What role do oracles play in linking blockchains to real-world data?

Understanding the Role of Oracles in Blockchain Technology

In the rapidly evolving world of blockchain, oracles serve as a vital link between decentralized networks and real-world data. While blockchains excel at maintaining secure, transparent ledgers, they inherently lack direct access to external information. This gap is where oracles come into play, enabling smart contracts—self-executing agreements with coded rules—to interact with data outside their native environment. Whether it's fetching current asset prices for decentralized finance (DeFi) applications or verifying real-world events for insurance claims, oracles are fundamental to expanding blockchain utility beyond digital assets.

What Are Oracles and How Do They Work?

Oracles are third-party services that provide external data to blockchain networks in a trustworthy manner. They act as bridges that transmit information from outside sources—such as APIs, IoT devices, human inputs, or databases—to smart contracts on the blockchain. For example, a weather oracle might supply rainfall data needed for crop insurance contracts; a price oracle could deliver live cryptocurrency valuations used in trading platforms.

The process typically involves an oracle querying an external source via mechanisms like API calls or webhooks. Once the data is retrieved and verified—either through multiple independent nodes in decentralized systems or trusted sources—it is then fed into the smart contract to trigger specific actions based on predefined conditions.

Why Are Oracles Essential for Blockchain Applications?

Blockchains operate within isolated environments called "trustless" systems—they do not inherently trust any external entity unless explicitly programmed to do so through mechanisms like oracles. Without them, smart contracts would be limited solely to internal logic and self-contained transactions.

This limitation restricts many practical use cases such as:

- Decentralized Finance (DeFi): Accurate asset prices are crucial for lending protocols and derivatives.

- NFT Marketplaces: Verifying ownership transfers based on real-world events.

- Insurance: Validating claims using external event data like weather patterns.

- Supply Chain Management: Tracking goods through IoT sensors providing location updates.

By integrating reliable external data sources via oracles, these applications can operate dynamically and respond accurately to real-world conditions.

Types of Oracles: Reliable vs Unreliable

Not all oracles offer equal levels of trustworthiness; understanding their types helps assess risks involved:

Reliable Oracles: These prioritize accuracy by sourcing data from reputable providers and often employ multiple nodes to cross-verify information before delivery.

Unreliable Oracles: These may rely on single sources without validation processes; thus they pose higher risks of delivering false or outdated information which can compromise contract execution.

Hybrid Oracles: Combining elements from both categories, hybrid models aim to balance reliability with flexibility by integrating multiple verification methods.

Choosing the right type depends heavily on application requirements—especially when dealing with high-stakes financial transactions where security breaches could lead to significant losses.

Mechanisms Used by Oracles

Oracular technology employs various methods for delivering accurate data:

- API Calls: Directly querying trusted APIs from service providers such as financial markets feeds.

- Webhooks: Listening for notifications from external services when new relevant events occur.

- Human Inputs: Incorporating expert judgment when automated sources are unavailable—or necessary—for validation purposes.

- Data Aggregation & Consensus Protocols: Especially in decentralized oracle networks (DONs), multiple nodes gather independent reports which are then aggregated using consensus algorithms like majority voting — reducing reliance on any single source's integrity.

These mechanisms help ensure that only validated information influences smart contract outcomes while minimizing potential attack vectors such as false reporting.

Security Challenges Facing Oracle Systems

Despite their importance,oracle systems face notable security concerns that must be addressed proactively:

Data Manipulation Attacks: Malicious actors may attempt to feed false information into an oracle system if it lacks proper safeguards.

Single Point of Failure: Centralized oracle solutions risk becoming targets because reliance on one node increases vulnerability—a problem mitigated by decentralization efforts like Chainlink’s multi-node architecture.

Denial-of-Service (DoS) Attacks: Attackers could disrupt service availability by overwhelming servers hosting critical data feeds leading to delays or failures in executing smart contracts correctly.

To mitigate these risks effectively requires implementing robust cryptographic techniques, decentralizing node infrastructure across diverse geographic locations—and continuously auditing system integrity against emerging threats.

Recent Innovations in Oracle Technology

The landscape has seen significant advancements aimed at enhancing security and interoperability:

Decentralized Oracle Networks (DONs)

Projects like Chainlink have pioneered decentralized architectures where multiple independent nodes source and verify data before feeding it into blockchains—a move toward reducing reliance on centralized points of failure while increasing trustworthiness through consensus mechanisms.

Cross-chain Compatibility

Emerging solutions focus not only on securing individual chains but also facilitating interoperability among different blockchain platforms—for example , projects developing cross-chain bridges enable seamless transfer of verified off-chain info across diverse ecosystems without compromising security standards.

Blockchain-Agnostic Solutions

Some newer oracle frameworks aim at platform neutrality—they work across various blockchains regardless of underlying architecture—thus broadening applicability especially within multi-chain environments prevalent today.

Risks Associated With Using Oracles

While offering immense benefits ,oracular solutions introduce certain vulnerabilities:

- If compromised ,a single malicious node can corrupt entire datasets leading potentially catastrophic outcomes — especially relevant during high-value DeFi operations where incorrect price feeds might cause liquidations unfairly .2 . Regulatory uncertainties around how externally sourced sensitive personal/financial info should be handled raise compliance questions .3 . Dependence upon third-party providers introduces operational dependencies that require rigorous due diligence .

Understanding these risks underscores why selecting reputable oracle providers with proven track records remains critical.

The Future Trajectory of Oracle Technology

Looking ahead,the evolution will likely focus heavily on enhancing decentralization further,making systems more resilient against attacks while improving transparency.Innovation areas include advanced cryptographic proofs such as zero knowledge proofs—which allow verification without revealing underlying sensitive info—and increased automation via AI-driven validation processes.These developments promise more secure,reliable,and scalable integrations between blockchains and real-world datasets .

As regulatory frameworks mature globally,the industry will also need standardized compliance protocols ensuring privacy standards meet legal requirements without hindering innovation—all contributing toward broader adoption across sectors ranging from finance,to supply chain management,and beyond.

By bridging the gap between digital ledgers and physical reality,data-oracle integration remains central not just for current applications but also future innovations within blockchain ecosystems.As technology advances,taking steps toward more secure,decentralized,and trustworthy solutions will be key drivers shaping this dynamic field moving forward

JCUSER-WVMdslBw

2025-05-22 09:45

What role do oracles play in linking blockchains to real-world data?

Understanding the Role of Oracles in Blockchain Technology

In the rapidly evolving world of blockchain, oracles serve as a vital link between decentralized networks and real-world data. While blockchains excel at maintaining secure, transparent ledgers, they inherently lack direct access to external information. This gap is where oracles come into play, enabling smart contracts—self-executing agreements with coded rules—to interact with data outside their native environment. Whether it's fetching current asset prices for decentralized finance (DeFi) applications or verifying real-world events for insurance claims, oracles are fundamental to expanding blockchain utility beyond digital assets.

What Are Oracles and How Do They Work?

Oracles are third-party services that provide external data to blockchain networks in a trustworthy manner. They act as bridges that transmit information from outside sources—such as APIs, IoT devices, human inputs, or databases—to smart contracts on the blockchain. For example, a weather oracle might supply rainfall data needed for crop insurance contracts; a price oracle could deliver live cryptocurrency valuations used in trading platforms.

The process typically involves an oracle querying an external source via mechanisms like API calls or webhooks. Once the data is retrieved and verified—either through multiple independent nodes in decentralized systems or trusted sources—it is then fed into the smart contract to trigger specific actions based on predefined conditions.

Why Are Oracles Essential for Blockchain Applications?

Blockchains operate within isolated environments called "trustless" systems—they do not inherently trust any external entity unless explicitly programmed to do so through mechanisms like oracles. Without them, smart contracts would be limited solely to internal logic and self-contained transactions.

This limitation restricts many practical use cases such as:

- Decentralized Finance (DeFi): Accurate asset prices are crucial for lending protocols and derivatives.

- NFT Marketplaces: Verifying ownership transfers based on real-world events.

- Insurance: Validating claims using external event data like weather patterns.

- Supply Chain Management: Tracking goods through IoT sensors providing location updates.

By integrating reliable external data sources via oracles, these applications can operate dynamically and respond accurately to real-world conditions.

Types of Oracles: Reliable vs Unreliable

Not all oracles offer equal levels of trustworthiness; understanding their types helps assess risks involved:

Reliable Oracles: These prioritize accuracy by sourcing data from reputable providers and often employ multiple nodes to cross-verify information before delivery.

Unreliable Oracles: These may rely on single sources without validation processes; thus they pose higher risks of delivering false or outdated information which can compromise contract execution.

Hybrid Oracles: Combining elements from both categories, hybrid models aim to balance reliability with flexibility by integrating multiple verification methods.

Choosing the right type depends heavily on application requirements—especially when dealing with high-stakes financial transactions where security breaches could lead to significant losses.

Mechanisms Used by Oracles

Oracular technology employs various methods for delivering accurate data:

- API Calls: Directly querying trusted APIs from service providers such as financial markets feeds.

- Webhooks: Listening for notifications from external services when new relevant events occur.

- Human Inputs: Incorporating expert judgment when automated sources are unavailable—or necessary—for validation purposes.

- Data Aggregation & Consensus Protocols: Especially in decentralized oracle networks (DONs), multiple nodes gather independent reports which are then aggregated using consensus algorithms like majority voting — reducing reliance on any single source's integrity.

These mechanisms help ensure that only validated information influences smart contract outcomes while minimizing potential attack vectors such as false reporting.

Security Challenges Facing Oracle Systems

Despite their importance,oracle systems face notable security concerns that must be addressed proactively:

Data Manipulation Attacks: Malicious actors may attempt to feed false information into an oracle system if it lacks proper safeguards.

Single Point of Failure: Centralized oracle solutions risk becoming targets because reliance on one node increases vulnerability—a problem mitigated by decentralization efforts like Chainlink’s multi-node architecture.

Denial-of-Service (DoS) Attacks: Attackers could disrupt service availability by overwhelming servers hosting critical data feeds leading to delays or failures in executing smart contracts correctly.

To mitigate these risks effectively requires implementing robust cryptographic techniques, decentralizing node infrastructure across diverse geographic locations—and continuously auditing system integrity against emerging threats.

Recent Innovations in Oracle Technology

The landscape has seen significant advancements aimed at enhancing security and interoperability:

Decentralized Oracle Networks (DONs)

Projects like Chainlink have pioneered decentralized architectures where multiple independent nodes source and verify data before feeding it into blockchains—a move toward reducing reliance on centralized points of failure while increasing trustworthiness through consensus mechanisms.

Cross-chain Compatibility

Emerging solutions focus not only on securing individual chains but also facilitating interoperability among different blockchain platforms—for example , projects developing cross-chain bridges enable seamless transfer of verified off-chain info across diverse ecosystems without compromising security standards.

Blockchain-Agnostic Solutions

Some newer oracle frameworks aim at platform neutrality—they work across various blockchains regardless of underlying architecture—thus broadening applicability especially within multi-chain environments prevalent today.

Risks Associated With Using Oracles

While offering immense benefits ,oracular solutions introduce certain vulnerabilities:

- If compromised ,a single malicious node can corrupt entire datasets leading potentially catastrophic outcomes — especially relevant during high-value DeFi operations where incorrect price feeds might cause liquidations unfairly .2 . Regulatory uncertainties around how externally sourced sensitive personal/financial info should be handled raise compliance questions .3 . Dependence upon third-party providers introduces operational dependencies that require rigorous due diligence .

Understanding these risks underscores why selecting reputable oracle providers with proven track records remains critical.

The Future Trajectory of Oracle Technology

Looking ahead,the evolution will likely focus heavily on enhancing decentralization further,making systems more resilient against attacks while improving transparency.Innovation areas include advanced cryptographic proofs such as zero knowledge proofs—which allow verification without revealing underlying sensitive info—and increased automation via AI-driven validation processes.These developments promise more secure,reliable,and scalable integrations between blockchains and real-world datasets .

As regulatory frameworks mature globally,the industry will also need standardized compliance protocols ensuring privacy standards meet legal requirements without hindering innovation—all contributing toward broader adoption across sectors ranging from finance,to supply chain management,and beyond.

By bridging the gap between digital ledgers and physical reality,data-oracle integration remains central not just for current applications but also future innovations within blockchain ecosystems.As technology advances,taking steps toward more secure,decentralized,and trustworthy solutions will be key drivers shaping this dynamic field moving forward

免責事項:第三者のコンテンツを含みます。これは財務アドバイスではありません。

詳細は利用規約をご覧ください。

To seize the global opportunities brought about by the rapid development of artificial intelligence (AI) technology and to further promote the deep integration of cutting-edge technology with the real economy and the digital economy, Ju.com officially announces the establishment of a $30 million AI special investment fund.

This fund will systematically invest around core AI technologies and the next generation of intelligent product forms. Key investment areas include, but are not limited to: • AI foundational models and underlying technologies • AI Agent products and solutions, encompassing autonomous decision-making, task execution, and automation scenarios • Intelligent robotics-related products, including software-driven robots, Embodied AI, and human-robot collaboration systems • Convergent applications of AI and Blockchain / Web3, such as smart contract automation, on-chain governance and risk control, and decentralized intelligent execution systems • Commercialization and implementation of AI in fields like fintech, enterprise services, content generation, and data analytics

This special fund will invite several listed companies and industrial capital to co-invest. By leveraging synergies from industrial resources, application scenarios, and financial support, it aims to provide portfolio projects with full-cycle empowerment, from technology validation and commercial implementation to long-term strategic partnerships.

Ju.com has always adhered to a long-term value and technological innovation-oriented approach, continuously building an open, robust, and sustainable technology investment ecosystem. The establishment of this AI special fund represents a crucial strategic move by Ju.com in the context of cutting-edge technology and the intelligent trend, and also reflects our high recognition of the long-term industrial value of AI, AI Agent, and robotics technologies.

In the future, Ju.com will collaborate with outstanding entrepreneurial teams, technical talent, and industrial partners worldwide to jointly promote the large-scale application and industrial upgrading of the next generation of intelligent products.

This is hereby announced.

#AI #Jucom

On January 4, the crypto market carried forward its early-year momentum, with Bitcoin decisively breaking through a key resistance level and lifting overall sentiment. Over the past 24 hours, market activity expanded notably, with total turnover and liquidations reaching $107.27 billion, while the Fear & Greed Index climbed to 40, signaling a clear rebound in risk appetite compared with year-end conditions.

Bitcoin rose 1.13% to $91,144.55, posting an intraday high of $91,574.40 and a low of $89,314.02. The successful break above the $91,000 level and subsequent consolidation suggest sustained bullish momentum. Ethereum followed with a 0.77% gain to $3,145.37, trading within a $3,166.41–$3,076.75 range and maintaining a steady correlation with BTC’s upward move. Positioning remained balanced, with BTC longs at 49.88% and ETH longs at 49.62%, indicating that the advance has been driven more by spot demand and trend-following capital than by excessive leverage.

Structural opportunities remained active across smaller-cap assets. FMC/X surged 70.24%, while NEXAI/USDT and PIPPIN/USDT advanced 41.53% and 24.14%, respectively. These moves reflect selective capital rotation as traders respond to Bitcoin’s breakout without broad-based risk expansion.

Macro and fundamental signals added depth to the move. The U.S. government disclosed that its cryptocurrency holdings now exceed $30 billion, with Bitcoin accounting for 97% of the total, reinforcing BTC’s status as the dominant digital reserve asset. On the Ethereum front, Vitalik Buterin stated that ZK-EVM and PeerDAS will transform Ethereum into a new form of high-performance decentralized network, strengthening long-term scalability and data availability narratives. Despite heightened geopolitical headlines, including reports of U.S. military strikes in Venezuela, Bitcoin prices remained resilient, underscoring its growing role as an asset capable of withstanding external shocks.

Overall, the opening days of 2026 show a market regaining directional clarity. Bitcoin’s breakout provides a clear technical anchor, while Ethereum’s roadmap supports medium-term confidence. With liquidity and sentiment improving in tandem, the crypto market appears to be entering the early phase of a new structural advance.

#cryptocurrency #blockchain

2025 marked prediction markets' breakthrough into mainstream consciousness. Polymarket alone processed over 95 million trades with $21.5 billion in volume, while the entire ecosystem reached $40-44 billion. With 1.77 million total users and monthly actives stabilizing at 400,000-500,000, these numbers dwarf many DeFi protocols.

💰 The Reality Check: Why 95% Lose

Only 5.08% of wallets realized profits over $1,000, with just 30.2% profitable overall. The top 0.04% of addresses captured over 70% of total profits, accumulating $4 billion in realized gains. This zero-sum game demands strategy over speculation.

🔄 The Turning Point: ICE's $2B Investment

In October 2025, the NYSE parent company ICE valued Polymarket at $9 billion with a $2 billion investment. The platform acquired a CFTC-licensed exchange for U.S. market re-entry and announced migration from Polygon to its own Ethereum L2 (POLY). Market expects token generation event after the 2026 World Cup.

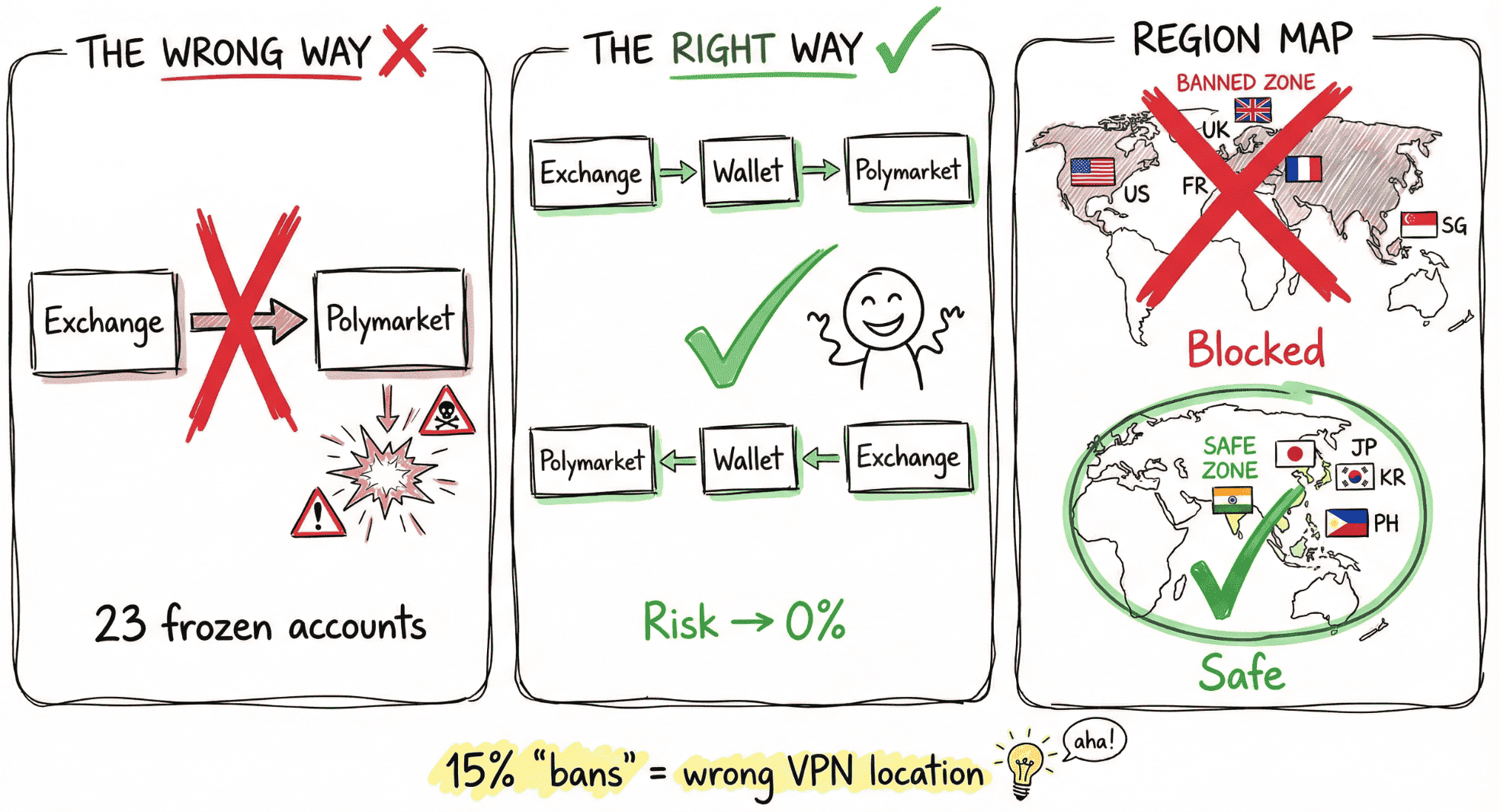

🚨 Risk Controls: The Zero Line of Defense

Never withdraw directly from exchanges to Polymarket. The correct flow is Exchange → Wallet → Polymarket for deposits, and reverse for withdrawals. This extra step costs minimal gas but eliminates account freeze risks. Explicitly prohibited regions include USA, UK, France, Ontario, Singapore, Poland, Thailand, and Taiwan. Recommended regions are Japan, Korea, India, Philippines, Spain, Portugal, and Netherlands.

📊 Airdrop Positioning: Become a High-Quality User

The platform values users who keep markets efficient and participate in price discovery. Key weight factors include Maker orders over Taker orders, Split/Merge operations for ~4% annual position rewards, diverse market participation across crypto/politics/sports/culture/economics, multiple time horizons from short-term to long-term markets, and sustained holding periods. The optimal trade size is $50-$500, with behavioral diversity and holding time carrying the highest weights.

🎯 Six Arbitrage Strategies for Profit

Cross-platform arbitrage exploits price differences where YES on Platform A plus NO on Platform B totals under $1. Multi-outcome arbitrage buys all mutually exclusive options when their combined YES prices sum below $1. Cross-event arbitrage identifies semantically identical events priced differently on the same platform. Term structure spread trades mispriced time value, buying longer-dated options while selling shorter ones. Rule-edge trading focuses on settlement criteria rather than headlines, finding value in the fine print. High-probability compounding targets events over 90% probability with under 72 hours to settlement, generating 80-150% annualized returns through disciplined execution.

💡 The Long-Term Builder's Edge

Prediction markets are approaching their "iPhone moment." Technology is ready, early user education is complete, and breakout events are imminent. Success rewards those who build information advantages, understand underlying mechanics, and prepare systematically. Don't chase short-term gains—build repeatable edges through compliant fund flows, line-by-line rule verification, and disciplined execution from low-risk arbitrage to late-stage strategies.

Read the complete survival guide with advanced strategies and risk mitigation: 👇 https://blog.ju.com/polymarket-prediction-markets/?utm_source=blog

#Polymarket #PredictionMarkets #Crypto #DeFi

The consolidation of major crypto assets within key price ranges does not necessarily signal the end of a trend. It more likely reflects a shift in market rhythm following increased institutional participation.

ETF flows have allocation characteristics, and their behavioral patterns differ significantly from retail sentiment. When volatility declines and options markets become more cautious, it often indicates that the market is waiting for new external variables.

In such phases, emotion-driven trading strategies tend to be less effective.

A listing wave among domestic chip companies. Recently, a number of domestic AI chip firms have accelerated capitalization: Moore Threads listed on Shanghai’s STAR Market with a market cap that once exceeded RMB 300 billion (longbridge.com); MetaX followed; Biren Technology launched a Hong Kong IPO plan targeting about $600 million in fundraising (finance.yahoo.com). This wave suggests that in AI chips, “domestic substitution” has become a clear direction strongly favored by capital markets. Even though domestic GPUs still lag global leaders in near-term performance, investors remain willing to support these companies at high valuations.

Certainty carries a premium. Under high geopolitical uncertainty, the certainty of domestic substitution itself commands a premium. Compared with projects that may be technically superior but strategically uncertain, domestic AI chips offer a clearer investment logic: regardless of external conditions, China’s demand for sovereign and controllable compute is structural and increasing. That certainty is why capital pays. In other words, capital does not always chase the theoretical “best” solution; it often favors the most sustainable solution. As domestic substitution becomes a national strategy and a market consensus, companies aligned with that direction are viewed as having long-term value. This explains the strong investor enthusiasm even when short-term profitability remains limited.

A shift in market preferences. The listing boom reflects a shift in how markets evaluate opportunities. In earlier cycles, investors chased high-growth, high-risk concepts; now, amid geopolitical and supply-chain risks, certainty and controllability have become key evaluation criteria. For companies, this implies that aligning with strategic national direction and delivering indispensable value improves the chance of sustained capital support. Domestic AI chip companies are leveraging this tailwind to grow rapidly, strengthening industrial resilience while creating a synergy between industry and capital.

PancakeSwap incubates the prediction market platform Probable, which is far more than just adding a product feature. It also reveals the strategic evolution of top DeFi applications: Expanding from a single "trading venue" to a comprehensive "on-chain casino/casino" ecosystem.

Strategic logic deduction:

1. User retention and value-added: The prediction market has strong entertainment and user stickiness , which can effectively improve user engagement rate and stay time, guide traffic to the PancakeSwap main station and create new sources of income.

2. Ecosystem collaboration: Probable seamlessly integrates PancakeSwap's liquidity and exchange functions to form an experience loop. Its automatic token conversion is the best example.

3. Seize the track: The prediction market is regarded as a key track in 2026 by institutions such as a16z, with huge trading volume (the peak of the sector in 2025 will reach $10 billion per month). PancakeSwap seizes the position in advance through incubation.

Challenge: Faced with the Network Effect and Liquidity Depth of mature platforms such as Polymarket (with monthly trading volume exceeding $2 billion), Probable needs to prove that its "zero commission" strategy is enough to attract users to migrate.

Analysis of ecosystem strategy:https://blog.ju.com/probable-prediction-market-bnb-chain/?utm_source=blog #DeFi #ecosystem #strategy #competition #PancakeSwap