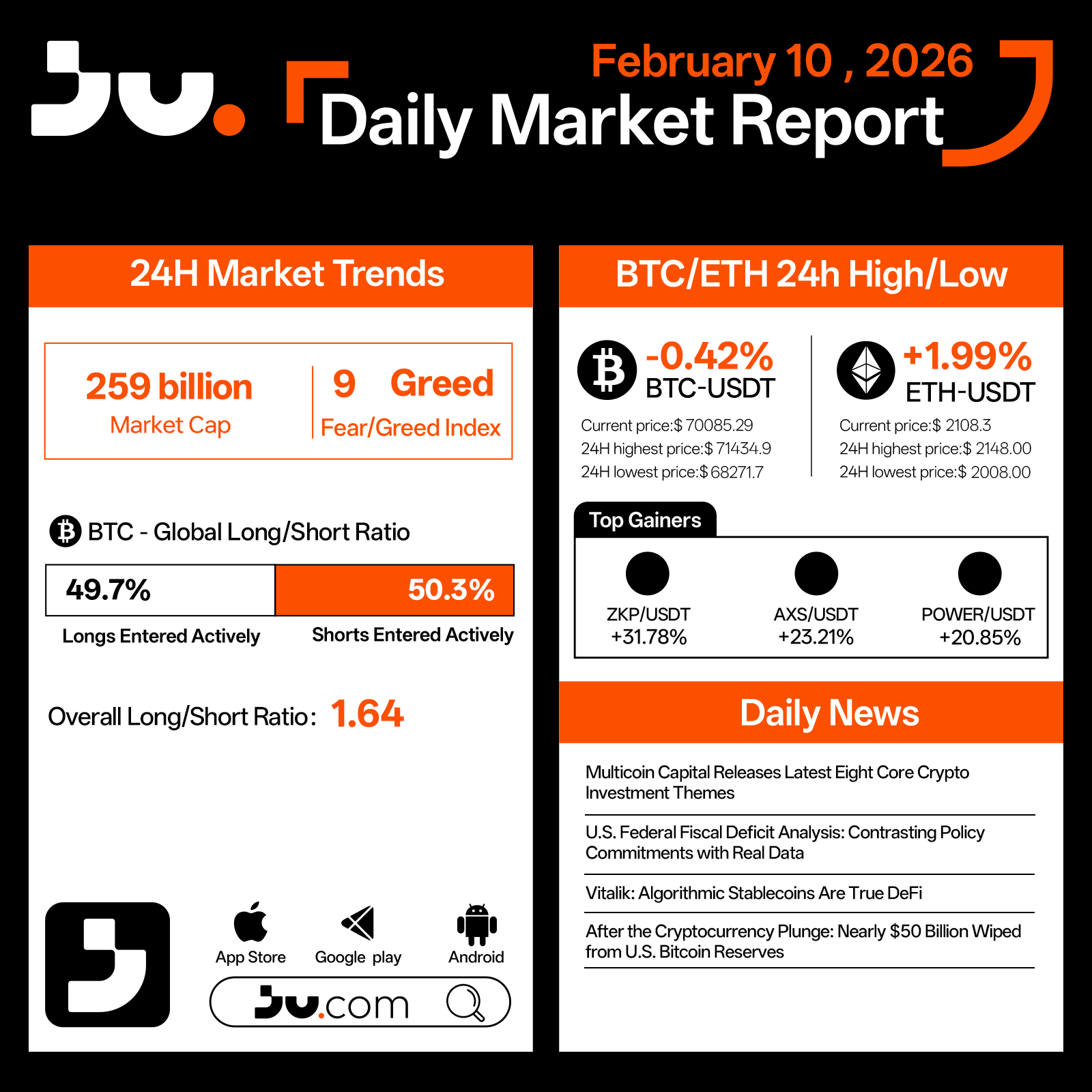

On February 10, the crypto market continued to trade within extreme fear territory, with total market capitalization holding at $259 billion and the Fear & Greed Index slipping further to 9. While sentiment remains deeply risk-averse, the pace of downside acceleration has clearly slowed compared with last week’s sell-off.

Bitcoin edged down 0.42% to $70,085.29, fluctuating between $68,271.7 and $71,434.9 throughout the session. Positioning data shows longs at 49.7% versus shorts at 50.3%, with the aggregate long–short ratio falling to 1.64. This reflects continued deleveraging and shrinking speculative exposure, suggesting the market is transitioning from a high-volatility liquidation phase to a low-leverage consolidation period.

Ethereum showed relative resilience, gaining 1.99% to $2,108.30 after briefly dipping to $2,008 before rebounding. This divergence indicates selective dip-buying in core assets even as overall risk appetite remains constrained.

Among smaller-cap tokens, ZKP, AXS, and POWER led gains, driven largely by short-term positioning and tactical rebounds rather than a broad-based improvement in sentiment. Market dynamics remain characterized by selective recovery rather than a full risk-on rotation.

Narrative focus continues to shift away from price action toward structural and long-term considerations. Variant’s reflections on insider trading in prediction markets highlight governance and transparency challenges in decentralized platforms. a16z reiterated its long-term philosophy for crypto, emphasizing that cyclical drawdowns do not negate the structural trajectory of the industry. At the same time, Goldman Sachs’ evolving crypto strategy and renewed discussion around the strategic role of gold underscore how digital assets and traditional safe havens are increasingly evaluated within the same macro allocation framework.

Overall, February 10 reflects a phase of late-stage fear and tentative stabilization. While selling pressure has eased, confidence remains fragile. Without clearer signals from liquidity conditions, macro policy, or regulation, the market is likely to remain range-bound near the lows as it searches for a durable base.

#JU #Jucom #cryptocurrency #blockchain #technical analysis

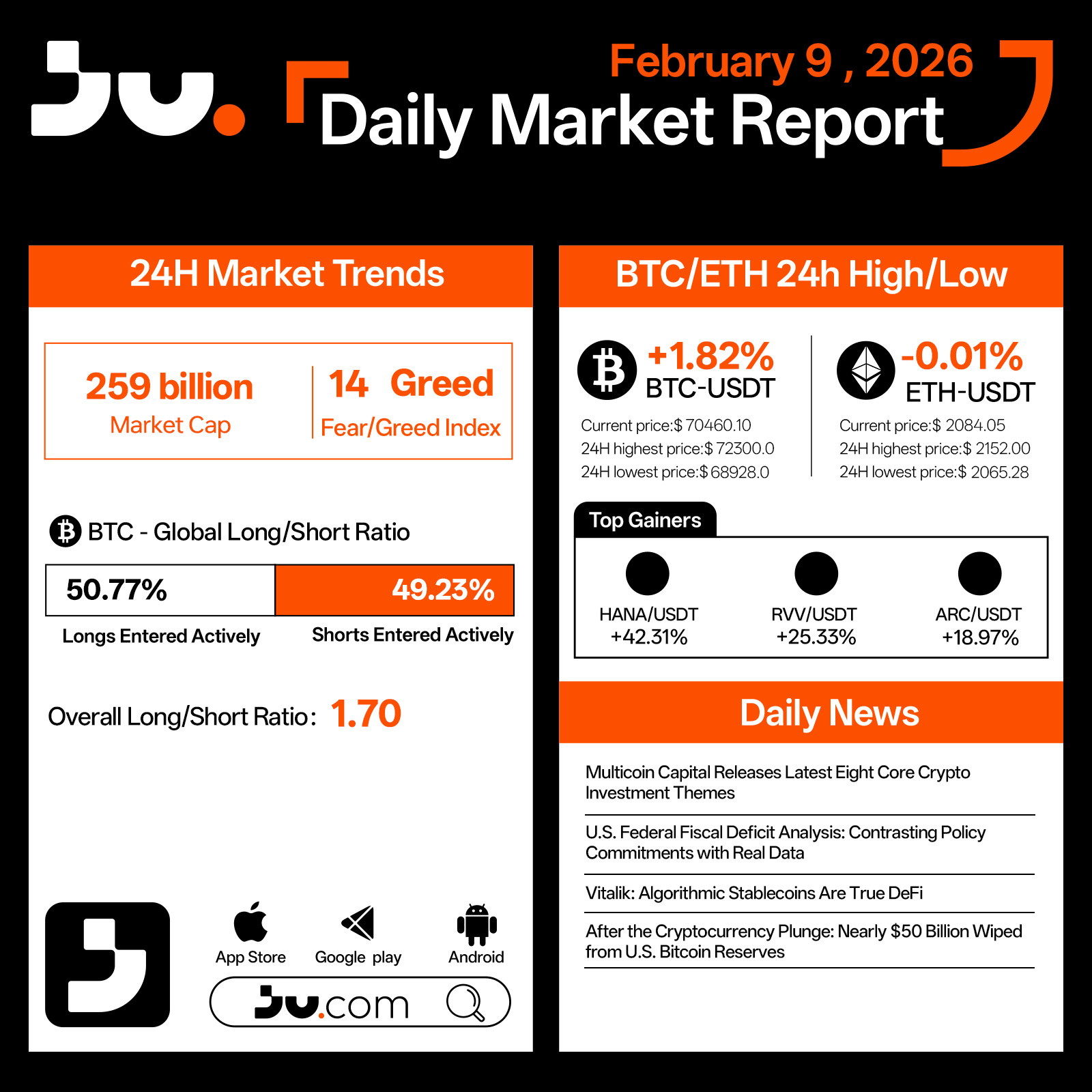

On February 9, the crypto market staged a modest rebound following the recent wave of extreme panic. Total market capitalization recovered to $259 billion, while the Fear & Greed Index remained depressed at 14, indicating that sentiment is still cautious even as selling pressure begins to ease.

Bitcoin rose 1.82% to $70,460.10, trading within a $68,928–$72,300 range. After last week’s aggressive deleveraging, downside momentum has clearly slowed. Positioning data shows BTC long exposure edging up to 50.77%, but with the aggregate long–short ratio at just 1.70, the move appears driven primarily by short covering and tentative dip-buying rather than conviction-based inflows. Ethereum lagged the rebound, finishing nearly flat at $2,084.05, underscoring continued weakness in higher-beta assets while risk appetite remains fragile.

Among smaller-cap tokens, names such as PIPPIN, RVV, and ARCU posted outsized gains, reflecting opportunistic trading in a liquidity recovery phase rather than a broad-based improvement in market sentiment.

From a narrative perspective, attention is shifting from post-crash blame to structural reflection. Multicoin Capital’s release of eight core crypto investment themes offers a refreshed framework for long-term positioning, while renewed scrutiny of the U.S. federal fiscal deficit highlights the growing gap between policy commitments and fiscal reality. Vitalik’s assertion that algorithmic stablecoins represent “true DeFi” has also resurfaced, prompting deeper discussion about the fundamental direction of decentralized finance.

Notably, following the recent sell-off, nearly $5 billion was wiped from U.S. Bitcoin reserves, reinforcing the idea that crypto assets are now intertwined with macro balance sheets rather than isolated from them.

Overall, February 9 appears to mark a technical rebound after extreme fear, not a confirmed trend reversal. While prices have stabilized, true recovery will depend on further deleveraging, improving liquidity conditions, and clearer macro signals. Until then, the market is likely to remain range-bound and fragile as it searches for a new equilibrium.

#cryptocurrency #blockchain #technical analysis #JU #Jucom