Welcome to JU Square🚀

Welcome to JU Square, your dedicated social community hub where every user can share the latest trends, news topics, discussions, and insights from the crypto world. Connect with fellow traders, follow your favorite accounts, and engage with the community through likes, replies, and forwards.

JU Square offers an integrated social feed that keeps you on top of what the community is discussing, bringing together voices from across the JuCoin ecosystem in one dynamic space.

How to Create a JU Square Account

Every JuCoin account is automatically associated with a JU Square account. Simply create a JuCoin account by following this guide.

Once you have your JuCoin account, click on JU Square in the top navigation header to access the platform.

How to Post Your First Article

- From the JU Square homepage, click on Profile in the left-side menu

- In your Profile Page, click Create Post, then select Publish Article

- You’ll be taken to a standard editor page where you can enter a title, write your content, use editor tools for additional formatting and options, add a cover image, and select your target language.

- Add hashtags to make your content easier to discover by typing “#” to see a dropdown of available hashtags and their usage frequency, or create your own

- Use the Preview button to see how your post will appear. When satisfied with your content, click the Post button.

- Read and tick the checkbox to accept the Agreement Terms, then click Post.

- Your post will now appear on the feed on the homepage and under the “Posted” tab of your profile page. From this page, you can also change the visibility of your post, make edits, or delete it.

How to Post Your First Video

- Follow the same process as posting an article, but when you click Create Post in your profile page, select Publish Video instead.

- The editor provides all the same tools and fields, with one additional option: an Upload Video button that allows you to select a video file from your computer.

- Once uploaded, you can preview and post your video content just like an article.

How to Interact with Other Accounts

- From the homepage feed, you’ll see posts from all accounts and recent activity. To the right of any account you’d like to follow, click the Follow button, which will update to Following.

- Click on any post to view the full content. At the bottom of each post, you can see:

- Number of views

- Give a like

- Reply to the post

- Forward to share

These same interaction options are available directly from the feed view as well.

Discovering Content

The left-side menu offers several discovery features:

Trending Discussions – View the top-ranking topics and hashtags currently popular in the community Popular Posts – Browse the best-ranked posts based on engagement and community interaction

Staying Updated with Notifications

Click Notifications in the left-side menu to track key activity including:

- Number of likes you’ve received

- Replies to your posts

- @mentions

- Activity from creators you follow

- Updates from official accounts

For a detailed guide with images, please click the link: https://blog.jucoin.com/ju-square-guide/

This JU Square account serves as an official channel dedicated to posting educational content and updates exclusively related to JU Square features and community developments. Follow us to stay informed about new features, community highlights, and platform updates.Welcome to the future of crypto community engagement. We’re excited to see what conversations and connections you’ll build here! 🌟

JU Square

2025-08-12 08:37

Welcome to JU Square🚀

Penafian:Berisi konten pihak ketiga. Bukan nasihat keuangan.

Lihat Syarat dan Ketentuan.

To seize the global opportunities brought about by the rapid development of artificial intelligence (AI) technology and to further promote the deep integration of cutting-edge technology with the real economy and the digital economy, Ju.com officially announces the establishment of a $30 million AI special investment fund.

This fund will systematically invest around core AI technologies and the next generation of intelligent product forms. Key investment areas include, but are not limited to: • AI foundational models and underlying technologies • AI Agent products and solutions, encompassing autonomous decision-making, task execution, and automation scenarios • Intelligent robotics-related products, including software-driven robots, Embodied AI, and human-robot collaboration systems • Convergent applications of AI and Blockchain / Web3, such as smart contract automation, on-chain governance and risk control, and decentralized intelligent execution systems • Commercialization and implementation of AI in fields like fintech, enterprise services, content generation, and data analytics

This special fund will invite several listed companies and industrial capital to co-invest. By leveraging synergies from industrial resources, application scenarios, and financial support, it aims to provide portfolio projects with full-cycle empowerment, from technology validation and commercial implementation to long-term strategic partnerships.

Ju.com has always adhered to a long-term value and technological innovation-oriented approach, continuously building an open, robust, and sustainable technology investment ecosystem. The establishment of this AI special fund represents a crucial strategic move by Ju.com in the context of cutting-edge technology and the intelligent trend, and also reflects our high recognition of the long-term industrial value of AI, AI Agent, and robotics technologies.

In the future, Ju.com will collaborate with outstanding entrepreneurial teams, technical talent, and industrial partners worldwide to jointly promote the large-scale application and industrial upgrading of the next generation of intelligent products.

This is hereby announced.

#AI #Jucom

On January 4, the crypto market carried forward its early-year momentum, with Bitcoin decisively breaking through a key resistance level and lifting overall sentiment. Over the past 24 hours, market activity expanded notably, with total turnover and liquidations reaching $107.27 billion, while the Fear & Greed Index climbed to 40, signaling a clear rebound in risk appetite compared with year-end conditions.

Bitcoin rose 1.13% to $91,144.55, posting an intraday high of $91,574.40 and a low of $89,314.02. The successful break above the $91,000 level and subsequent consolidation suggest sustained bullish momentum. Ethereum followed with a 0.77% gain to $3,145.37, trading within a $3,166.41–$3,076.75 range and maintaining a steady correlation with BTC’s upward move. Positioning remained balanced, with BTC longs at 49.88% and ETH longs at 49.62%, indicating that the advance has been driven more by spot demand and trend-following capital than by excessive leverage.

Structural opportunities remained active across smaller-cap assets. FMC/X surged 70.24%, while NEXAI/USDT and PIPPIN/USDT advanced 41.53% and 24.14%, respectively. These moves reflect selective capital rotation as traders respond to Bitcoin’s breakout without broad-based risk expansion.

Macro and fundamental signals added depth to the move. The U.S. government disclosed that its cryptocurrency holdings now exceed $30 billion, with Bitcoin accounting for 97% of the total, reinforcing BTC’s status as the dominant digital reserve asset. On the Ethereum front, Vitalik Buterin stated that ZK-EVM and PeerDAS will transform Ethereum into a new form of high-performance decentralized network, strengthening long-term scalability and data availability narratives. Despite heightened geopolitical headlines, including reports of U.S. military strikes in Venezuela, Bitcoin prices remained resilient, underscoring its growing role as an asset capable of withstanding external shocks.

Overall, the opening days of 2026 show a market regaining directional clarity. Bitcoin’s breakout provides a clear technical anchor, while Ethereum’s roadmap supports medium-term confidence. With liquidity and sentiment improving in tandem, the crypto market appears to be entering the early phase of a new structural advance.

#cryptocurrency #blockchain

2025 marked prediction markets' breakthrough into mainstream consciousness. Polymarket alone processed over 95 million trades with $21.5 billion in volume, while the entire ecosystem reached $40-44 billion. With 1.77 million total users and monthly actives stabilizing at 400,000-500,000, these numbers dwarf many DeFi protocols.

💰 The Reality Check: Why 95% Lose

Only 5.08% of wallets realized profits over $1,000, with just 30.2% profitable overall. The top 0.04% of addresses captured over 70% of total profits, accumulating $4 billion in realized gains. This zero-sum game demands strategy over speculation.

🔄 The Turning Point: ICE's $2B Investment

In October 2025, the NYSE parent company ICE valued Polymarket at $9 billion with a $2 billion investment. The platform acquired a CFTC-licensed exchange for U.S. market re-entry and announced migration from Polygon to its own Ethereum L2 (POLY). Market expects token generation event after the 2026 World Cup.

🚨 Risk Controls: The Zero Line of Defense

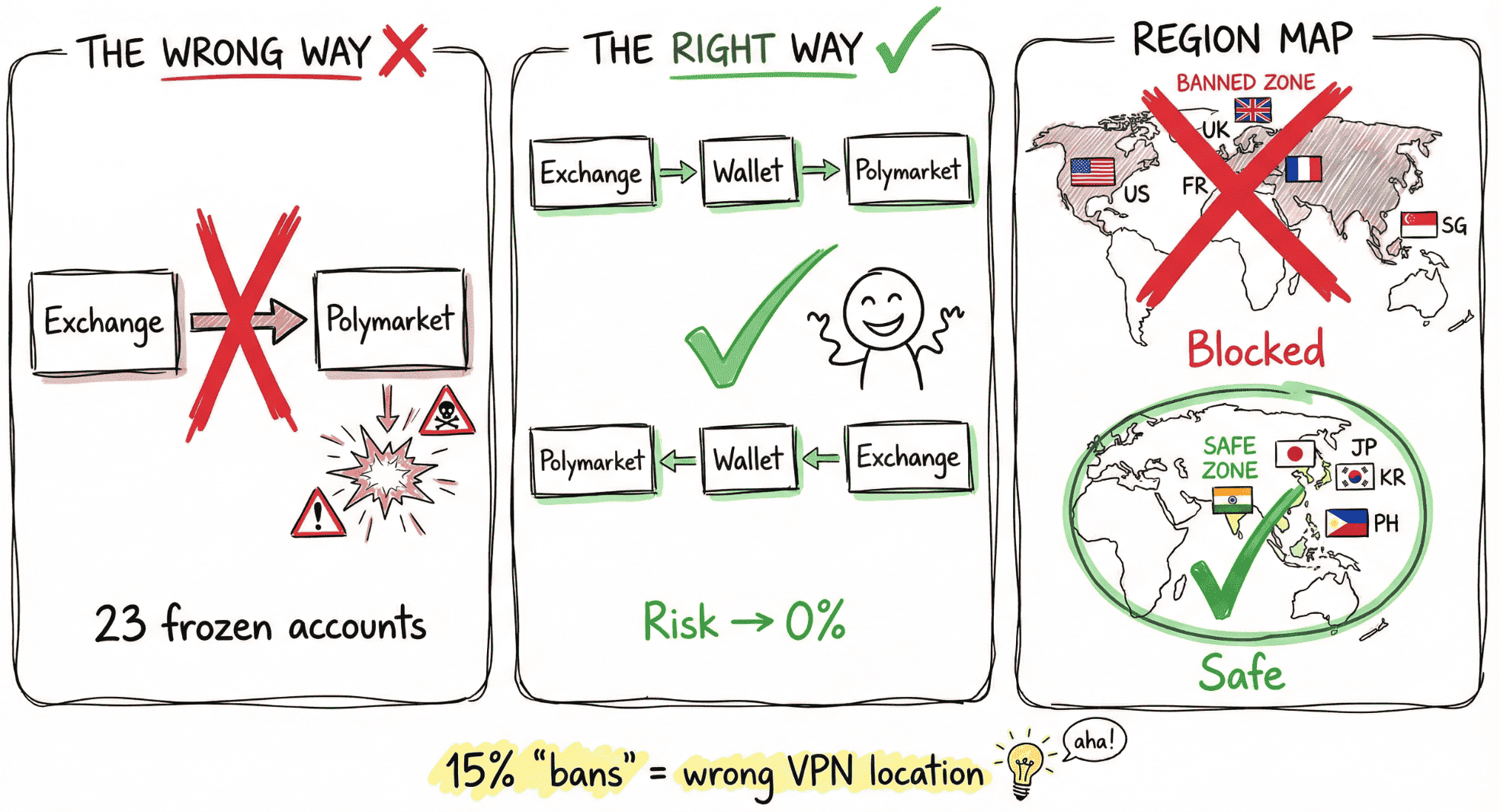

Never withdraw directly from exchanges to Polymarket. The correct flow is Exchange → Wallet → Polymarket for deposits, and reverse for withdrawals. This extra step costs minimal gas but eliminates account freeze risks. Explicitly prohibited regions include USA, UK, France, Ontario, Singapore, Poland, Thailand, and Taiwan. Recommended regions are Japan, Korea, India, Philippines, Spain, Portugal, and Netherlands.

📊 Airdrop Positioning: Become a High-Quality User

The platform values users who keep markets efficient and participate in price discovery. Key weight factors include Maker orders over Taker orders, Split/Merge operations for ~4% annual position rewards, diverse market participation across crypto/politics/sports/culture/economics, multiple time horizons from short-term to long-term markets, and sustained holding periods. The optimal trade size is $50-$500, with behavioral diversity and holding time carrying the highest weights.

🎯 Six Arbitrage Strategies for Profit

Cross-platform arbitrage exploits price differences where YES on Platform A plus NO on Platform B totals under $1. Multi-outcome arbitrage buys all mutually exclusive options when their combined YES prices sum below $1. Cross-event arbitrage identifies semantically identical events priced differently on the same platform. Term structure spread trades mispriced time value, buying longer-dated options while selling shorter ones. Rule-edge trading focuses on settlement criteria rather than headlines, finding value in the fine print. High-probability compounding targets events over 90% probability with under 72 hours to settlement, generating 80-150% annualized returns through disciplined execution.

💡 The Long-Term Builder's Edge

Prediction markets are approaching their "iPhone moment." Technology is ready, early user education is complete, and breakout events are imminent. Success rewards those who build information advantages, understand underlying mechanics, and prepare systematically. Don't chase short-term gains—build repeatable edges through compliant fund flows, line-by-line rule verification, and disciplined execution from low-risk arbitrage to late-stage strategies.

Read the complete survival guide with advanced strategies and risk mitigation: 👇 https://blog.ju.com/polymarket-prediction-markets/?utm_source=blog

#Polymarket #PredictionMarkets #Crypto #DeFi

The consolidation of major crypto assets within key price ranges does not necessarily signal the end of a trend. It more likely reflects a shift in market rhythm following increased institutional participation.

ETF flows have allocation characteristics, and their behavioral patterns differ significantly from retail sentiment. When volatility declines and options markets become more cautious, it often indicates that the market is waiting for new external variables.

In such phases, emotion-driven trading strategies tend to be less effective.

A listing wave among domestic chip companies. Recently, a number of domestic AI chip firms have accelerated capitalization: Moore Threads listed on Shanghai’s STAR Market with a market cap that once exceeded RMB 300 billion (longbridge.com); MetaX followed; Biren Technology launched a Hong Kong IPO plan targeting about $600 million in fundraising (finance.yahoo.com). This wave suggests that in AI chips, “domestic substitution” has become a clear direction strongly favored by capital markets. Even though domestic GPUs still lag global leaders in near-term performance, investors remain willing to support these companies at high valuations.

Certainty carries a premium. Under high geopolitical uncertainty, the certainty of domestic substitution itself commands a premium. Compared with projects that may be technically superior but strategically uncertain, domestic AI chips offer a clearer investment logic: regardless of external conditions, China’s demand for sovereign and controllable compute is structural and increasing. That certainty is why capital pays. In other words, capital does not always chase the theoretical “best” solution; it often favors the most sustainable solution. As domestic substitution becomes a national strategy and a market consensus, companies aligned with that direction are viewed as having long-term value. This explains the strong investor enthusiasm even when short-term profitability remains limited.

A shift in market preferences. The listing boom reflects a shift in how markets evaluate opportunities. In earlier cycles, investors chased high-growth, high-risk concepts; now, amid geopolitical and supply-chain risks, certainty and controllability have become key evaluation criteria. For companies, this implies that aligning with strategic national direction and delivering indispensable value improves the chance of sustained capital support. Domestic AI chip companies are leveraging this tailwind to grow rapidly, strengthening industrial resilience while creating a synergy between industry and capital.

PancakeSwap incubates the prediction market platform Probable, which is far more than just adding a product feature. It also reveals the strategic evolution of top DeFi applications: Expanding from a single "trading venue" to a comprehensive "on-chain casino/casino" ecosystem.

Strategic logic deduction:

1. User retention and value-added: The prediction market has strong entertainment and user stickiness , which can effectively improve user engagement rate and stay time, guide traffic to the PancakeSwap main station and create new sources of income.

2. Ecosystem collaboration: Probable seamlessly integrates PancakeSwap's liquidity and exchange functions to form an experience loop. Its automatic token conversion is the best example.

3. Seize the track: The prediction market is regarded as a key track in 2026 by institutions such as a16z, with huge trading volume (the peak of the sector in 2025 will reach $10 billion per month). PancakeSwap seizes the position in advance through incubation.

Challenge: Faced with the Network Effect and Liquidity Depth of mature platforms such as Polymarket (with monthly trading volume exceeding $2 billion), Probable needs to prove that its "zero commission" strategy is enough to attract users to migrate.

Analysis of ecosystem strategy:https://blog.ju.com/probable-prediction-market-bnb-chain/?utm_source=blog #DeFi #ecosystem #strategy #competition #PancakeSwap