Get free 2 usdt

🤑 🚀Every day 2$ FREE FREE🔥💰 🔥💰💰🔥Free VIP2 👇 ❗️Invite only 2 members to VIP 2 and get vip2,buy VIP 2 and Invite 3 A-level VIP2s and get VIP 3 💰55 🔋LONG TERM & TRUSTED ✨start today 11-09-2025 Withdrawal proof in My channel and link also

➜ 𝗠𝗶𝗻𝗶𝗺𝘂𝗺 𝗥𝗲𝗰𝗵𝗮𝗿𝗴𝗲= $16 ➜ 𝗠𝗶𝗻𝗶𝗺𝘂𝗺 𝗪𝗶𝘁𝗵𝗱𝗿𝗮𝘄𝗮𝗹= $12 (Daily) 🛑 ➜ 𝗕𝗼𝗻𝘂𝘀 𝗥𝗲𝗰𝗵𝗮𝗿𝗴𝗲 𝗧𝗲𝗮𝗺 💯 જ⁀➴ 𝗟.𝗔 = 11% 💯 જ⁀➴ 𝗟.𝗕 = 2% 💯 જ⁀➴ 𝗟.𝗕 = 1% ✅𝗩𝗜𝗣1 - Deposit 00$ = Daily 2$ ✅𝗩𝗜𝗣2 - Deposit 16$ = Daily 12$ ✅𝗩𝗜𝗣3 - Deposit 66$ = Daily 55$ #cryptocurrency #blockchain #Cryptocurrency #technical analysis ✔️.TELEGRAM CHANNEL @MAKEMONEYINZEROINVESTMENT$BTC/USDT $ETH/USDT $JU/USDT

JCUSER-ORoZXVG5

2025-09-12 15:28

Get free 2 usdt

免責事項:第三者のコンテンツを含みます。これは財務アドバイスではありません。

詳細は利用規約をご覧ください。

🤑 🚀Every day 2$ FREE FREE🔥💰 🔥💰💰🔥Free VIP2 👇 ❗️Invite only 2 members to VIP 2 and get vip2,buy VIP 2 and Invite 3 A-level VIP2s and get VIP 3 💰55 🔋LONG TERM & TRUSTED ✨start today 11-09-2025 Withdrawal proof in My channel and link also

➜ 𝗠𝗶𝗻𝗶𝗺𝘂𝗺 𝗥𝗲𝗰𝗵𝗮𝗿𝗴𝗲= $16 ➜ 𝗠𝗶𝗻𝗶𝗺𝘂𝗺 𝗪𝗶𝘁𝗵𝗱𝗿𝗮𝘄𝗮𝗹= $12 (Daily) 🛑 ➜ 𝗕𝗼𝗻𝘂𝘀 𝗥𝗲𝗰𝗵𝗮𝗿𝗴𝗲 𝗧𝗲𝗮𝗺 💯 જ⁀➴ 𝗟.𝗔 = 11% 💯 જ⁀➴ 𝗟.𝗕 = 2% 💯 જ⁀➴ 𝗟.𝗕 = 1% ✅𝗩𝗜𝗣1 - Deposit 00$ = Daily 2$ ✅𝗩𝗜𝗣2 - Deposit 16$ = Daily 12$ ✅𝗩𝗜𝗣3 - Deposit 66$ = Daily 55$ #cryptocurrency #blockchain #Cryptocurrency #technical analysis ✔️.TELEGRAM CHANNEL @MAKEMONEYINZEROINVESTMENT$BTC/USDT $ETH/USDT $JU/USDT

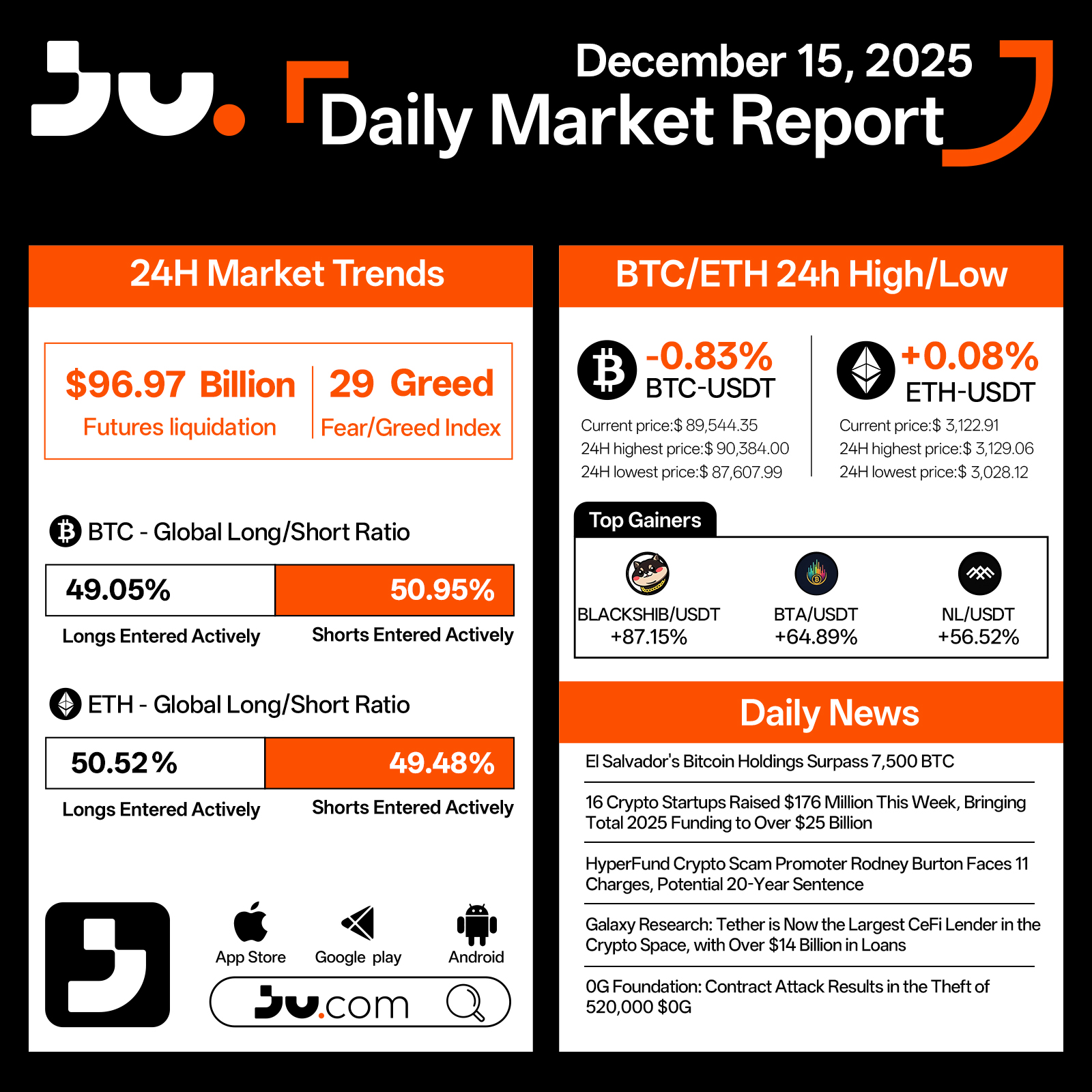

Crypto markets traded sideways on December 15 with a mild defensive tone. Twenty-four hour liquidations totaled $96.97 billion, and the Fear & Greed Index printed 29. Bitcoin(BTC) fell 0.83% to $89,544.35, moving within a $90,384.00–$87,607.99 range, while Ethereum(ETH) edged 0.08% higher to $3,122.91 after fluctuating between $3,129.06 and $3,028.12. Positioning remained balanced but slightly bearish for BTC at 49.05% longs vs. 50.95% shorts, whereas ETH leaned modestly bullish at 50.52% longs vs. 49.48% shorts. High-beta names outperformed, with BLACKSHIB/USDT +87.15%, BTA/USDT +64.89%, and NL/USDT +56.52%, pointing to a rebound in short-term speculation.

News flow was neutral to supportive. El Salvador’s sovereign Bitcoin stash surpassed 7,500 BTC, extending its accumulation trend. Sixteen crypto startups raised $176 million this week, pushing total 2025 funding above $25 billion, a sign of resilient primary-market activity. In enforcement, alleged “HyperFund” promoter Rodney Burton faces 11 charges with potential sentencing of up to 20 years. Galaxy Research reported that Tether is now the largest CeFi lender in crypto with more than $14 billion in outstanding loans. Meanwhile, OG Foundation suffered a contract exploit resulting in the theft of roughly 520,000 $OG. With no major macro shocks and steady institutional signals, sentiment remains cautiously constructive; the next directional cue hinges on BTC reclaiming and holding above the $90K handle and ETH pressing through the $3,150–$3,200 band.

#cryptocurrency #blockchain #technical analysis #Cryptocurrency #finance